NGI Archives | Daily GPI | NGI All News Access

EIA Natural Gas Price Forecasts A Broken Record: Lower, Lower, Lower

The months-long decline in projected natural gas prices shows no sign of ending, with the Energy Information Administration (EIA) saying Tuesday it expects gas to average $2.81/MMBtu this year and $3.05/MMBtu next year.

Those forecasts are down from $2.84/MMBtu and $3.11/MMBtu, respectively, that EIA forecast last month (see Daily GPI, Sept. 9). At the beginning of the year, EIA projected 2015 Henry Hub prices to average $3.44/MMBtu and 2016 gas to average $3.86/MMBtu (see Daily GPI, Jan. 13). The latest EIA prognostication for 2015 is down a stunning 27% ($1.03/MMBtu) from the $3.84/MMBtu the agency forecast a year ago (see Daily GPI, Oct. 7, 2014).

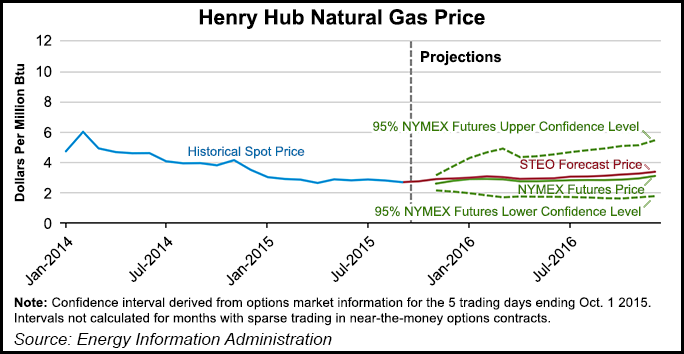

Henry Hub prices averaged $2.66/MMBtu last month, a decrease of 11 cents from August, according to a Short-Term Energy and Winter Fuels Outlook (STEO) released by EIA Tuesday. Natural gas futures prices for January 2016 delivery (for the five-day period ending Oct. 1) averaged $2.87/MMBtu.

Current options and futures prices imply that market participants place the lower and upper bounds for the 95% confidence interval for January 2016 contracts at $1.93/MMBtu and $4.27/MMBtu, respectively. At this time last year, the natural gas futures contract for January 2015 averaged $4.19/MMBtu and the corresponding lower and upper limits of the 95% confidence interval were $2.96/MMBtu and $5.94/MMBtu, EIA said.

The agency said marketed gas production will increase by 4.2 Bcf/d (5.6%) this year and by 1.9 Bcf/d (2.2%) in 2016, with increases in the Lower 48 more than offsetting long-term production declines in the Gulf of Mexico. Increases in drilling efficiency will continue to support growing natural gas production in the forecast, despite relatively low natural gas prices, EIA said. Most of the growth will continue to come from the Marcellus Shale, as a backlog of uncompleted wells is reduced and new pipelines come online.

Natural gas working inventories totaled 3,538 Bcf as of Sept. 25, which is 454 Bcf more than at the same time in 2014 and 152 Bcf higher than the previous five-year average. The agency projected that end-of-October inventories will total 3,956 Bcf, which would be 158 Bcf above the five-year average and the highest end-of-October level on record.

In an annual review of winter fuel supplies included in this month’s STEO, EIA said the average U.S. household can expect a 10% decrease in natural gas expenditures this winter compared with last winter, based on a 4% decline in gas prices and more moderate average temperatures.

“If winter temperatures come in as expected by U.S. government weather forecasters, U.S. consumers will pay less to stay warm this winter no matter what heating fuel they use,” said EIA Administrator Adam Sieminski.

Even in the event of another cold winter, EIA does not expect natural gas inventories to fall below 1,000 Bcf by the end of the heating season.

“Natural gas supplies should be adequate to meet demand this winter, as average household natural gas consumption during the heating season is expected to be the lowest in four years,” Sieminski said.

But transportation constraints continue to pose a challenge to Northeast markets, according to EIA.

“Over the past two winters, natural gas-fired power plants in the Northeast had to compete for an increasingly limited amount of available natural gas pipeline capacity from a system that was already constrained, particularly in New England and New York,” the agency said. “These constraints contributed to spikes in natural gas spot prices at regional hubs and, consequently, day-ahead power prices during periods when temperatures were extremely cold. Some pipeline capacity has been added to deliver natural gas from the Marcellus region in Pennsylvania to the New York market. However, pipeline constraints still exist in the Northeast, particularly into the New England market, and day-to-day price volatility is likely.”

EIA expects households heating primarily with heating oil to spend an average of $459 (25%) less this winter than last winter, and households heating primarily with electricity to spend an average of $30 (3%) less. Households using mostly propane will also spend less this winter, but the projected decrease varies across regions. EIA expects households heating with propane in the Midwest will spend an average of $320 (21%) less this winter than last winter, while in the Northeast they are expected to spend an average of $342 (15%) less, the agency said.

U.S. inventories of propane and propylene reached 97.7 million bbl on Sept. 11, the highest level for the 22 years that EIA has been recording weekly propane inventory statistics (see Daily GPI, Sept. 21). Two weeks later they had swelled to 98.7 million bbl, 19 million bbl higher than at the same time last year, the agency said.

Total natural gas consumption is expected to average 76.4 Bcf/d next year, up from an estimated 73.5 Bcf/d in 2014 and 76.2 Bcf/d this year. Growth this year is expected to be largely driven by the industrial and electric power sectors, while residential and commercial consumption is projected to decline in 2015 and again in 2016.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |