E&P | Haynesville Shale | NGI All News Access | NGI The Weekly Gas Market Report | Utica Shale

Chesapeake Strikes Sweeter Haynesville, Utica Gathering Deals With Williams

Chesapeake Energy Corp. (CHK) has struck a deal with units of Williams Partners LP that gives it a break on natural gas gathering fees in the Haynesville and Utica shales while it agrees to increase production/volume commitments to Williams’ pipes.

In January, Chesapeake will move to fixed-free agreements with Williams in both plays. Williams own 60% of Williams Partners, including the general partner interest.

Fees in the Haynesville will be reduced on a unit basis, and existing minimum volume obligations are expected to be met with the consolidation of the Springridge and Mansfield gathering contracts into a single agreement with a term to 2035, as well as a projected increase in Haynesville volumes, the companies said. Including previously expected minimum volume commitment (MVC) shortfall payments, Chesapeake’s gas production is expected to see improved gathering rates of about 20 cents/Mcf in 2016 and 2017 and about 30 cents/Mcf in 2018 and beyond, the company said.

Chesapeake committed to turn the equivalent of 140 Haynesville wells online by the end of 2017, which it said is expected to “result in significant production growth” in the Haynesville over the next two years, thus increasing Williams’ revenue from the area.

“Our improved performance in the Haynesville is the primary reason that we were able to negotiate new gathering rates,” said Chesapeake CEO Doug Lawler. “These agreements will result in lower gathering rates and lower differentials, making these assets even more competitive within our portfolio. In this capital-constrained environment, we will benefit from these higher-return assets and expect to allocate incremental capital to these areas, while enabling Williams to more fully utilize its gathering systems.”

In the Utica, Chesapeake is expected to see an estimated gathering rate reduction of about 25 cents/MMBtu. The company is dedicating an additional 50,000 net acres to Williams, for a total of 190,000 acres, and will be subject to a new MVC of 250 MMBtu/d beginning in mid-2017. Williams said the additional acreage dedicated is adjacent to its existing assets.

“This change to a fixed-fee contract enhances Williams’ ability to gather third-party volumes and build scale in Utica’s dry gas areas,” the company said. “Williams expects this will provide the opportunity to invest more than $600 million over five years to install more than 200 miles of pipeline and related facilities as this prolific area of the basin grows with up to 800 MMcf/d of capacity to serve the development.”

Chesapeake said it expects to meet the Utica volume commitment by running about one rig per year. The Oklahoma City-based company is the second-largest producer of natural gas and the 11th largest producer of oil and natural gas liquids in the United States.

Wunderlich Securities Inc. said Chesapeake has improved its transportation costs “significantly” with the agreements. “For a sense of scale, we believe the company pays about 90 cents/Mcf currently, so these figures are quite material,” Wunderlich said. “These deals drastically improve the cost structure and economics of CHK’s drilling programs in the two regions by reducing transportation costs/improving differentials 20-30% starting in 2016. As such, this should allow CHK to get more active in both regions…”

Williams said it expects “positive impact” to earnings before interest, taxes, depreciation and amortization in both the Utica and the Haynesville due to near-term higher volumes and drilling commitments.

“This demonstrates our commitment to working with Chesapeake to align our interests on mutual growth while sustaining the financial support of our investments,” said Williams CEO Alan Armstrong. “These new fee structures are designed to promote production in the best locations across a wider footprint in these great basins, which improves the economics on both the drilling and midstream side.”

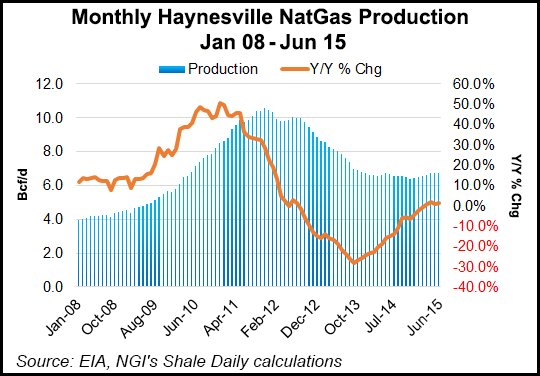

Natural gas production in the Haynesville Shale has stabilized in recent months, thanks in no small part to Chesapeake’s renewed focus in the area. Overall, gas production in the Haynesville averaged roughly 6.7 Bcf/d in June, the fourth consecutive month the formation has seen a positive year-over-year increase in output, after posting y/y production declines in every month between August 2012 and February 2015.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |