Mexico Sweetens Deal For Next Set of GOM Lease Blocks

After the first auction of shallow water oil and gas lease blocks in the Gulf of Mexico (GOM) generated little interest this summer due to low commodity prices, the Mexican government has sweetened the deal for another five groups of blocks up for auction at the end of the month.

On Monday, Mexico’s Comision Nacional de Hidrocarburos (CNH) said the Secretariat of Finance and Public Credit had modified the minimum bids for the five blocks. The revised minimum bids range from 30.2% to 35.9% of operating profit, and are due Sept. 30.

“The government must ensure that it receives oil revenues resulting from the extraction of hydrocarbons while establishing a framework that is competitive and encourages investment in the sector,” said a translation of a CNH statement.

The five offshore blocks, and the revised minimum bid set by the Mexican government, are: Amoca, Mizton and Tecoalli (34.8%); Hokchi (35.9%); Ichalkil and Pokoch (33.7%); Mison and Nak (35.2%); and Xulum (30.2%).

According to the CNH, the nine fields have been certified to hold a combined 143 million boe of proved (1P) reserves, 355 million boe of proved and probable (2P) reserves, and 671 million boe of proved, probable and possible (3P) reserves. Combined, the blocks have a surface area of 280.9 square kilometers (108.5 square miles).

“The minimum values imply that, considering all the economic elements included in the contractual and tax framework, the government will receive most of the total profits associated with the development of contractual areas bids,” CNH said.

Last July, nine companies and consortia — fewer than half of the 38 exploration and production companies qualified for the tenders — chose to submit offers for the 14 blocks in the southern GOM (see Daily GPI, July 15). Several blocks received no offers, and other bids failed to meet the minimum threshold for profit sharing with the government. CNH awarded two shallow GOM lease blocks to a consortium of Mexico’s Sierra Oil & Gas, Houston’s Talos Energy LLC and the United Kingdom’s Premier Oil plc.

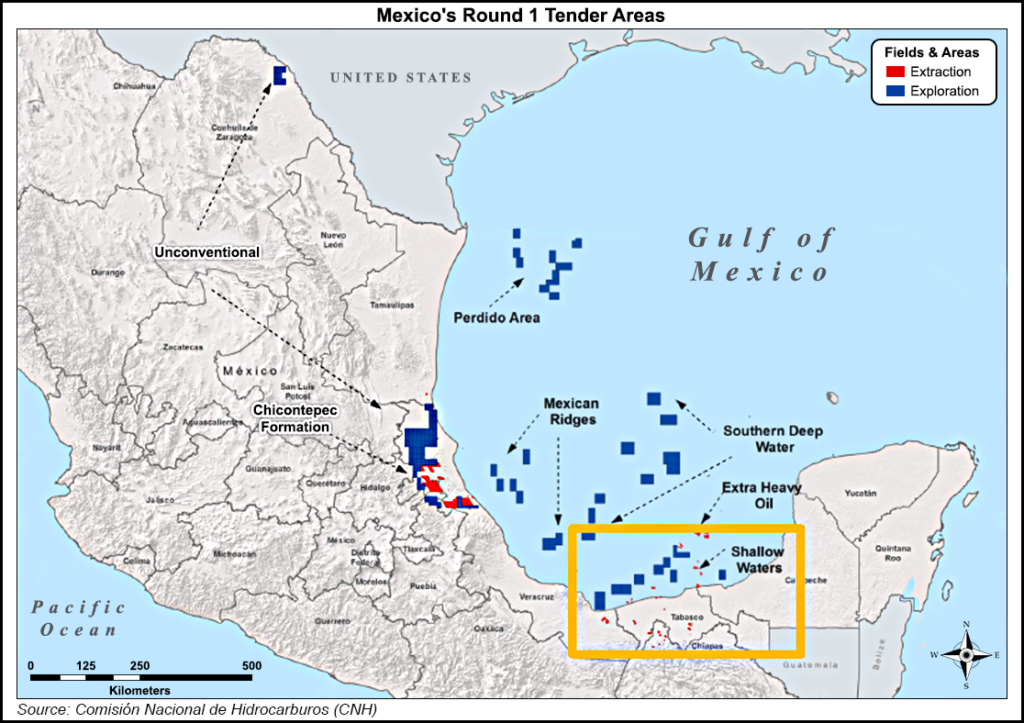

The CNH launched what it has dubbed “Round 1” last December, inviting oil and gas companies to bid on 14 offshore exploratory blocks in the shallow GOM (see Daily GPI, Dec. 11, 2014). The lease sales are part of sweeping energy reforms enacted by President Enrique Pena Nieto.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |