Bakken Shale | NGI All News Access | NGI The Weekly Gas Market Report

Continental Cuts Spending, Completions as Oil Prices Languish

Continental Resources Inc. is slashing its capital budget by $300 million to $350 million for 2015 in an effort to align spending with cash flow as oil prices remain depressed. Well completions will be deferred where the company is not obligated to complete wells, the Bakken Shale producer said Tuesday.

“While we do not believe today’s low commodity prices are sustainable long term, we are committed to living within cash flow until they recover,” said CEO Harold Hamm. “We are reducing capital expenditures to protect our balance sheet and to preserve the value of our world-class assets until commodity prices improve.”

The Oklahoma City-based company’s 2015 guidance remains unchanged. Continental continues to expect production growth of 19-23% for the year, compared with 2014, but it now expects to exit the year with production in a range of 200,000-215,000 boe/d. The bottom end of the range is 10,000 boe/d below the previous outlook, reflecting an increase of inventory from the previously expected 100 gross operated wells that are drilled but not yet completed at year-end 2015 to the current estimate of 160 gross wells drilled but not yet completed at year-end 2015. Capital to maintain 2016 production at the 2015 exit rate is now projected to be $1.6 billion to $2.0 billion.

In early August, Continental said actual capital spending was trending below its $2.7 billion non-acquisition capital expenditures budget (see Shale Daily, Aug. 6). Management said at the time that measures to balance spending with cash flow would be taken if oil prices remained weak.

“We continue to focus on achieving cash flow neutrality in the current environment,” said CFO John Hart. “We believe it is in the interest of shareholders to defer new production growth until we see stronger commodity prices.”

“Annual production growth is expected to be toward the top end of our guidance range, even with deferred completions,” he said. “Production expense per boe and general and administrative expense per boe are also trending positively toward the low end of guidance. Lower capex spending and excellent operating performance should position us to be cash flow neutral for the remainder of 2015 in an environment of approximately $50/bbl for West Texas Intermediate [WTI]. In a $40/bbl WTI environment, our updated spending outlook would result in capital expenditures being approximately $150 million over cash flow.

“We continue to have ample liquidity with approximately $1.3 billion available under our credit facility at Aug. 31, 2015, basically in line with our June 30, 2015 balance.”

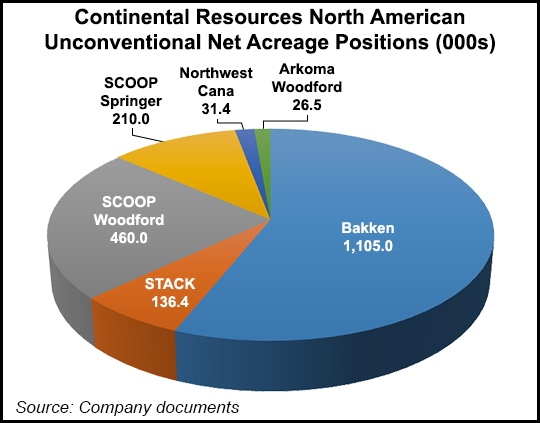

Continental is the largest leaseholder and one of the largest producers in the Bakken. It also has significant positions in Oklahoma.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |