Markets | Infrastructure | NGI All News Access

Appalachian Natural Gas Pushing West as Transportation Comes Online

Natural gas infrastructure and market dynamics are likely to change significantly, operators said Tuesday in Chicago, if east-to-west transportation projects continue to be built from the Marcellus and Utica shales to send gas to the Midwest, Canada and Gulf Coast markets.

Many of the coal-to-gas power generation conversions are in a region where 75% of the electricity is still generated by burning coal, said TransCanada Corp.’s Todd Johnson, who directs U.S. pipeline business development. He shared a panel discussion at the LDC Mid-Continent Gas Forum.

TransCanada’s ANR Pipeline expects to make a pre-filing next spring to FERC for its Midwest Market Access Pipeline Project (see Daily GPI, Sept. 10, 2014).

“A tremendous amount of supply is going to be landing in the ANR system, and adding firm transportation and storage services on a short notice basis for power plant customers,” Johnson said.

Last year, ANR proposed the ANR East Project to connect its system with Utica/Marcellus shale gas, enabling it to access multiple markets downstream of the its system (see Shale Daily, July 9, 2014). The pipeline has been billed as a scalable, multi-part project that would allow shale gas to access the Midwest, Gulf Coast and Dawn, ON, via multiple pipeline interconnections.

ANR’s project would also allow for receipts of Utica/Marcellus gas near Defiance, OH, a hub of several existing and proposed third-party pipelines that offer capacity to various downstream markets.

Panelists from DTE Energy and Tallgrass Energy Partners also outlined their expansion plans to carry Appalachian gas to other markets.

Tallgrass Vice President Doug Walker, who runs business development, updated the status of the first-out-of-the gate Rockies Express Pipeline (REX) east-to-west reversal (see Daily GPI, Aug. 19). He said REX soon is going to announce a deal with a major electric generation customer and a second major deal currently is in negotiations.

Last month REX started up its east-to-west expansion to add 1.2 Bcf/d of incremental westbound capacity from its easternmost point in Clarington, OH, to Moultrie, IL.

“We have several discussions ongoing with several gas local distribution companies and we’re planning to add more of them, including eventually building downstream pipelines,” including the Prairie State Pipeline Project (see Daily GPI, Oct. 14, 2014). “There is a lot of supply trying to find its way to Chicago, which has been a resilient market,” Walker said.

“In the not too distant future, we will be announcing our first interconnect with a major power plant. Power plants are definitely part of our focus, and we have a second interconnect now in negotiations of the final terms. And these are large-scale plants.”

Walker said the Tallgrass vision calls for Appalachian output to move to the Midwest on the large-diameter REX pipeline’s Zone 3, and it expects to make its presence felt in the region through robust and growing connectivity (see Shale Daily, July 30).

“The Midwest is becoming more and more important to us,” said Walker.

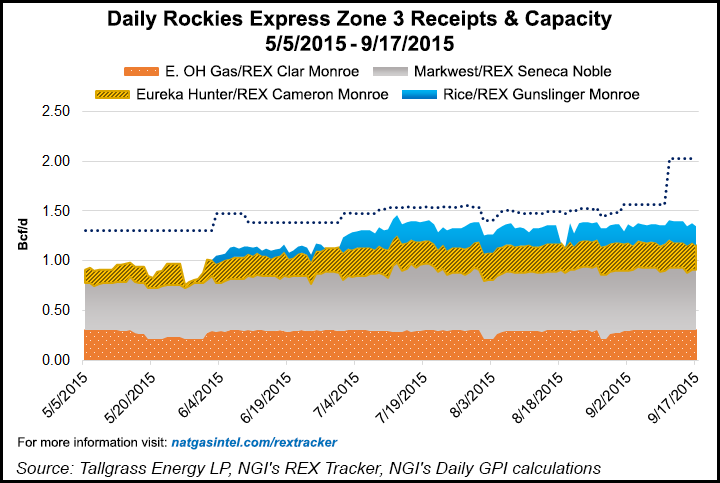

He noted that NGI’s Rockies Express Zone 3 Tracker product is a great resource for keeping tabs on gas movement and prices.

“Sometimes you get a little concentric about what you do and think it is not that important or big of a deal, but we have a feature on NGI that is called the REX Tracker,” Walker said. “We didn’t develop it, they did. It has everything on it.

“It really is a useful tool. NGI’s team “tried to make it consistent as much as they could…It is a good snapshot of what is going on…

“It shows operational capacity in the lower right-hand side that is at 2 Bcf/d, and a week ago that was 1.4 Bcf/d, or something. These guys are very current and up-to-date,” Walker added. “One thing I would point out is you see prices all along here, so these points do have a fair amount of liquidity, and you also see that the pricing in this area is fairly flat right now. So we will keep moving that gas out and getting it to these new delivery points in the Midwest.”

Slowly but steadily, gas has started to flow into REX Zone 3 via its four major receipt points. “Zone 3 receipts surpassed the 1 Bcf/d mark on June 1 and are on their way up,” said NGI markets analyst Nate Harrison. “REX receipts amounted to 1.35 Bcf/d for the flow date of Sept. 17. Despite the rapid growth, Tallgrass has managed to keep operating receipt capacity coming online as well. Receipt capacity has risen 55.2% since May 5, when NGI began monitoring its progress to where it currently sits at 2.03 Bcf/d.”

Calling the Utica a “robust and very prolific” region, DTE Energy President David Slater characterized it as the shale gas supply source that promises to become “THE basin” because of its economics.

He outlined DTE’s joint plans with Spectra to bring Utica supplies to the upper Midwest and Canadian markets through the Nexus project.

“The Utica continues to grow and it is going to have the lion’s share of the domestic supply growth for years to come,” said Slater. He said Nexus plans to file an application with the Federal Energy Regulatory Commission late this year.

Early this year the Nexus backers submitted a pre-filing application at FERC for its proposed 250-mile pipeline (see Shale Daily, Jan. 9).

The move has brought on the usual opposition from local groups along the route, that now commonly accompanies any new pipeline project.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |