Markets | NGI All News Access | NGI Data

Great Lakes Storage Under Scrutiny; NatGas Cash, Futures Weak

Physical natural gas for Thursday delivery was down almost a nickel in Wednesday’s trading, though a few illiquid eastern points with multi-dollar jumps managed to skew the overall market.

The NGI Daily Spot Gas Average was down four cents at $2.59, but take away two New England pipes and a more representative decline becomes apparent. Low forecast power loads and tumbling eastern next-day power tugged eastern quotes lower by about 8 cents.

Temperature forecasts across major market centers remained close to seasonal norms, but futures traders grasped a slight forecast decrease in cooling load to send prices back down to the low end of the recent trading range. At the close, October was down 5.9 cents to $2.651 and November had shed 5.6 cents to $2.736. October crude oil skidded $1.79 to $44.15/bbl.

Cash quotes in the Great Lakes are elevated as storage in the area falls short. Of all the market points NGI follows west of the Hudson River, only a handful in California points exceeded quotes on Michigan-based Consumers, Michcon and Canadian market point Dawn.

In a generally down trading day, quotes on Consumers was flat at $3.03, and gas on Michcon slipped just below the $3 threshold with a decline of 2 cents to $2.98. Gas at Dawn was quoted at $3.08, down a penny on the day. Pivotal pipeline storage facilities in northern Michigan operated by ANR Pipeline are well below normal levels, despite storage inventories nationally expected to approach, if not exceed, record levels. Some analysts have estimated ending storage at 4.0 Tcf or higher. The record is 3.929 Tcf reached in October 2012, according to EIA figures.

“With under two months of injection season remaining, ANR storage and Blue Lake storage are on pace to enter the Winter strip at record low inventories,” Genscape said. “At the start of July, ANR storage and Blue Lake storage aggregate inventory was 6,500 MMcf above last year’s mark and had a chance to reach maximum capacity levels.

“Since then, inventories have only risen by 17,500 MMcf to 67,400 MMcf, which is the lowest recorded level at this time of year. Injection rates in July and August came in at 80 MMcf/d, well short of last year’s pace of 152 MMcf/d during the same period. Using injection rates from last September and October, season-ending aggregate inventories would only reach 85,000 MMcf, almost 7,000 MMcf below last year’s peak inventory and 20,000 MMcf below the maximum capacity.

“Using the three-year average injection rates, inventories would fail to reach 78,000 MMcf. Entering withdrawal season with record low inventories will provide support for prices in the upper Midwest,” Genscape said.

More gas may be on its way eastward as the REX Zone 3 East-to-West Expansion gets under way. According to the NGI Rex Zone 3 Tracker, the capacity of the ANR Pipeline interconnect with REX at Shelby, IN, got a large increase in operating capacity Wednesday, going from 608,605 Dth/d to 1,253,000 Dth/d with deliveries holding pretty steady.* “The result was a drop in utilization from 100% to just 48%. The market can expect more increases like this at both delivery and receipt points in the coming weeks,” said NGI markets analyst Nathan Harrison.

At other market points, slumping next day power and falling load forecasts prompted lower quotes. Intercontinental Exchange said that on-peak power at the ISO New England Massachusetts Hub fell $8.83 to $48.13 and peak power at the PJM West terminal skidded $12.45 to $33.82/MWh.

Next day deliveries on Tetco M-3 Delivery fell 11 cents to $1.52, and gas headed for New York City on Transco Zone 6 lost 19 cents to $2.66.

Forecast power loads also eased. The New York ISO forecast peak load Wednesday of 28,614 MW would drop to 26,272 MW Thursday and 24,053 MW Friday. The PJM Interconnect said peak load Thursday of 53,289 MW would tumble to 38,688 MW Thursday and reach 39,407 MW Friday.

Other market points were flat to lower. Henry Hub deliveries were quoted at $2.73, unchanged, and Chicago Citygate came in at $2.75, down 5 cents.

Market technicians continue to look for an elusive price breakout, either higher or lower. “More congestion,” said Brian LaRose, a market technician at United ICAP. “That means we are still stuck in neutral gear. Bears need to crack $2.624 to signal a further decline to $2.543, even $2.425-2.385 is possible from here.

“Bulls need to push natural gas up and over $2.871-2.881 to signal a seasonal advance of some degree may be taking hold. As long as natural gas is stuck between these levels, we are stuck sitting on our hands,” he said in closing comments Tuesday.

Forecasters calculate a slight lessening in cooling requirements in the near term. “[Wednesday’s] six-10 day period forecast is warmer than yesterday’s forecast over the Plains, Midwest and Northeast. The West and South are cooler. As a result, PWCDDs are down 0.2 to 28.5 for the CONUS,” said WSI Corp. in its Wednesday morning report to clients.

“Forecast confidence is average today. Medium-range models are in better agreement with the progression of the large-scale pattern when compared to yesterday’s runs. The West and north-central states have the greatest risk to the cooler side. The central and northern U.S. have a small upside risk.”

Tom Saal, vice president at FC Stone Latin America LLC, in his work with Market Profile said to look for the market to test Tuesday’s value area at $2.719 to $2.701. “Eventually” he expects the market to test a second value area at $2.812 to $2.774.

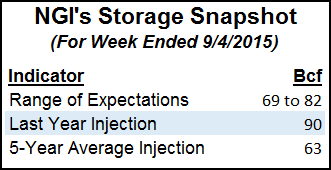

Those value areas may get a test Thursday when the Energy Information Administration releases storage data for the week ended Sept. 4. Last year 90 Bcf was injected and the five year pace stands at 63 Bcf. Analysts at IAF Advisors calculate a 74 Bcf increase while ICAP Energy figures on an 80 Bcf build. A Reuters poll of 25 traders and analysts revealed an average 75 Bcf with a range of 69 Bcf to 82 Bcf.

*Correction: NGI originally stated that the ANR Pipeline interconnect with REX at Shelby, IN, got a large increase in operating capacity Wednesday, going from 608,605 MMcf/d to 1,253,000 MMcf/d. In fact, the large increase was actually 608,605 Dth/d to 1,253,000 Dth/d. NGI regrets the error.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |