Markets | NGI All News Access | NGI Data

Smaller-Than-Expected Natural Gas Storage Injection Gives Bulls a Bump

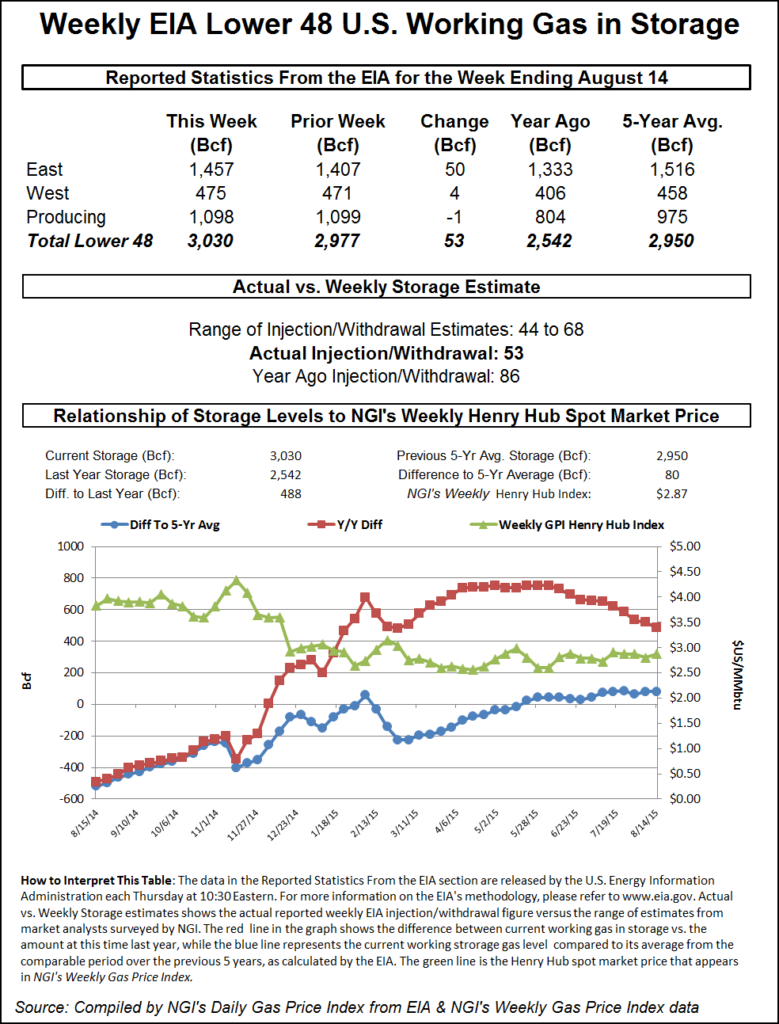

Natural gas futures traders reacted somewhat bullishly following the news Thursday that 53 Bcf was injected into underground storage for the week ending Aug. 14, a number that was somewhat smaller than industry expectations.

September natural gas futures reached a high of $2.781 shortly after the report was released and as of 11 a.m. EDT, the prompt-month contract was trading at $2.765, up 4.9 cents from Wednesday’s close.

Heading into the report, ICAP Energy was looking for a fill of 60 Bcf, and IAF Advisors was looking for a 58 Bcf injection. A Reuters survey of 20 industry cognoscenti revealed an average 58 Bcf build with a range of 44 to 68 Bcf. The actual 53 Bcf build compares to last year’s stout 86 Bcf build for the week. The five-year average injection stood at 48 Bcf.

Citi Futures Perspective analyst Tim Evans called the number “bullish,” noting that the injection was somewhat less than expected.

“The 53 Bcf build for last week was a larger-than-expected decline from the 65 Bcf refill a week ago, and it matched the five-year average for the date,” Evans said. “This should be reassuring to the market that the surprise bearish build of the prior week has not translated into an ongoing weaker supply-demand balance.”

Working gas in storage stood at 3,030 Bcf as of Aug. 14, according to EIA estimates. Stocks are now 488 Bcf higher than last year at this time and 80 Bcf above the five-year average of 2,950 Bcf. For the week, the East Region added 50 Bcf and the West Region chipped in 4 Bcf, while the Producing Region switched to withdrawals for the second time in three weeks with a 1 Bcf decline.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |