Markets | NGI All News Access | NGI Data

Physical, Futures Both Shed More Than a Nickel; Triple Digit Storage Report Awaits

Physical natural gas for Thursday delivery continued to fall in Wednesday’s trading. Only a handful of points made it to the “win” column and losses of a nickel or more were common at many points.

The NGI National Spot Gas Average was down 8 cents to $2.30, and eastern points on average managed to come out flat buoyed by a few locations lifted by a pipeline outage. Futures couldn’t do any better than the physical market, and at the close November had lost 6.2 cents to $2.524 and December shed 6.2 cents as well to $2.701. November crude oil was quoted 14 cents lower at $45.09/ bbl.

Deliveries to Marcellus points put in double-digit drops sending some locations to sub $1 levels as next-day power prices retreated. The Intercontinental Exchange reported that on-peak Thursday power at the ISO New England’s Massachusetts Hub fell $5.37 to $28.12/MWh. Next-day power at the PJM West Hub fell 92 cents to $35.32/MWh.

Quotes on Millennium fell 18 cents to $1.03 and next-day gas on Transco-Leidy Line was quoted at 81 cents, down 29 cents. Packages on Tennessee Zn 4 Marcellus came in 26 cents lower at 83 cents and gas on Dominion South changed hands at $1.22, down a penny.

Pipeline outages on Transco in southeast Pennsylvania elevated quotes at several Philadelphia-area and New York City points. Gas on Transco Zone 6 non-NY North serving southeastern-most Pennsylvania and southern New Jersey rose a stout 36 cents to $2.39, and gas bound for New York City on Transco Zone 6 vaulted 43 cents to $2.44.

Transco reported on its website that as part of the Leidy Southeast Expansion project, Transco will be performing facility modifications at Station 515 in Luzerne County, located in southeastern Pennsylvania. “The current construction schedule requires that compression at Station 515 to be out of service from October 1 through October 22, 2015,” the company said.

Major market hubs were down more than a nickel. Gas at the Henry Hub fell 6 cents to $2.47 and deliveries to Opal were seen 8 cents lower at $2.39. Gas at the Chicago Citygate was quoted 7 cents lower at $2.56, and packages at the SoCal Citygates fell 7 cents to $2.75.

Futures traders see the market in a steady grind lower. “I think we’ll trade down to the $2.45 to $2.50 area and hold again,” a New York floor trader told NGI. “Another 5 cents to 10 cents might be the downside for the next couple of weeks is what I’m thinking.”

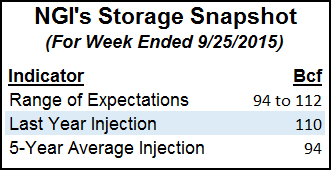

That 5 to 10 cents to the downside will likely see a test with the release of Thursday’s storage figures from the Energy Information Administration. Last year 110 Bcf was injected and the five-year pace is for a 94 Bcf build. Stephen Smith Energy predicts a fill of 98 Bcf, and industry consultant Genscape Energy is looking for an injection of 102 Bcf. A Reuters poll of 21 traders and analysts showed an average 100 Bcf with a range of 94 Bcf to 110 Bcf.

Analysts now expect an extended injection season carrying through the end of November — and a stunted seasonal price rally. “The gas storage injection season typically takes place between April 1st and Oct. 31st each year. The industry does commonly report net weekly injections in the first weeks of November,” Teri Viswanath, director of natural gas strategy at BNP Paribas, said in a note to clients Tuesday.

She said that as heating demand rose in November, it was unusual to see a net build for the month. “Since the mid-1970s, there have been four years in which monthly injections have been recorded for November. Given our domestic production and demand growth projections, and assuming normal weather patterns, we expect that the industry will likely report the fifth net monthly build for November in 2015. All told, we see working gas in storage increasing 40 Bcf over November to 4 Tcf.

“While we think a seasonal rally for gas is still in the making, the lift-off will now likely be delayed. Moreover, supply-side adjustments will lessen the need to call upon inventory to meet peak winter demand. The end result will be a truncated price rally this winter with high-end March stocks limiting the scope of recovery during the first half of 2016.”

Natgasweather.com sees Hurricane Joaquin generating load-killing showers and thunderstorms along the East Coast, “if it can get absorbed by another slow-moving system stalled over the east-central U.S.”

At 5 p.m. EDT, the National Hurricane Center reported that Joaquin was 175 miles east of the Bahamas and was holding winds of 85 mph. It was moving to the southwest at 8 mph but was expected to make a turn to the northwest and north.

Otherwise, the near-term weather outlook is benign. “Mixed changes are noted overnight nationally,” said Commodity Weather Group in its morning report. “We see some cooler adjustments again in the West during the six-10 day, while the Midwest to East are slightly warmer. The 11-15 day changes split in the East, with a cooler start but then warmer finish. The warmest 11-15 day anomalies are in the Western states.

“Overnight models were mixed, but warmer trends at end. Models saw a net demand addition overall overnight, but the individual runs were mixed in this variable pattern situation,” said Matt Rogers, president of the firm.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |