E&P | NGI All News Access | NGI The Weekly Gas Market Report

Growing Production Lifts DJ Basin, Weld County Profile in Colorado

With the emergence of the Denver-Julesburg (DJ) Basin as a leading producer, Colorado’s Weld County is being touted as the DJ’s core. The county is on pace to become the state’s major natural gas producer this year, according to Colorado Oil and Gas Conservation Commission (COGCC) data.

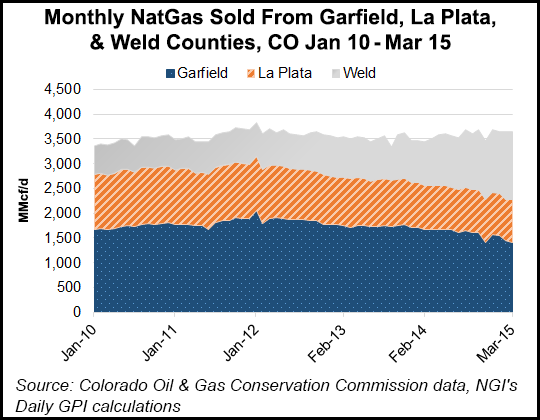

Historically, two western counties, La Plata and Garfield, have alternated for more than a decade as Colorado’s leading gas producers. But in the current low commodity price environment for both crude oil and natural gas, operators have focused on their higher-return areas, and the DJ Basin in apparently one of those.

The DJ is a liquids-rich play, so producers are going after oil and getting lots of wet associated gas.

Through part of July this year, Weld County produced 242.5 Bcf, or about one-third of the state’s overall total at that time. Comparatively, Garfield County, in the far northwestern part of the state, produced 224.7 Bcf, and La Plata in the southwestern corner of Colorado had 181.3 Bcf of production.

Last year, Garfield produced about one-third of Colorado’s gas production of 1.6 Tcf with 610.9 Bcf produced; Weld was second at 388.4 Bcf with La Plata, which for many years was the state leader, third with 334 Bcf in production.

Analysts are now assuming that Weld and the DJ Basin are going to take over the state’s gas leadership. Various industry analytical sources, along with COGCC data point to the DJ as being on the rise, while Garfield and La Plata draw on more mature fields.

La Plata gas traditionally has come mostly from the Ignacio Blanco gas field in the northern end of the prolific San Juan Basin in southwestern Colorado and northern New Mexico. Garfield, which replaced La Plata in the No. 1 spot in 2012, draws most of its gas from the Piceance Basin where three years ago it provided more than 40% of the state’s gas production.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |