Markets | NGI All News Access | NGI Data

Multi-Dollar New England Gains Lead Physical NatGas Higher; Futures Fall

All producing basins and most market points away from the Northeast recorded losses in Thursday’s physical natural gas trading as traders scurried to get trading done before the release of Energy Information Administration (EIA) storage figures.

At first glance, the overall market gained a nickel. NGI’s National Spot Gas Average was up 6 cents to $2.59, but take away a number of dollar-plus gains on constrained New England pipes and the figure comes in closer to a 1 cent loss, about in line with the futures. Eastern points alone averaged an increase of close to 30 cents. Healthy on-peak power prices and stout next-day load requirements kept a firm bid under the New England market.

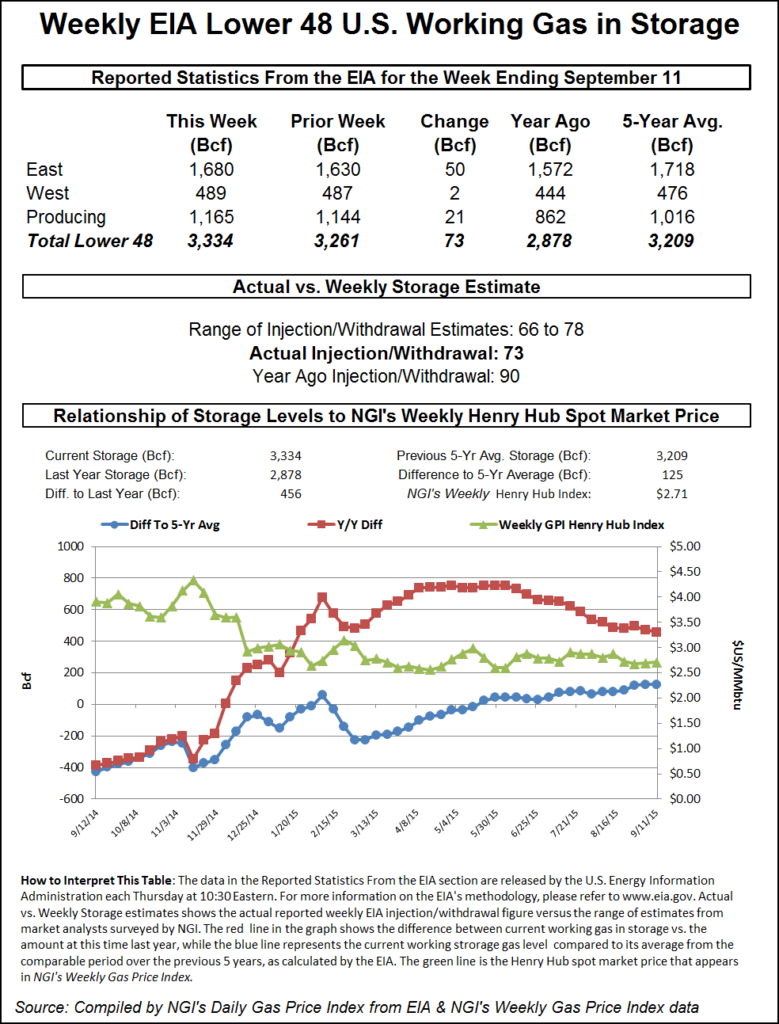

Futures traders got an initial hiccup when the EIA released on-target storage of 73 Bcf, but at the close it looked as though almost no market-moving event had taken place. October finished down 0.8 cent to $2.652 and November was off 1.1 cents to $2.728. October crude oil shed 25 cents to $46.90/bbl.

The big market-mover of the day was the EIA storage report. The agency reported a 73 Bcf injection in its 10:30 a.m. EDT release. October futures slammed to a low of $2.603 after the number was released, but by 10:45 a.m. October was trading at $2.654, down 0.6 cent from Wednesday’s settlement.

Prior to the release of the data analysts were looking for an increase right at 73 Bcf. Bentek Energy estimated 71 Bcf, utilizing its flow model, and IAF Advisors had calculated a 73 Bcf increase. A Reuters poll of 24 traders and analysts showed an average 73 Bcf with a range of 66 Bcf to an 78 Bcf injection.

A big wild card was the Labor Day holiday and its impact on demand. All indications are that the industry is on path to equal if not exceed the record 3,929 Bcf inventory established in 2012, and some analysts have suggested that 4,000 Bcf is in sight. EIA predicts a 3,840 Bcf total by the end of the injection season.

Natgasweather.com predicted a build of 74 Bcf and said, “It was warmer than normal over much of the country, especially the northern U.S., while also relatively hot over the southern U.S. where plenty of 90s to locally 100s were observed, including over much of Texas, and even briefly into major California cities. This led to hotter temperatures week over week compared to last week’s plus-68 Bcf build, although the long Labor Day weekend is expected to have led to lighter demand overall,” the company said in a Thursday morning report.

“As soon as the number was released, the market made a new low of $2.603, but then you looked back up and it was trading $2.66. That’s how quick it was,” a New York floor trader told NGI. “Why it jumped down, I don’t know. We had heard numbers from 70 Bcf to 75 Bcf so it’s right in there. It was a crazy move for no reason. I would think that was an algorithmic trader.”

Neither bulls nor bears found much to their liking. “The 73-Bcf net injection for last week was a direct match with the consensus expectation, a neutral result,” said Tim Evans of Citi Futures Perspective. “The refill was still slightly less than the 76-Bcf five-year average level, but this comparison looks rather neutral as well.”

Inventories now stand at 3,334 Bcf and are 456 Bcf greater than last year and 125 Bcf more than the five-year average. In the East Region 50 Bcf was injected and the West Region saw inventories increase by 2 Bcf. Stocks in the Producing Region rose by 21 Bcf.

Before the report, weather models changed little overnight. Commodity Weather Group in its Thursday morning six- to 10-day outlook predicts a broad pattern of above-normal temperatures throughout the plains states from North Dakota as far south as Texas.

In store are “another day of mixed changes overall, with some slightly warmer Midwest adjustments for next week, a hotter California this weekend, then cooler Western changes next week with the inclusion of potentially more tropical moisture there. The Deep South is also very slightly cooler overall, while the East Coast sees some warmer mid-week changes and then cooler late-week shifts. The net result is a very close to flat demand change from yesterday,” the forecaster said.

“The 0z cycle of all models gained minor demand as cooling degree days increased and early-season heating degree days remained about flat. There are still major splits between the models from the near-normal American side to the moderate to even much above at times European guidance. 11-15 day chaos levels on the European ensemble edge slightly higher again overnight, with mixed pattern views for the end of the forecast period,” said Matt Rogers, president of the firm.

In physical market trading New England was hit with a triple whammy of forecast warm temperatures, a strong next-day power environment, and pipeline constraints. Intercontinental Exchange reported on-peak Friday power at the ISO New England’s Massachusetts Hub gained a healthy $11.12 to $51.17/MWh. Deliveries to the New York ISO’s Zone G delivery point (eastern New York) added $4.00 to $45.00/MWh.

Next-day gas at the Algonquin Citygate surged $2.20 to $4.77, and gas on Tenn Zone 6 200L added $1.82 to $4.42.

AccuWeather.com forecast the Thursday’s high in Boston of 88 would slide to 82 Friday and 78 Saturday, 6 degrees above normal. New Haven, CT’s Thursday high of 81 was anticipated to hold Friday and ease to 78 Saturday. The normal high in New Haven is 74.

Algonquin Gas Transmission reported severe restrictions at its Cromwell Compressor Station. It said on its website that it had restricted 100% interruptible, 100% secondary out of path, 100% secondary in path and approximately 5% primary firm nominations sourced from points west of Cromwell for delivery to points east of Cromwell. “No increases in nominations sourced from points west of Cromwell for delivery to points east of Cromwell, except for Primary Firm No-Notice nominations, will be accepted,” it said.

Next-day gas pricing at other points was less frenzied. At the Chicago Citygate, Friday gas came in at $2.71, up a penny, and at the Henry Hub next-day deliveries were unchanged at $2.68. Gas at the NGPL Midcontinent Pool fell 3 cents to $2.57, and packages at the PG&E Citygate were quoted a penny lower at $3.13.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |