Infrastructure | Markets | NGI All News Access | NGI Data

NatGas Futures, Physical Match Nickel Losses; Risky Storage Report on Tap

Physical natural gas for Thursday delivery fell hard and fell often in Wednesday’s trading. A double whammy of an expected plump build in inventories and a bullish weather scenario that is starting to fray around the edges were enough to keep buyers on the sidelines.

Only a handful of points in the East and Midwest managed to make it to the win column, and NGI’s National Spot Gas Average fell a nickel to $2.55, with eastern points on average posting losses of more than a dime.

Futures trading was no more inspired, with the October contract falling 5.4 cents to $2.648 and November shedding 5.1 cents to $2.720. October crude oil added 84 cents to $46.25/bbl.

Checking in with NGI‘s Rockies Express Zone 3 Tracker, combined receipts into Zone 3 of Rockies Express increased just over 5% to 1,367.7 from Sept. 1 flow to Sept. 2nd flow.

This increase brought overall Zone 3 receipt capacity utilization up to 87.6%. Wednesday deliveries from REX Zone 3 into the Midwest were divided with the more western points closer to Mexico, MO, seeing higher deliveries while eastern points nearer to Clarington (non-Tenn), OH, flowed less gas than the previous day. The most interesting change in flows was probably a 72,100 Dth increase in deliveries into Midwestern Gas at Edgar — where operational capacity was also increased by 72,000 Dth.

Looking at the national picture, an industry veteran said all eyes are focused on production, and any hint of lower output could cause a hefty short-covering rally in the markets.

“From the guys I work with, they are concerned that the [low] price of oil is going to take the production of gas down,” First Enercast Financial President Ben Smith told NGI. What Smith is wrestling with is the fact that “gas production really hasn’t increased all year; it’s been pretty flat, yet there have been huge increases in transportation capacity.

“My clients were all believing that production was going higher with all these expansions. There have been huge expansions to get gas from the Northeast to the Midwest, and Northeast gas production has gone up, but that has been more than offset by declines in other producing regions.

“Production looks like it is not going up, but demand is going to keep growing at these prices. You can’t take prices very much higher [because] then you shed some of the generation demand and the demand needed to keep the market more balanced. It’s hard to sell it off, because you could quickly get into an undersupplied situation, particularly with lower oil production and the loss of associated gas once those wells are shut in.

“You don’t want to price too high and lose power generation.”

A lot of money “is on the sidelines waiting for a breakout or a collapse,” he said.

“I think the supply situation is really what people are looking for, almost more so than early season winter demand. The early season cold is always important and if you get a forecast in late September or October and see a cold wave hit that might have some impact.”

Everyone is watching the gas supply figures, said Smith. Looking at Commodity Futures Trading Commission data, “the open interest is down from what it was from a year ago so there is definitely money not in the market. There is definitely money on the sidelines, but if you look at the managed money, they are net short. The funds are not very optimistic.”

If there were a change in the weather outlook, the funds could beat a path to the door to cover shorts, according to Smith.

“That is what happened last year, but I think what would trigger a bigger short covering rally is if supply actually started declining. A lot of people are short this market because they think supply will grow.

“There are a lot of producers holding back because of the current price environment. If production rises I think those guys will be fine with their short positions, but if production gets flat or even declines, those guys will have to cover.”

Forecasters saw an overall change in the models Tuesday overnight showing less energy demand.

“All models lost demand overnight, but we still see major disconnects among them as the European ensemble retains a much warmer position for both six-10 (with slower and weaker cold front) and 11-15 day (keeping warmth on East Coast),” said Commodity Weather Group President Matt Rogers in a Wednesday morning report to clients.

“Changes were mostly on the minor side…for the six-10 day, but they were slightly warmer for the Midwest to East, while slightly cooler (wetter) for the South. In the West, we see some cooler Southwest changes and hotter changes for the Pacific Northwest by especially the second half of the six-10 day. The 11-15 day changes are marginally cooler overnight, especially toward the Midwest, but slightly toward the East Coast, too, as we head toward middle September and cooling demand weakens climatologically, too.”

Weather models may continue to show near-term heat, but looking further out the heat is not expected to last long enough or be intense enough to drive market-moving weather changes. “We continue to view bigger picture weather patterns as moderately bearish, especially looking out past this weekend as we continue to see stronger Canadian cool blasts making attempts at pushing into the northern U.S., which would ease national cooling demand for next week, and even more so during approaching the middle of September,” Natgasweather.com said in a morning report.

“The warm high-pressure ridge over the eastern U.S. may try to regain ground briefly for a day or two in between northern and central U.S. weather systems, but it’s not looking to become quite strong enough to bring intense heat…”

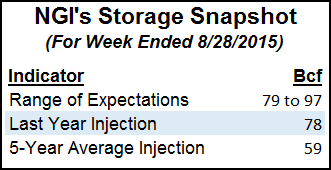

The Energy Information Administration’s (EIA) Thursday report on gas storage inventories is embedded with somewhat more risk than usual. Consensus estimates center around a build of 90 Bcf, but a possible revision is throwing a wrench into the estimates. Last year 78 Bcf was injected and the five-year average build for the week stands at 59 Bcf.

United ICAP Vice President Drew Wozniak is forecasting an implied flow build of 94 Bcf, with his probability of a 30% chance “that the net change will be plus-103 if ANR reported their reclassification of 9 Bcf from base to working gas.

“It is my understanding that the reporting of reclassifications to the EIA is at the discretion of the storage owner so when exactly this 9 Bcf of increased storage is reflected in the EIA’s report is not exactly known.”

First Enercast is looking for an increase of 90 Bcf, and IAF Advisors calculated a build of 93 Bcf including the ANR revision. A Reuters survey of 24 traders and analysts revealed a sample mean of 88 Bcf with a range of 79 Bcf to 97 Bcf.

In the physical market, both the Northeast and the Marcellus saw double-digit declines. Gas delivered to the Algonquin Citygate took back some of the $1 gains of Monday and dropped 49 cents to $3.14. Gas at Iroquois Waddington fell 8 cents to $3.10 and gas on Tenn Zone 6 200L tumbled 55 cents to $3.12.

Gas on Millennium was lower by a nickel at $1.20, and gas on Transco-Leidy Line was quoted 26 cents lower at $1.21. Gas on Tennessee Zn 4 Marcellus added a dime to $1.04, while gas on Dominion South shed 13 cents to $1.32.

Technical analysts aren’t willing to push the bearish case much further given market seasonality. “Still inclined to label this congestion as rest stop in a continuing down trend,” said United ICAP market analyst Brian LaRose. “Assuming the bears can crack $2.624 this week the ”a’=’c’ objectives from the $3.105 high will be our next downside targets. 0.618 of ”a’=’c’ targets $2.595-2.585-2.541. ”a’=’c’ targets $2.443-2.385.”

He admitted to also calculating lower targets, but “given the seasonal cycle this is as bearish as we are willing to get at this time.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |