M&A | NGI All News Access | NGI The Weekly Gas Market Report | Regulatory

Emera Sees Stability, Carbon-Light Future in $10.4B Teco Deal

A quest for security as a regulated utility with stable income inspired a former Canadian government-owned power and gas corporation’s expansion into the United States.

“What we have been doing is looking very, very carefully in recent years for more regulated earnings,” Emera Inc. President Chris G. Huskilson told financial analysts after announcing his firm’s Friday takeover of Teco Energy Inc. for US$10.4 billion.

“That’s where really Teco Energy becomes a perfect match for Emera,” he said. “We are in the position with this transaction of being able to merge with essentially 100% regulated business, and that pure play regulated business is one that fits our strategy and our objectives extremely well.”

Halifax-based Emera started its current life as an investor-owned energy firm in 1991, in a “privatization” sale of Nova Scotia Power Inc. by the provincial government. The firm went through a second conversion in 1998, into a utility holding company with an array of subsidiaries and built-in ability to acquire more.

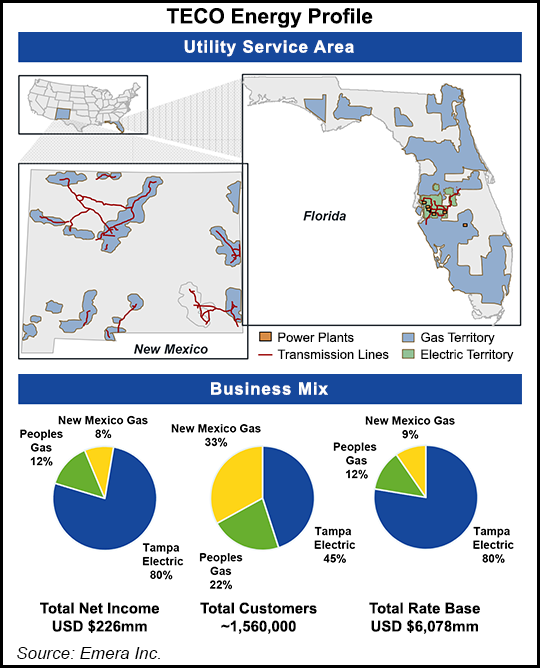

The takeover of Tampa-based Teco with Florida and New Mexico power and gas franchises will result in an enlarged utility conglomerate with more than four-fifths of its earnings drawn from stable, regulated services, Huskilson said.

Prior to the move into U.S. public energy supplies, Emera told its shareholders that the regulated service elements of its generation, transmission, distribution, gas pipeline and marketing portfolio in Canada, the Caribbean and New England were down to 67%.

Huskilson added that Emera and Teco are both “focused on the transformation that’s going on in this industry today from higher-carbon sources of electricity and energy in total to lower sources of carbon or lower intensity sources of carbon.”

In Canada, Emera is embarking on construction of an 840 MW Labrador hydroelectric site called Muskrat Falls and a new Atlantic Canada transmission network that includes a subsea link between Newfoundland and Nova Scotia.

In the United States, Teco is working on selling its coal interests in Kentucky, Tennessee and Virginia in a self-administered overhaul that has gained steam as the U.S. government attempts to reduce national reliance on greenhouse gas-emitting, fossil fuel-fired power generation.

The Canadian scheme has strong official backing. On top of favorable environmental policies, a federal government construction loan guarantee and project agreements with the Newfoundland and Nova Scotia administration’s support the new Atlantic Canadian power package.

Total costs of the regional development scheme have been forecast as up to C$3.6 billion (US$2.7 billion) for the remote dam and C$2.6 billion (US$1.9 billion) for the transmission network. When completed, the hydropower scheme will pare down Emera’s current 78% reliance on fossil fuel-fired generation: 50% coal and 28% gas or oil.

The Teco takeover puts the Emera growth campaign on a solid financial foundation, Huskilson said. “This will move us to 84% regulated earnings…and that strengthens our business. It strengthens our access to capital and strengthens our credit metrics. It provides tremendous support to our dividend,” he said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |