Infrastructure | Markets | NGI All News Access | NGI Data

Few Positives on Physical NatGas Trading; October Adds 3 Cents Post EIA Report

Led by double-digit declines in the East, physical natural gas for Friday delivery endured a broad setback in Thursday’s trading.

Selling was pervasive. Weather forecasts called for widespread load-killing thunderstorms and eastern points tumbled about 20 cents. The NGI Daily Spot Gas Average fell 8 cents to $2.51. The EIA reported a storage increase of 68 Bcf for the week ended Sept. 4 and futures managed to climb. At the close, October had gained 3.2 cents to $2.683 and November was higher by 2.3 cents to $2.759. October crude oil jumped $1.77 to $45.92/bbl.

Northeast points were hit the hardest as heavy showers and thunderstorms were forecast. According to Keri Strenfel, meteorologist at Wunderground.com, “A cold frontal boundary will extend southwestward over the Northeast, the Ohio Valley, the Tennessee Valley, the lower Mississippi Valley and the southern Plains. Rain and thunderstorms will develop along and ahead of this frontal boundary over much of the eastern states, as well as the southern Plains. The heaviest rain will develop over New England on Thursday, where three to four inches of rain will be possible.”

Next-day gas into the Algonquin Citygate fell $1.09 to $2.62, and deliveries to Iroquois, Waddington shed 12 cents to $3.04. Gas on Tenn Zone 6 200L tumbled 93 cents to $2.65.

Declines at Midwest points were more subdued. Deliveries to Alliance shed 7 cents to $2.76, and gas at the Chicago Citygate was quoted 4 cents lower at $2.71. Gas on Consumers came in 4 cents lower at $2.99, and parcels on Michigan Consolidated changed hands down 3 cents at $2.95.

Next-day power prices also made incremental gas purchases less attractive. Intercontinental Exchange reported that Friday on-peak power at the ISO New England’s Massachusetts Hub fell $12.13 to $36.00/MWh and Friday power at the PJM West Hub weakened $2.01 to $31.00/MWh.

Transportation alternatives out of the Midwest continue to multiply. NGI‘s Rockies Express Zone 3 Tracker recorded a large increase in operating capacity at the Moultrie IL interconnect with NGPL. Between Sept. 9 and 10, capacity there has more than doubled from 615,000 Dth/d to 1,395,000 Dth/d. The increase brought utilization at the point down from 75% to just 33% as deliveries held steady. The expansion news at Moultrie comes just one day after REX upped the operating capacity of its interconnect with ANR at Shelby, IN. The increase at Shelby was almost as large with operating capacity rising from 609,000 Dth/d to 1,253,000 Dth/d between September 8th and 9th flow dates.

Gas at the Moultrie, IL, interconnect with NGPL fell 4 cents to $2.63 and gas on REX at the Shelby, IN, junction with ANR shed a nickel as well to $2.64.

Deliveries to Midwest Pipeline at Edgar, IL, skidded 6 cents to $2.63.

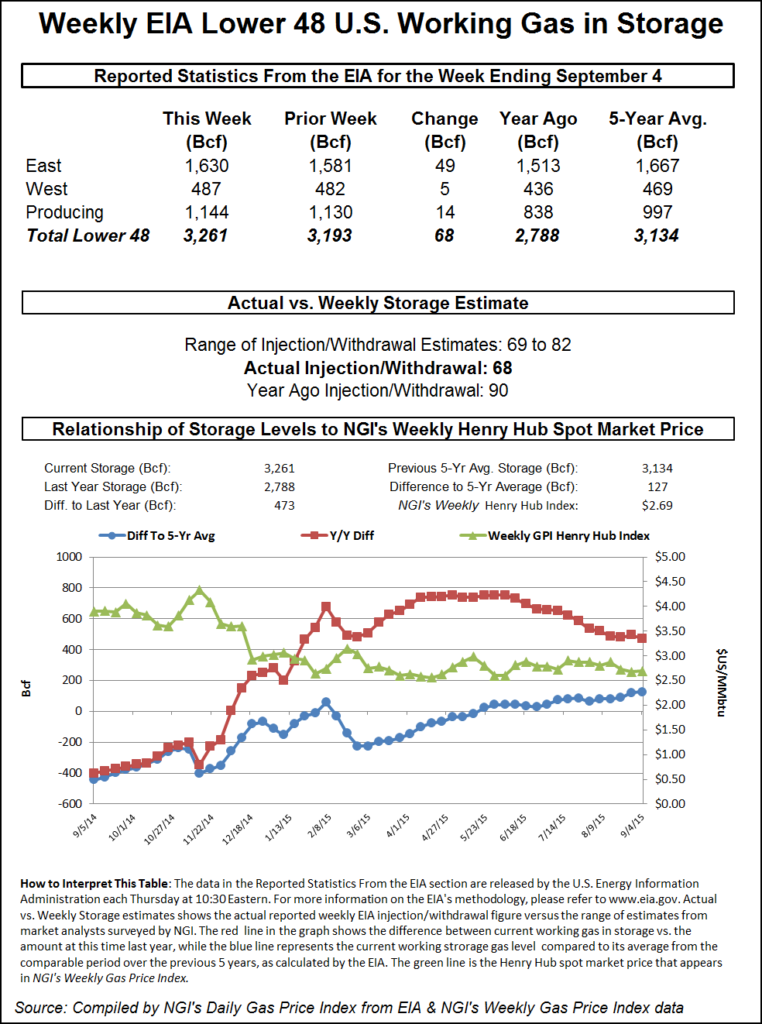

Traders were caught a little off guard at the 10:30 a.m. EDT release of EIA storage figures. For the week ended Sept. 4 the Energy Information Administration (EIA) reported a 68 Bcf injection in its 10:30 a.m. release. October futures rose to a high of $2.730 after the number was released, and by 10:45 a.m. October was trading at $2.726, up 7.5 cents from Wednesday’s settlement.

Prior to the release of the data analysts were looking for an increase in the 74 to 75 Bcf range. ICAP Energy estimated 80 Bcf, and IAF Advisors had calculated a 74 Bcf increase. A Reuters poll of 25 traders and analysts showed an average 75 Bcf with a range of 69 to 82 Bcf.

“We were looking for an increase of 74 Bcf to 75 Bcf so this is something of a bullish surprise,” a New York floor trader told NGI. “I think you have to look at $2.65 support and $2.75 resistance.”

“The DOE reported a clean 68-Bcf net injection into US natural gas storage with no reclassifications or other adjustments this week,” said Tim Evans of Citi Futures Perspective. “While still just above the 63 Bcf five-year average for the data, this was a smaller than expected build that implies at least a somewhat tighter background supply/demand balance. We’d call it constructive overall.”

Inventories now stand at 3,261 Bcf and are 473 Bcf greater than last year and 127 Bcf more than the five-year average. In the East Region 49 Bcf was injected and the West Region saw inventories increase by 5 Bcf. Stocks in the Producing Region rose by 14 Bcf. With 3,193 Bcf in storage and nine weeks to go on the traditional injection season, weekly increases of 90 Bcf will be required to reach the marquee level of 4 Tcf and set a new inventory record in the process.

Weather model runs turned slightly warmer overnight. Commodity Weather Group in its Thursday morning report said, “Warmer shifts for the Midwest to East were most notable in today’s update for the six-10 day into the 11-15 day. This is a trickier time of year as warmer changes in the Midwest offer smaller impacts on demand, while we can still see some marginal late-season cooling demand on the East Coast (80s vs. 90s).

“The Deep South is also slightly warmer today, while the West is cooler following the strong heat over the next few days. Sacramento is forecast to be at 107 F today and tomorrow, which would both be record highs,” said Matt Rogers, president of the firm.

Jim Ritterbusch of Ritterbusch and Associates contends that the market is becoming less focused on near-term weather forecasts and is concentrating on what storage builds will look like during the shoulder season. “The price consolidation of the past 2 and a half weeks within a very narrow 10-cent range is reinforcing our opinion that most favorable trading opportunities will take the form of option straddle strategies designed to collect premium,” he said in opening comments Thursday to clients.

“So while we still feel that [Thursday’s] storage report could contribute to fresh lows to around the $2.58 area, we will also expect a renewed lift back into this recent trading range by the end of next week. Regarding today’s EIA release, we feel that a bearish miss is more likely than a bullish figure given the recent upswing in production and possible increase in imports. An injection of more than 80 Bcf is certainly possible and would likely jam nearby futures to below the $2.63 support that has been validated on several occasions this month.

“And while the daily shifts in the short-term temperature views are prompting some price volatility, the expected above-normal trends out to about the 24th of this month are not showing enough deviation from normal to spur sustained buying interest.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |