Markets | NGI All News Access | NGI Data

Futures, Physical NatGas In Lock-Step Lower; November Falls 9 Cents

Physical natural gas for Friday delivery continued to cartwheel lower along with futures as a hat-trick of unsupportive weather forecasts, a weak power environment, and a hefty government inventory report relegated market bulls to the bench.

Only a single point followed by NGI showed a gain, and most points retreated anywhere from a nickel to a dime. The NGI National Spot Gas Average lost 6 cents to $2.24. Temperature forecasts at major population centers could do no better than average, and although most traders try to get deals done ahead of the 10:30 a.m. EDT Energy Information Administration (EIA) inventory report, the report reinforced expectations of record supplies going into the winter heating season.

Traders were also keeping close track on the course of Hurricane Joaquin as it takes aim at the Atlantic Seaboard for the load-killing effects of what are likely to be pervasive rain and thunderstorms. The EIA reported an increase of 98 Bcf, putting record storage clearly in the crosshairs. Futures at first didn’t react much to the stout storage build, but by the end of the day November had fallen 9.1 cents to $2.433 and December was off 7.0 cents to $2.631. November crude oil fell 35 cents to $44.74/bbl.

Next-day gas across the East dropped by double digits as weather forecasts called for rain and below-normal temperatures. AccuWeather.com forecast that the high in Boston Thursday of 59 would ease to 54 Friday and Saturday, 12 degrees below normal. Chicago’s Thursday high Thursday of 58 was expected to make it to only 62 Friday and ease to 60 on Saturday. The seasonal high in Chicago is 69. Los Angeles’ maximum Thursday of 85 was seen easing to 84 Friday and 82 by Saturday. The normal high is Los Angeles in early October is 81.

Marcellus points took it on the chin, pushing quotes well below $1. Parcels on Millennium fell 7 cents to 96 cents, and gas on Transco-Leidy Line skidded 15 cents to 66 cents. Deliveries to Tennessee Zone 4 Marcellus fell 14 cents to 69 cents.

Quotes at Mid-Atlantic points fell by double digits. Gas on Transco Zone 6 non-NY North serving southeastern-most Pennsylvania and southern New Jersey fell 19 cents to $2.20, and gas bound for New York City on Transco Zone 6 was quoted at $2.13, down 31 cents.

Traders will be closely watching the load dampening effects from Hurricane Joaquin as it trudges northward after thrashing Bermuda. “Projections continue to show Hurricane Joaquin heading up the East Coast but new developments suggest Joaquin may not make landfall in the U.S.” said AccuWeather.com meteorologist Alex Sosnowski.

“Hurricane Joaquin strengthened rapidly Wednesday into Thursday. Joaquin reached Category 3 status late Wednesday evening and Category 4 status on Thursday afternoon. Joaquin has strengthened significantly and continues to hover near the Bahamas on Thursday. This delay has altered the forecast track. Other weather systems impacting Joaquin will be in slightly different positions as a result.

“Joaquin will move northward much of this weekend, roughly paralleling the East coast. There is now a much lower possibility of a landfall along the mid-Atlantic coast and a greater chance the storm will veer out to sea,” he said.

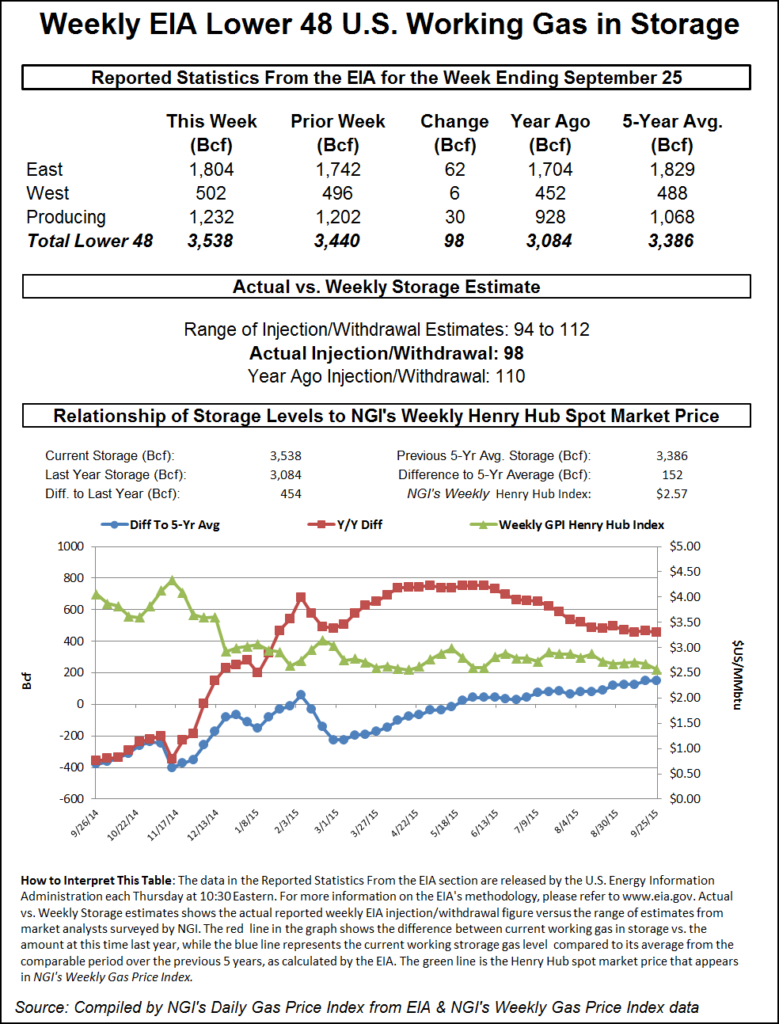

Futures traders were closely following the EIA storage report. Figures show that with five weeks remaining in the traditional injection season, 92.4 Bcf would have to be injected weekly to reach a record 4 Tcf, but if November should turn out to feature net injections as well, the figure could go even higher. This week’s storage report is right on track, if not more so, to hurdle 4 Tcf. Last year, 110 Bcf was injected, and the five year pace stands at 94 Bcf. Last week, 106 Bcf was injected and caught almost all analysts off guard about 10 Bcf shy of the mark.

This week, the estimates were coming in right around the century mark. Stephen Smith Energy calculated a 98 Bcf build, and Bentek Energy was also looking for 98 Bcf utilizing both its flow model and supply-demand models. A Reuters survey of 21 industry traders and analysts showed an average 100 Bcf with a range of 94 to 110 Bcf.

John Sodergreen, editor of Energy Metro Desk, saw a 100 Bcf build as well but hinted this week that the actual figure might come in on the low side.

Once the number was released, November futures dropped to a low of $2.482 and traded as high as $2.502, and by 10:45 a.m. November was trading at $2.497, down 2.7 cents from Wednesday’s settlement.

“The number didn’t impact the market at all, but we may actually be seeing a day where we settle under $2.50,” a New York floor trader told NGI. “I figure it would have to settle under $2.50 for a few days for it to sink in that maybe you might see some lower numbers.”

Inventories now stand at 3,538 Bcf and are 454 Bcf greater than last year and 152 Bcf more than the five-year average. In the East Region 62 Bcf was injected, and the West Region saw inventories increase by 6 Bcf. Stocks in the Producing Region rose by 30 Bcf.

Weather forecasters see little change in demand until Canadian air makes it way south. “Although, without tapping subfreezing Canadian air, heating demand will be relatively light for this time of year,” said Natgasweather.com in a noon update Wednesday. “In addition, the southern U.S. will also experience highs dropping into the 70s, ending cooling demand over many states. We continue to see ways the pattern can still set up quite cold over the northern and eastern U.S. in the second half of October, so we must keep a watchful eye on the growing cold pool over the northern latitudes. Overall, we view weather sentiment as at least somewhat bearish until stronger cold blasts arrive.”

Data from the National Weather Service (NWS) also supports the thesis of low energy demand. In its forecast for the week ended Oct. 3, NWS predicts well below normal accumulations of both heating degree days (HDD) and cooling degree days (CDD) for major energy markets. New England is expected to see a combined total of 47 HDD and CDD, or 22 below normal. The Mid-Atlantic will see 38 combined DD, or 19 below its norm, and the greater Midwest from Ohio to Wisconsin should see 47 DDs, or 13 fewer than its seasonal tally.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |