Markets | NGI All News Access | NGI Data

Bears See Modest Gains Following Oversize EIA Natural Gas Storage Data

Natural gas futures proved resilient following the release of government inventory figures showing an increase in working gas storage greater than what the market was expecting by about 10 Bcf.

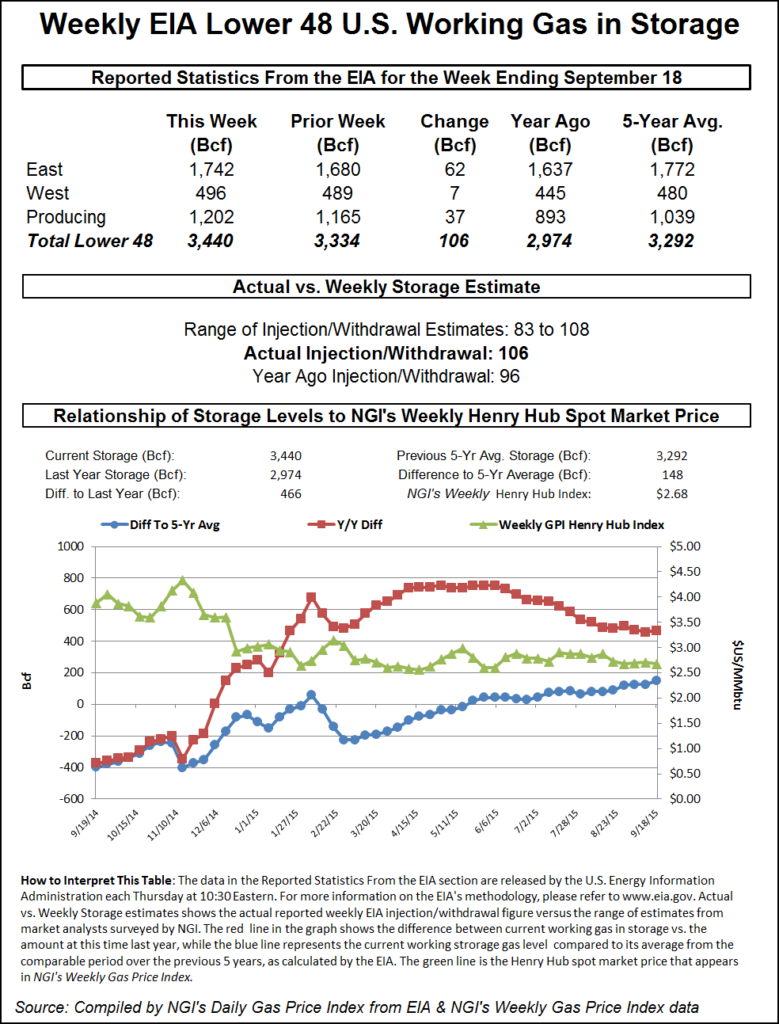

For the week ended Sept. 18, the Energy Information Administration (EIA) reported a 106 Bcf injection in its 10:30 a.m. EDT release. October futures dropped to a low of $2.521 after the number was released, and by 10:45 a.m. October was trading at $2.540, down 2.9 cents from Wednesday’s settlement.

Prior to the release of the data, analysts were looking for an increase in the upper-90 Bcf area. Bentek Energy estimated 100 Bcf, utilizing its flow model, and ICAP Energy was also figuring on a 100 Bcf build. A Reuters poll of 22 traders and analysts showed an average 96 Bcf with a range of 83 to 108 Bcf.

“It basically took a 3-cent dip, and in the scheme of things we are off a penny and a half prior to the number coming out,” a New York floor trader told NGI. “It looks like $2.50 is a big number on the downside and $2.60 on the upside. If it settles below $2.50, that would be a bearish sign.”

“The 106 Bcf net injection was more than the consensus expectation, a bearish result that was also more than the 83 Bcf five-year average level. It was close to our model’s 108-Bcf estimate, however, so we don’t see much need for revisions to our overall storage forecast,” said Tim Evans of Citi Futures Perspective.

Inventories now stand at 3,440 Bcf and are 466 Bcf greater than last year and 148 Bcf more than the five-year average. In the East Region 62 Bcf was injected, and the West Region saw inventories increase by 7 Bcf. Stocks in the Producing Region rose by 37 Bcf.

The Producing Region salt cavern storage figure was up 14 Bcf at 312 Bcf, while the non-salt cavern figure increased 23 Bcf to 890 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |