Markets | NGI All News Access | NGI Data

East Buoys National Physical NatGas Average; October Futures Drop 7 Cents

Physical natural gas gains averaging a dime or more at eastern points Wednesday for Thursday delivery were able to stem the vast sea of red ink at other locations, where most points suffered losses of about a nickel. NGI’s National Spot Gas Average added a penny to $2.53.

Futures took it on the chin ahead of the Department of Energy’s (DOE) Energy Information Administration storage report due Thursday for the week ending Sept. 11. October fell 6.8 cents to $2.660 and November was off 6.1 cents to $2.739. October crude oil jumped $2.56 to $47.15/bbl.

Analysts see the large price differentials between the Marcellus and Utica pipes — such as Transco-Leidy Line, Dominion, and Tennessee and points on Rockies Express (REX) westbound — continuing until the market structure improves.

“There are a large number of wells awaiting connection, but it’s a portfolio optimization thing,” said Energy GPS President Jeff Richter. “The ”Chesapeakes’ of the world know that if they turn on the wells they are just going to depress [the] price, and that crushes their portfolio even more. Space on REX going west has opened up, and it looks like there is room, so now it’s a price thing.

“People talk about 20-30 cents needing to be put back in the curve and that is what people are hoping for this winter. Anytime you get gas flowing east to west, the spread has to come together. The gas is going to get backhauled into the Rockies and California is going to get the Rockies gas, and shippers will be saying ‘What am I going to do with all this gas?’

“The collision course is there, and the reason price doesn’t go down from a fundamental standpoint is the Henry Hub doesn’t have that collision quite yet, and that’s where everybody prices their volumes. Thus cash looks strong, production numbers are down, but at the end of the day you have all these molecules colliding with each other on these peripheral basins. Ultimately they have to go back to Henry Hub pricing. That’s not the case right now. the Henry Hub is at $2.71, and that’s the way the world turns.”

Eastern points were the day’s big gainers. Deliveries to the Algonquin Citygate vaulted 64 cents to $2.57, and gas at Iroquois, Waddington shed 2 cents to $3.08. Gas on Tenn Zone 6 200L added 61 cents to $2.60.

Thursday gas on REX at the Shelby, IN, interconnect with ANR fell 4 cents to $2.65, and gas at the NGPL interconnect at Moultrie, IL, shed 5 cents to $2.63.

Gas at the Chicago Citygate came in 8 cents lower at $2.70, and deliveries to Northern Natural Demarc changed hands down 4 cents to $2.67.

Weather forecasters don’t see much in the way of heat or cooling to encourage a bullish outlook.

“The latest overnight weather data continues to show a fairly bearish setup for the coming few weeks, likely through the rest of September,” said Natgasweather.com in a Wednesday morning report. “Over much of the U.S., it’s going to play out to the warm side, but for late September, we view this as bearish over the northern U.S. as little to no demand for heating will be needed, while only moderate demand for cooling will be required over the southern U.S., including Texas, Florida and California due to highs reaching the 80s to lower 90s, but still not quite impressive enough.

“Of importance, we still aren’t seeing any true cold blasts moving toward the Midwest and eastern U.S. for at least a couple more weeks, although, the northwestern U.S. will see some fall-like systems roll through with high-elevation snowfall.”

Forecast cooling requirements may not be much, but they are nonetheless well above seasonal norms. The National Weather Service (NWS) for the week ended Sept. 19 is forecasting New England will see 28 cooling degree days (CDD), or 25 above normal. The Mid-Atlantic, including the populous states of New York, New Jersey and Pennsylvania, is expected to experience 28 CDDs, or 16 above normal. The greater Midwest, from Ohio to Wisconsin should see 23 CDD, or 10 above normal.

Tim Evans of Citi Futures Perspective said Tuesday’s weakness was a function of near-term weather forecasts.

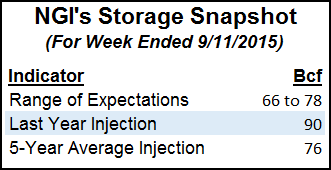

“The early consensus view for Thursday’s DOE storage report seems to be centered at 72-73 Bcf in net injections, modestly supportive compared with the 76 Bcf five-year average refill for the week ended Sept. 11.”

Evans is forecasting a build of 66 Bcf and senses that the market might be set up for “a minor bullish surprise,” but going forward stout injections are expected to take the year-on-five-year surplus to 171 Bcf from its present 127 Bcf by Oct. 2. He still expects the potential for a seasonal rally capable of taking the market above $3.00.

Tom Saal, vice president at FC Stone Latin America LLC in Miami, in his work with Market Profile expects the market to test Tuesday’s value area at $2.765-2.747. Market profile methodology requires buying or selling price breakouts above or below the week’s initial balance, and this week’s initial balance Saal places at $2.771-2.695. Saal is not specific in his timing, but he expects the market to test a second value area at $2.812-2.774.

Other estimates of Thursday’s storage figures include IAF Advisors, which is looking for a 73 Bcf increase, and Genscape Inc., which is calculating a build of 77 Bcf. A Reuters survey of 24 industry cognoscenti revealed an average 73 Bcf with a range of 66 Bcf to 78 Bcf. Last year 90 Bcf was injected for the date-adjusted week.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |