E&P | Eagle Ford Shale | Haynesville Shale | Marcellus | NGI All News Access | Permian Basin | Utica Shale

Declining North America Rig Count at 44% of Year Ago

The U.S. and Canadian rig counts continued their slide in the latest Baker Hughes Inc. census amid the mantra of “lower for longer” oil prices now widely spouted by industry executives and analysts.

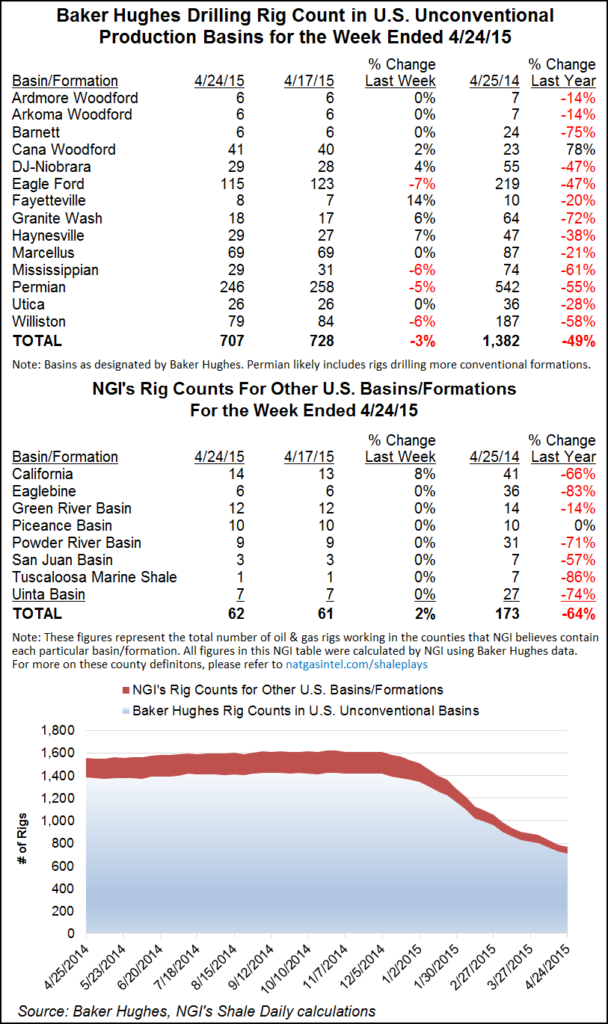

The United States dropped a net of 16 rigs, giving up 10 oil and six natural gas units. Canada was down a net of two after giving up eight oil rigs but adding six gas units. The U.S. count settled at 848, and Canada landed at 185. For North America, the tally was down a net of 18 rigs for a count of 1,033, which is 44% of the year-ago tally of 2,336.

Texas was the biggest loser among states, giving up nine rigs, which far eclipsed the pullback seen in other states. Texas had 366 rigs running, which is just 40% of the year-ago tally of 905. The Permian Basin and the Eagle Ford Shale were also the biggest losers among leading plays, with each dropping three rigs.

During the week, Goldman Sachs came out with a note titled “The New Oil Order: Lower for Even Longer.” An “oil special” from Societe Generale proclaimed that “prices need to stay lower in order to rebalance the market.” And Barclays Equity Research analysts were ruminating on “a New Oil Paradigm.”

“As we continue to view U.S. shale as the likely near-term source of supply adjustment given the short-cycle nature of shale production, we forecast that U.S. Lower 48 crude and NGL [natural gas liquids] production will decline by 585,000 b/d in 2016 with other non-OPEC supply down 220,000 b/d to end the oversupply by 4Q16,” Goldman said in its note.

If production takes too long to wane, supplies could challenge storage capacity, Goldman warned. “While not our base case, the potential for oil prices to fall to such levels, which we estimate near $20/bbl, is becoming greater as storage continues to fill,” Goldman analysts said.

Societe Generale said to look out for volatility on the road to a rebalanced market. “The U.S. swing producer in action: lower prices lead to less supply, and higher prices lead to more supply. This is similar to Saudi Arabia. The difference is that with the U.S., [the] market balancing is a messy and extended process. Not one key player, but hundreds. The result is price volatility.”

Those players won’t go quietly, not even in the face of these “lower for longer” oil prices, Barclays cautioned. “We expect U.S. oil production to remain surprisingly robust despite the 50% plus fall in oil prices over the past 12-18 months,” analysts said. “As a result, we think U.S. oil production will remain robust in a low oil price environment, and despite another year of potential double-digit CAPEX [capital spending] cuts in 2016.”

Marathon Oil Corp. CEO Lee Tillman has spending cuts on his mind. He told the audience at a Barclays conference in New York City that the company is taking a “strong response” to “lower for longer pricing.” There is no incentive to accelerate activity with prices where they are today, he said (see Shale Daily, Sept. 10).

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |