Low Commodity Prices, Stable Production to Stick Around, CME Economist Says

Influenced by China as a global economic barometer and driver of commodity prices, U.S. oil/natural gas production will stay relatively stable amid continued low prices, but over the long-term prices will edge upward, according to Bluford Putnam, chief economist for CME Group.

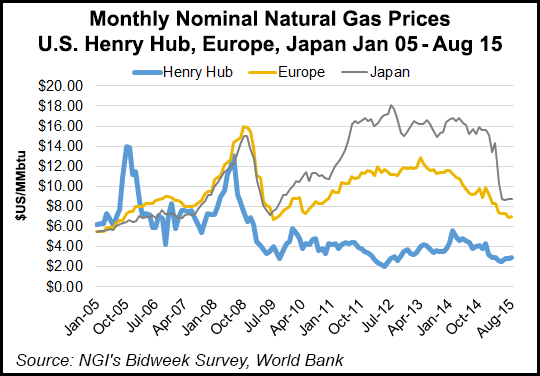

Noting that the United States will “reconnect” with the rest of the world through liquefied natural gas (LNG) exports, Putnam said he sees lower gas prices in Europe and rising prices in the United States — not in 2016, but longer term, into 2020.

“U.S. gas and oil prices have come down to about the same place today, but this is not going to stay that way,” he told the LDC Mid-Continent Gas Forum Monday.

“There are a lot of factors affecting natural gas prices that over time will push U.S. prices up and global prices down,” Putnam said. “This is very different than the [global] oil dynamic, where lots of supply meets slowing demand.”

About the only factors globally that could upset that outlook would be a major upheaval in the Middle East or a global recession, both of which have a low probability of occurring, Putnam said.

He sees the world remaining in a “low commodity price” era. Putnam’s forecast sees oil staying between $35-50/bbl and natural gas staying at current levels in the short term. “But as you look out over the years, the farther out, the more optimistic I am about natural gas prices outperforming oil prices, but that will only happen in years, not months,” he said.

Putnam sees production remaining relatively high amid the low prices as U.S. producers keep oil/gas flowing for cashflow purposes if nothing else. “It turns out that the actual cash that it costs to get the next increment of production out of a well is pretty low, so you don’t shut the wells down. We really haven’t had that drop in production, and it is not going to happen.”

In his projections, Putnam said, “we have supply demand coming together for a long period of fairly low energy prices.”

This is an outgrowth of global macroeconomic developments that are driven by a Chinese economy that has been slowing for the last three years, not just recent months, Putnam pointed out. That helps lower global energy prices, but has only “marginal” impacts long term for the U.S. and European economies. “This is a more isolated problem than the stock markets give it credit for.”

Similarly, if and when the Federal Reserve raises U.S. interest rates, as it could do as early as this Thursday and most likely before the end of the year, Putnam thinks it will have little impact on the national economy, although he thinks it will be an important signal that the Fed feels the economy, bashed by the 2008 recession, is “now out of intensive care.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |