NGI Archives | NGI All News Access | NGI The Weekly Gas Market Report

Global Oil/Gas Companies Show ‘Wide Deficit’ of Operating Cash to Capex

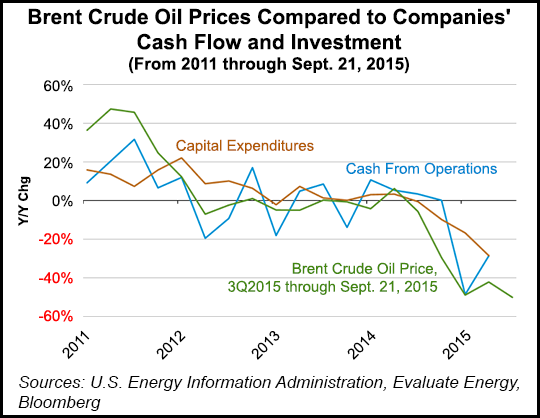

Despite cuts in capital expenditures (capex), oil and natural gas producers worldwide are seeing greater declines in their operating cash flow and, consequently, lower cash balances, trends that could continue into 3Q2015 if crude oil prices continue to fall, the U.S. Energy Information Administration (EIA) said.

In a 22-page report released last Tuesday, EIA’s markets and financial analysis team found that during 2Q2015, many of the 97 global oil and gas companies it surveyed — including majors BG Group, BP plc, Chevron Corp., ConocoPhillips, ExxonMobil Corp., Hess Corp., Royal Dutch Shell plc and Total SA — were less profitable than the U.S. manufacturing sector, which had also showed declining profitability during the second quarter.

EIA analysts found that during 2Q2015, liquids production — which includes crude oil and hydrocarbon gas liquids — was 7% higher than the previous second quarter among leading world producers, while natural gas production was flat between the two quarters. Both trends occurred while crude oil prices rose from 1Q2015 to 2Q2015, but were still “well below” prices from 2Q2014. Operating cash flow also increased $26 billion between 1Q2015 and 2Q2015.

But while EIA found the companies had reduced their capex budgets by $38 billion in 2Q2015 (to about $95 billion) compared to the preceding second quarter (about $130 billion), “the difference between cash from operations and capex was almost zero in 2Q2015,” with both in the neighborhood of $90 billion and a Brent crude oil price just north of $60/bbl.

The agency added, however, that on an annualized basis “the energy companies still have a wide deficit of operating cash to capex,” with the former totaling about $420 billion and the latter about $470 billion. “This operating deficit continues to be funded from asset sales, debt issuance and equity issuance.

“Cash balances declined more than $8 billion for the four quarters ending June 30, 2015. Companies refinanced debt and increased share issuance, but fixed debt payments took a higher share of operating cash flow,” EIA said. “Net hedging assets, which provide downside price protection, declined $9 billion since the first quarter.”

The energy companies’ profitability, according to EIA, peaked just below 18% midway through 2011, but had since fallen to nearly zero. By comparison, the profitability of U.S. manufacturing has ranged from 15-17% from 1Q2011 through 1Q2015, and had trailed down to a current level of about 14%. The agency added that although profitability in the energy and manufacturing sectors had fallen for several quarters since 2012, the energy companies’ decreases were larger.

“Both sectors had the highest debt-to-equity ratios since 2010 in the second quarter,” EIA said. Long-term debt-to-equity for energy companies is currently about 43%, while for manufacturers it is about 54%.

EIA reported that Brent crude prices had declined by nearly 50% year-over-year (y/y) through Sept. 21, while cash from operations and capex spending were both down about 30% y/y in 2Q2015. Should Brent crude oil prices continue to decline into 3Q2015, that would “likely pressure companies’ cash flow and investment,” EIA said.

Other companies surveyed included shale players Anadarko Petroleum Corp., Apache Corp., Carrizo Oil & Gas Inc., Chesapeake Energy Corp., Cimarex Energy Co., Continental Resources Inc., Devon Energy Corp., EOG Resources Inc., Goodrich Petroleum Corp., Gulfport Energy Corp., Marathon Oil Corp., Noble Energy Inc., QEP Resources Inc., Range Resources Corp. and Talisman Energy Inc.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |