Bakken Shale | E&P | Eagle Ford Shale | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin

Raymond James Sees Onshore Rig Count Declining 45% from 2014

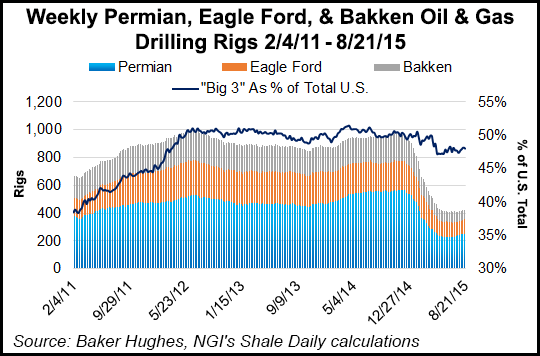

U.S. oilfield activity over the next year is going to be ugly, but a robust recovery should be underway in 2017, led by the Permian Basin, Eagle Ford and Bakken shales, Raymond James & Associates Inc. said Monday.

“On an absolute basis, the Permian and Eagle Ford are expected to almost double through the end of 2017, growing 94% and 97%, respectively, while the Bakken is expected to grow 74%,” said analysts J. Marshall Adkins, Praveen Narra and Victor Kalivas. “These three plays alone are expected to account for roughly 55% of the total rig additions (or 384 of 697 rigs) over the same time period, with 31% (or 217 rigs) going to the Permian.”

The bottom may be at hand for the domestic rig count, “but we are not out of the woods yet.”

The topsy turvy oil market dynamics led Raymond James earlier this month to reduce oil price expectations and U.S. exploration and production cash flow assumptions (see Shale Daily, Aug. 17). The new report updates the firm’s U.S. rig count forecast through 2018.

“We now think that the average total U.S. rig count will finish 2015 down 845 rigs (or 45%) year/year (y/y), exiting the year at just 891 rigs,” 5% lower than a prior estimate, Adkins and his colleagues said. “Our previous 2016 U.S. rig forecast called for more than a 10% increase y/y.

“The revised rig count for 2016 is 19% lower than our prior estimate and is now down 6% (or 57 rigs) y/y. This represents a much more restrained recovery, with much of the growth pushed into 2017, when we expect the average total U.S. rig count to grow by 45% (or 435 rigs) y/y followed by another 18% annual growth in 2018.”

The revisions also led the analysts to reduce oilfield service earnings estimates. Once the recovery begins, it should continue to be led by high-spec rigs, i.e., alternating current (AC) rigs, said the analysts.

“Through the current down cycle, AC rigs have remained the most resilient to declines in the rig count. Having made up around 40% of the active at the peak in September 2014, we estimate that the count is now closer to 55%.”

Newbuilds with contracts delivered throughout 2014 and 2015 help to explain some of the shift toward horizontal-heavy AC rigs.

“As operators continue to focus on efficiencies and horizontal drilling continues to gain share, demand for these AC rigs is likely to increase,” said the trio. “If we keep the AC share of the active rig count static at the current 55%, this implies that we will hit full utilization of AC rigs in late 2017.”

In all likelihood, said the team, the AC share would continue to increase over the next year, leading to full AC utilization “sometime in the first half of 2017. “However, that’s not without pain for U.S. land drillers in 2016.

“With contracts rolling off, dayrates in the first half of 2016 are likely to get ugly, particularly with the lower quality rigs,” Adkins noted.

The domestic rig recovery is expected to be disproportionately weighted to horizontals in the Permian, Bakken and Eagle Ford.

“Already past the halfway point for the year, we are expecting horizontal rigs to make up 77% of the total rig count, or 8% more y/y,” the analysts said. “Vertical drilling programs have been the first to go as the total U.S. rig count began to decline…

“We believe that it is likely that many of the legacy rigs and lower end rigs dropped during the downcycle will disappear forever,” with horizontals representing about 92% of the total rigs added from July 2015 through December 2017, representing 83% of active domestic rig count at the end of 2017.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |