Infrastructure | LNG | NGI All News Access | NGI The Weekly Gas Market Report

International Undersea Pipeline Mulled For West Coast LNG

A seabed pipeline project that sank 11 years ago resurfaced Tuesday in enlarged form, proposed by a Vancouver entry in the long lineup of liquefied natural gas (LNG) export schemes on the Pacific Coast of British Columbia (BC).

Steelhead LNG Corp. announced an agreement with the Williams group to work on design and regulatory preparations for an international conduit that would carry gas from the BC mainland to two planned LNG terminal sites on Vancouver Island.

The proposed pipeline, called the Island Gas Connector, mimics the bygone Georgia Strait Crossing project that the U.S. firm devised for provincial government-owned British Columbia Hydro.

Known as GSX for short, the plan survived environmental and aboriginal protests to obtain approval in 2002 by the United States’ Federal Energy Regulatory Commission, and in 2003 by the Canadian Environmental Assessment Agency and the National Energy Board.

But BC Hydro and Williams discarded GSX in late 2004 after a review by provincial utilities authorities rated its chief driver, a proposed power plant, as unnecessary and replaceable by more economical electricity supplies (see Daily GPI, Dec. 21, 2004).

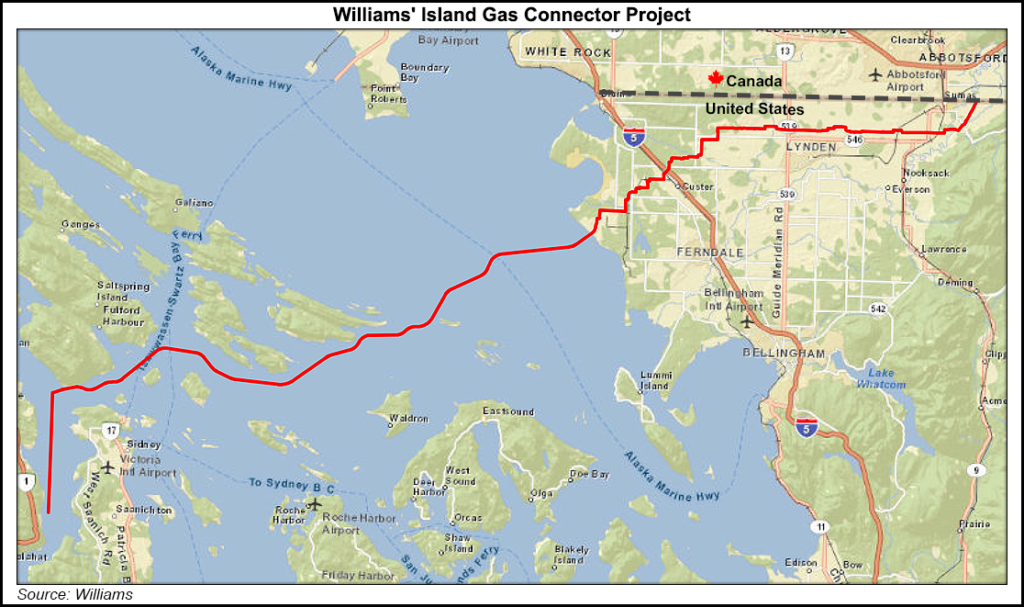

Like the misfired original, the new version of the line would start at a connection between the established Williams and Westcoast Energy (Spectra) pipeline networks at the Sumas border crossing into Washington State from BC. From Sumas the route would go west on land to Cherry Point on the Washington coast, then run north under the sea to Vancouver Island.

The scrapped pipeline was a relatively small pipeline meant to deliver a modest 96 MMcf/d. Construction of the full 84-mile (134 kilometer) project was forecast to cost only C$322 million (US$241 million).

The reincarnation as the proposed Island Gas Connector would also only be about 80 miles long, but would be required to deliver vastly greater volumes of gas.

Steelhead is proposing to moor five floating LNG export terminals, capable of shipping out up to 4.5 Bcf/d, in two aboriginal communities. The natives have tentatively agreed to co-operate in exchange for lease payments and other local benefits.

Steelhead CEO Nigel Kuzemko said, “Our partnership with one of the world’s leading builders and operators of natural gas pipelines is a significant step forward for both of our proposed projects.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |