Markets | NGI All News Access | NGI Data

NatGas Cash, Futures Creep Higher; September Up Less Than A Penny

Physical natural gas for Thursday delivery moved little in Wednesday’s trading as both weather forecasts and next-day power prices offered little incentive for traders to make incremental purchases.

NGI’s National Spot Gas Average rose a penny to $2.55, and losses in the East and Gulf Coast were largely offset by stronger performances in the Midwest, Midcontinent, Rockies and California. Futures were hardly a bastion of inspiration, and at the close September had inched higher by 0.8 cent to $2.693 and October had also gained 0.8 cent to $2.703. October crude oil retreated 71 cents to $38.60/bbl.

Bidweek trading is well under way, and traders will no doubt see a spike in activity with the September futures expiration Thursday. For the moment, bidweek trades are coming in slightly less than current spot market quotes. According to the NGI Bidweek Alert, gas at the Chicago Citygate is trading between $2.78 and $2.79, and deals for gas on ANR SW are going for between $2.43 and $2.45. Gas on El Paso Permian for September is changing hands at $2.53 to $2.55 and at Opal bidweek volumes are quoted at $2.50 to $2.54.

An analysis by NGI of Chicago Citygate prices gives traders an idea of the seasonality of prices at the Midwest Hub. Analysis of the Chicago Citygate forward price curve shows the market’s current assessment of prices going forward. Not surprisingly prices typically peak in January and are weakest in June, and Chicago Citygate January is projected at $3.35 and June 2016 comes in at $2.71.

NGI also provides forward curve analysis for numerous other market centers in its Forward Look newsletter.

Moderating temperature outlooks kept next-day Midwest prices from moving little more than a penny, although in the Northeast Thursday gas traded lower as next-day power quotes softened. Forecaster Wunderground.com predicted that Chicago’s Wednesday high of 68 would reach 75 Thursday and 79 by Friday. The normal high in Chicago in late August is 81. New York City’s Wednesday maximum of 81 was seen rising to 83 Thursday and 84 by Friday. The normal high in the Big Apple is 81.

Gas on Alliance was seen at $2.83, up 1 cent, and at the Chicago Citygate gas changed hands at $2.81, also up a penny. Gas on Consumers rose a penny to $2.96, and gas on Michcon came in at $2.93, up 2 cents.

Northeast quotes slipped as the power price environment weakened. Intercontinental Exchange reported that peak power Thursday at the PJM West Hub fell $1.00 to $31.04/MWh and on-peak deliveries at the ISO New England’s Massachusetts Hub fell $4.41 to $36.65/MWh.

Thursday packages at the Algonquin Citygate fell 23 cents to $3.06, and gas on Iroquois Waddington lost 3 cents to $3.05. Gas on Tennessee Zone 6 200 L shed 20 cents to $3.02.

Overnight model runs shifted warmer. According to Commodity Weather Group in its Wednesday morning report, “The Midwest to East is same to warmer overall for next week going into especially the early 11-15 day, while we see some slightly warmer short-term West changes with cooler shifts next week.

“The South is slightly cooler in the short term into next week. The East Coast still has warmer to hotter risks next week with chances for more 90s than shown, but confidence struggles, especially late next week with risks for some cooling onshore flow,” said Matt Rogers, president of the firm.

Tim Evans of Citi Futures Perspective sees a moderate tightening of storage as the injection season winds down. “Although there’s risk that a larger than projected storage refill for last week or a change in the weather forecast will shift the storage outlook, our current base case scenario features a modest overall decline in the year-on-year average storage surplus from 80 Bcf as of Aug. 14 to 66 Bcf as of Sept. 11,” he said in closing comments to clients Tuesday.

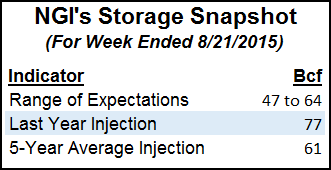

Evans is looking for a 47 Bcf build in this week’s report. “A declining year-on-five year surplus confirms a moderate tightening of supplies on a seasonally adjusted basis, which tends to support a rally in prices,” he said.

Evans contends that natural gas is “conservatively valued” at the bottom of its five-year price range for this time of year, with only a moderate storage surplus. “In our view, this should mean less downside risk than upside potential, giving us at least a moderately bullish bias. Over the intermediate term, we think this could translate into a move to $3.25 or perhaps even $3.50 as a Q4 peak.”

Other estimates of Thursday’s storage build include IAF Advisors at 61 Bcf, United ICAP also at 61 Bcf, and a Reuters poll of 20 traders and analysts showed an average 59 Bcf with a range of 47 Bcf to 64 Bcf. Last year 77 Bcf was injected and the five-year pace is 61 Bcf.

In its 2 p.m EDT Wednesday report, the National Hurricane Center (NHC) said TS Erika was holding winds of 45 mph and was 245 miles east of Antigua. It was heading west at 17 mph and was projected to move toward Florida and the Bahamas.

Jeff Masters, meteorologist at Wunderground.com said “that Erika continued to be disorganized in the face of dry air and wind shear… Erika had only a modest area of heavy thunderstorms on its east side, and these thunderstorms did not change much in intensity or areal coverage on Wednesday morning. Wind shear due to upper-level winds out of the west was a moderate 10-20 knots, and this shear was driving dry air on the northwest side of Erika into its core, disrupting the storm. Sea surface temperatures were favorable for development, though-near 28 degrees C (82 degrees F).

Tom Saal, vice president at FC Stone Latin America LLC, in his work with Market Profile expects the market to test Tuesday’s value area at $2.682 to $2.660. Subsequent to that he says to go with weekly breakout ($2.696) or breakdown ($2.627) targets with the market “eventually” testing $2.785 to $2.747.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |