Infrastructure | NGI All News Access | NGI The Weekly Gas Market Report

‘Different’ Storage Primed For Resurgence, Natural Gas Buyers Say

The doldrums that natural gas storage has been mired in for some time could disappear, replaced by a re-energized market for short-term, regionally based deals, according to some major natural gas buyers.

Their insights were offered at the LDC Mid-Continent Gas Forum in Chicago on Wednesday while examining broader issues of supply-demand and price in the face of low crude oil prices and the prospects for more U.S. gas exports. The panel signaled the start of a recovery in gas storage, but acknowledged that any favorable trend now taking shape could reverse itself quickly.

Chris Shorts, director of gas supply and customer support at Spectra Energy Corp.’s Union Gas Ltd. utility in Ontario, Canada, said the past two severe winters, particularly in 2013-2014, re-established the need for storage in his area where he buys 175 Bcf of gas annually for 1.4 million retail gas utility customers with 70% of those volumes going to industrial customers.

“As a utility buyer, storage is always a critical asset to have, and we continue to rely on it,” Shorts said. “[The past two winters] re-emphasized the value of storage not only to us, but our customers. We are starting to see a recovery in the storage market.

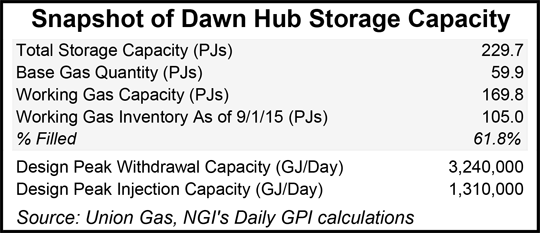

“In the other side of our operations as a non-utility storage provider [at Dawn Hub], we have seen almost a doubling in the value of storage this year compared to recent years. The last couple of winters have helped people realize the value of storage. I would say [storage] is on the road to recovery, but it could turn around on a dime, and if we get a couple of warmer-than-normal winters in a row, people will tend to forget.”

Kenneth Yagelski, managing director for gas supply at AGL Resources, thinks that there needs to be a shift in the way the industry looks at and uses storage. “The traditional way we value storage has to change,” Yagelski told the LDC audience. “I think the days are gone of annual seasonal summer injections and winter withdrawals that you could arbitrage on an annual basis.”

Yagelski said he envisions the use of more storage to balance liquefied natural gas (LNG) exports and more localized distribution [pipeline system] balancing. “There will still be arbitrage opportunities, but they are going to be on short-term time frames and on a regional basis,” he said. “I think there is still a lot of value in storage, and the arbitrage value may be greater today than ever before, but these are local opportunities in different sectors [than in the past].”

As an end-user, state of Illinois Energy Manager Donald Barnes said he views gas storage differently, noting he still tries “to maximize the use of storage as a buffer against winter peaks.”

Barnes said the pattern for gas use peaking has changed over the years where the summer peaks are getting as pronounced as those in the winter heating season. “With the switch from coal to gas in power generation, I think we are going to see more of the summer peaks,” he said. “Therefore, storage optimization is something we monitor very closely, and I think it is going to be very different from past storage uses in the 1980s and ”90s.”

With Southern Illinois still having large percentages of electricity coming from coal-fired generators, Barnes said the current push to replace those megawatts with gas-fired generation will be most pronounced in the area south of the Chicago metropolitan area. “Basically, what that is done is spike electric utility capacity rates, given the lower fuel cost rates with gas, and driven up electricity bills,” he said.

Dan Rowe, director of energy risk and supply for McDonald’s 14,000 restaurants in the United States, said the coal-to-gas switch has had a generally beneficial effect for the fast food chain’s operations, but it hasn’t lowered electricity costs.

“From east-to-west we see where power prices have come up, particularly in the PJM area, the lower energy commodity costs [of the electric utilities] are being replaced by higher capacity charges. So what McDonald’s has done is try to reduce our peak demand.”

Rowe said low gas prices have been “great,” but unfortunately any savings have been offset by the higher capacity costs. “The bottom line is that our overall utility costs have not gone down much,” he said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |