Marcellus | E&P | Eagle Ford Shale | NGI All News Access | Permian Basin

Rigs Retreat; Texas Tally Falls Hard

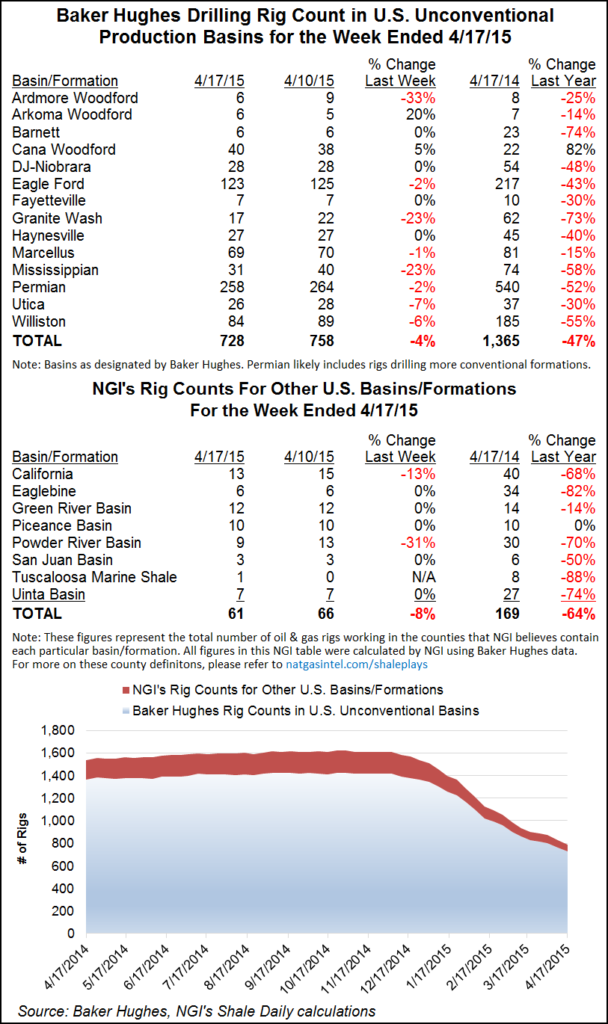

The U.S. oil and gas rig count saw a net decline of 13 as 16 rigs retreated from land drilling while three joined the hunt offshore, according to Baker Hughes Inc. in its report for the week ending Sept. 4. Texas took the biggest hit, losing 11 rigs to the ongoing price route.

The U.S. oil and gas rig count stands at 864; Canada is at 187. That makes for a North American total of 1,051, way down from 2,339 one year ago.

Natural gas-directed rigs in the United States held steady with the previous week’s tally of 202, but the oil campaign lost 13 rigs. Canada saw 10 oil-directed rigs pack it in while one gas-directed rig was added.

In Texas, nothing changed in the dry gas Barnett Shale where seven rigs remained, a shadow of the year-ago tally of 26. The Eagle Ford lost four rigs to end at 93, far from its year-ago tally of 202. The Permian Basin only gave up two rigs, but at 253 running, it’s at less than half its year-ago power of 563.

In the previous week’s count, driller’s closed the door on the Tuscaloosa Marine Shale of Louisiana and Mississippi (see Shale Daily, Aug. 28), but one rig is back in the most recent count. In the previous week’s count, Louisiana lost six rigs statewide. In the most recent count, the Pelican State is up by four to end at 75, far from the year-ago tally of 117. Louisiana was the most noteworthy gainer among states in the latest count. That’s likely to be little comfort to Louisiana Oil & Gas Association President Don Briggs, who recently told NGI’s Shale Daily that things are about as bad as they were in the mid-1980s (see Shale Daily, Sept. 1).

While analysts have been noting that the decline in active oil rigs will impact production of associated natural gas, they warn to not expect much in the way of oversupply relief as the mighty Marcellus will keep on doing its thing.

“…[E]stimated Marcellus growth (about 1.5 Bcf/d) combined with soon-to-open pipeline takeaway capacity (of which we have identified about 4 Bcf/d) is set to more than compensate for price-driven associated gas production declines elsewhere,” Raymond James & Associates Inc. said in an Aug. 31 note (see Daily GPI, Aug. 31).

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |