Markets | NGI All News Access | NGI Data

Natural Gas Futures Rise Post EIA Storage Report, But Cash Slogs Lower

All indications ahead of Thursday’s Energy Information Administration (EIA) gas storage report were that it would be a much larger than normal build, and physical traders jumped on the “sell” bandwagon early, sending gas for Friday delivery broadly lower with only a handful of points registering small gains.

NGI’s National Spot Gas Average fell 7 cents to $2.48, but eastern points really took it on the chin, with average drops of a quarter or more. The EIA reported an increase in storage of 94 Bcf, and even with an 8 Bcf reclassification in the East Region to determine implied injections, the 86 Bcf injection was well above historical averages.

Markets have a way of making the smartest guys in the room, however, look less than stellar, and in the face of a stout build, October futures added 7.7 cents to $2.725 and November rose 7.6 cents to $2.796. October crude oil rose 50 cents to $46.75/bbl.

Prior to the release of the EIA storage data analysts were looking for an increase in the 85-90 Bcf range without the adjustment. ICAP Energy estimated 94 Bcf, and IAF Advisors had calculated an 85 Bcf increase. A Reuters poll of 24 traders and analysts showed an average of 88 Bcf with a range of 79-97 Bcf.

Drew Wozniak, vice president at United ICAP, forecast an implied flow build of 94 Bcf “with a (my probability is 30%) chance that the net change will be +103 if ANR reported their reclassification of 9 Bcf from base to working gas. It is my understanding that the reporting of reclassifications to the EIA is at the discretion of the storage owner, so when exactly this 9 Bcf of increased storage is reflected in the EIA’s report is not exactly known,” he said in a report to clients.

The initial market reaction to the data was underwhelming, at best. October futures fell to a low of $2.640 after the number was released, and by 10:45 a.m. EDT September was trading at $2.647, down a minuscule 0.1 cent from Wednesday’s settlement. October had traded as low as $2.633 earlier in the session.

“I was hearing an 88 Bcf injection, but the 8 Bcf reclassification brings it about in line,” said a New York floor trader. “We didn’t have much activity off the number.”

Citi Futures Perspective analyst Tim Evans noted that while the topline 94 Bcf build “looks larger than expected and bearish” at first glance, the 8 Bcf reclassification had already been announced by ANR Pipeline.

“The ”implied flow’ of 86 Bcf was actually close to our 84 Bcf estimate,” Evans said. “There will likely be some confusion off the meaning of the reclassification, but that was a one-off event. The flow figures is more constructive in our view.”

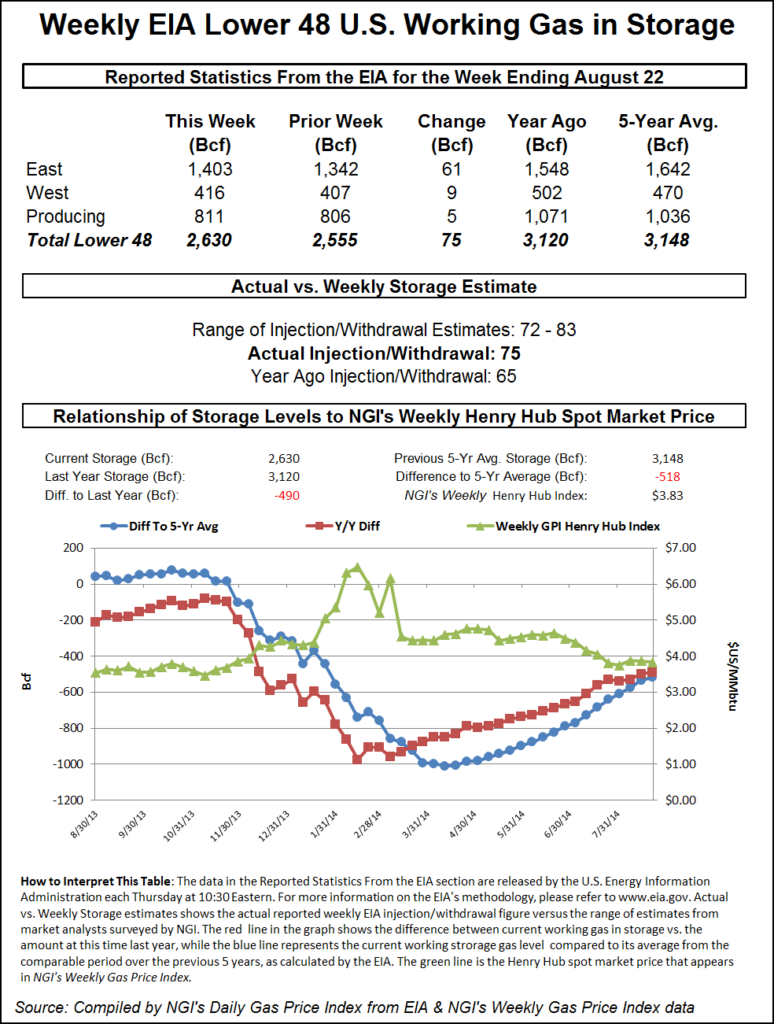

Inventories now stand at 3,193 Bcf and are 495 Bcf greater than last year and 122 Bcf more than the five-year average. In the East Region 71 Bcf was injected, and the West Region saw inventories increase by 3 Bcf. Stocks in the Producing Region rose by 20 Bcf.

The bullish case was given a nudge when overnight weather model runs turned slightly warmer. Greater uncertainty, however, arose during the back half of the forecast period. WSI Corp. in its Thursday morning report to clients said, “The latest six-10 day period forecast depicts a shift with the pattern. The forecast is cooler than yesterday’s forecast across the Northwest, Rockies and central U.S. However, the southern and eastern U.S. are a bit warmer. PWCDDs are up 1 to 42.6 for the CONUS.

“Forecast confidence is average at best today. Models are in better agreement early in the period, but significant differences emerge between the op models by the end of the period.” Risks include “the forecast waiver[ing] in either direction, especially during the back half of the period given the spread in the models. The central U.S. has the greatest downside risk. The West Coast has the greatest upside risk.”

The physical market was awash in red ink with New England points leading the charge lower. If the prospect of a super-sized storage report wasn’t enough to entice traders to sell, temperature forecasts in major population centers made the sell decision easier. Forecaster Wunderground.com predicted that the Thursday high in New York City of 90 would drop to a more seasonal 81 on Friday and Saturday. The normal early September high in the Big Apple is 80. Chicago’s Thursday high of 92 was seen falling to 81 as well Friday before recovering to 87 by Saturday. The seasonal high in Chicago is also 80.

Gas at the Algonquin Citygate tumbled 88 cents to $2.26, and deliveries to Iroquois, Waddington shed 7 cents to $3.03. Gas on Tennessee Zone 6 200 L came in 83 cents lower at $2.29.

Transco Zone 6 NY plummeted 57 cents to $2.27, but other major market hubs endured less of a setback. Gas at the Henry Hub fell 4 cents to $2.67, and deliveries to Opal were quoted 4 cents lower at $2.52. Gas at the PG&E Citygate softened 2 cents to $3.08.

The margin on moving gas from REX Zone 3 into Chicago got a little tighter. Gas at REX into ANR in Shelby, IN, fell 3 cents to $2.64, and packages at Edgar, IL, shed 4 cents to $2.63. Deliveries to NGPL at Moultrie, IL, changed hands 4 cents lower at $2.63.

Friday gas at the Chicago Citygate was quoted at $2.72, down 7 cents.

The National Hurricane Center in its 5:00 p.m. EDT Thursday report said Tropical Storm Fred was holding on to its tropical storm status. It was reported 850 miles west northwest of the Cape Verde Islands and was holding winds of 40 mph. It was headed west-northwest at 12 mph, and projections had it eventually turning to the north.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |