Utica Shale | E&P | NGI All News Access | NGI The Weekly Gas Market Report

Just Three Producers Drive Ohio’s 2Q Shale Oil/Gas Production

An analysis of state data shows that just three operators accounted for more than 70% of Ohio’s unconventional oil and gas production in the second quarter.

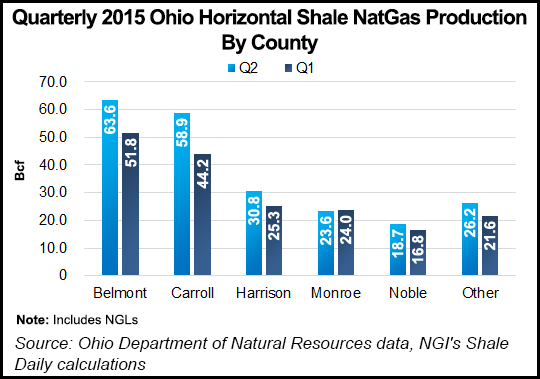

Natural gas production from Ohio’s Marcellus and Utica Shales was 221.9 Bcf during the period, while oil production was more than 5.5 million bbl (see Shale Daily, Aug. 28). That’s up from 88 Bcf and 2.4 million bbl a year ago (see Shale Daily, Sept. 9, 2014). Overall, production increased by nearly 13% from 1Q2015, going from 210 Bcfe to 255.3 Bcfe in the second quarter (see Shale Daily, June 1).

Chesapeake Energy Corp., Gulfport Energy Corp. and Antero Resources Corp. combined to produce about 180 Bcfe during the period. Moreover, the Ohio Department of Natural Resources’ report shows that of the state’s 24 dominant shale producers, just five others — Rice Energy Inc., Eclipse Resources Corp., Hess Corp., Ascent Resources LLC and Consol Energy Inc. — contributed meaningfully to second quarter production.

Chesapeake’s 491 Utica wells in the state produced 96.3 Bcfe to top the list, followed by Gulfport, which produced 56.9 Bcfe from 137 wells, and Antero, which produced 26.5 Bcfe from 75 wells. Chesapeake alone produced more than a third of the state’s natural gas, or roughly 37%, with 83.2 Bcf. Many of its wells are located in Carroll County, which once again was the state’s top producing area, where 366 wells combined to produce 67.6 Bcfe of Ohio’s shale production.

Belmont County was the second top-producing area, where 103 wells produced 64 Bcfe, followed by Harrison County, where 172 wells produced 39.2 Bcfe. The state’s most prolific wells were located in Belmont County, where Rice Energy Inc.’s results proved most impressive. Of Ohio’s top-50 producing wells, eight of them belonged to Rice Energy.

Two wells at the company’s Gold Digger pad there reported about 1.5 Bcfe each of production during the quarter. Rice’s other six wells on the list each produced more than 1.2 Bcfe during the quarter. Gulfport Energy also reported six leading wells in Belmont County that produced more than 1 Bcfe each. Both Ascent and Antero reported wells with more than 1 Bcfe during the quarter. Ascent’s wells are located in Belmont County, while Antero’s are located in Monroe County.

Last quarter’s data is reflective of the steps producers have taken in the last year to respond to the commodities downturn. Carrizo Oil & Gas Inc. and Hess were among the state’s leading producers in 1Q2015, reporting 81 Bcfe and 46 Bcfe respectively. While some operators have hunkered down in the Appalachian Basin, others have shut-in more production or switched their focus to other fields.

Antero, for example, remains one of the basin’s most active producers with 11 rigs running. Gulfport has narrowed its focus almost entirely to the Utica, neglecting a patchwork of assets in places such as the Canadian oilsands and Louisiana’s Gulfcoast in favor of the play’s dry gas (see Shale Daily, May 8, 2014). Chesapeake has always been a leading producer in Ohio, where it was the first to drill a series of wells in 2011 and 2012 when commercial shale production began to ramp-up (see Shale Daily, May 7, 2013).

Rice Energy reported just 16 wells in the state during the quarter, but it finds itself leaning more heavily on its 55,000 net acre position in Belmont County. The company ramped-up its Utica program at the beginning of this year (see Shale Daily, Aug. 7).

Data from the state’s top-50 Utica wells shows that they produced an average of 11.4 MMcfe/d during the second quarter, according to an analysis by Topeka Capital Markets analyst Gabriele Sorbara.

“The Utica Shale continues to post impressive results and the data is a testament to wells that are performing roughly in line with expectations,” he said. “More importantly, well results should improve further as operators continue to transition to longer laterals, enhanced completion methods and implement a choke management methodology.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |