Infrastructure | Markets | NGI All News Access | NGI Data

REX Westbound NatGas Expected to Return; Futures, Cash Move Little

Physical natural gas for delivery Thursday was little changed in Wednesday’s trading, and both cash and futures were equally uninspired ahead of the week’s Energy Information Administration’s weekly storage report.

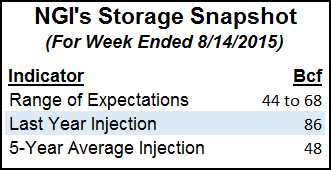

The NGI National Spot Gas Average was $2.52, down 2 cents, and gains and losses across all market points were scattered with few points moving much either side of unchanged. Traders are on the lookout for a inventory build about 60 Bcf, less than last year but ahead of the five-year average.

At the close, September had risen 1.2 cents to $2.716, and October rose 0.7 cent to $2.747. Natural gas managed to ignore the turbulence in the crude and products as September crude approached its last trading day by tumbling $1.82 to $40.80/bbl.

The puzzle of what prompted a sudden drop in receipts into westbound Rockies Express Pipeline’s REX Zone 3 seems to have an answer.

Industry consultant Genscape Inc. reported Tuesday that Rice Energy deliveries to REX in Monroe County, OH, “dropped to zero, causing REX [east to west] flows to fall by about 190 MMcf/d.”

Late Tuesday, Rice Energy told NGI that it is installing permanent facilities at its REX interconnect, so it will be diverting production to other interstate lines for a day or two. It commissioned it during the second quarter.

“Rockies Express Pipeline (REX) receipts at the ‘Rice/REX Gunslinger Monroe’ point fell to zero on the 18th and are at just 8 MMcf/d in [Wednesday’s] preliminary cycle. The drop comes after volumes had averaged 190 MMcf/d in the 30-days prior to the 18th,” Genscape said.

NGI Markets Analyst Nathan Harrison noted that Wednesday’s flows at Gunslinger remained at zero holding down REX Zone 3 receipt point capacity utilization at just 76.7%. “Utilization had averaged 89.5% during the prior week from Aug. 10 through 14,” Harrison said.

The gas that would normally have gone to REX went to Tetco, according to Genscape.

“Flows onto Tetco at Boltz Ridge Road spiked to 198 MMcf/d. Tetco’s Boltz Ridge Road interconnect came into service on July 16 and received on average 28 MMcf/d before August 18. A Rice Energy investor presentation confirms that meter point is within Rice’s acreage in Monroe County, OH.”

The 190 MMcf/d that went to Tetco Tuesday was expected to be back on REX late Wednesday. “Tetco has revised their nominations back down to about 30 MMcf/d, which is about what they were receiving before the big boost in receipts,” Genscape analyst Erik Fabry told NGI.

The quick rerouting of gas seems to have had little impact on prices. According to the NGI REX Zone 3 Tracker, gas for delivery Thursday at the REX interconnect with NGPL at Moultrie, IL, eased 2 cents to $2.74 and gas on REX delivered to ANR at Shelby, IN, was flat at $2.76.

Moderating weather has had as much of a market impact as anything. Forecaster AccuWeather.com reported that Wednesday’s high of 87 in New York City was expected to ease to 85 Thursday and 81 Friday, 1 degree below normal. Chicago’s high Wednesday was forecast to reach 78 but decline to 73 by Thursday. Friday’s high is anticipated to be 80, 2 degrees below normal.

Gas on Alliance shed 2 cents to $2.89, and deliveries to the Chicago Citygate were seen flat at $2.85. Gas on Consumers fell 1 cent to $2.99, and deliveries to Michigan Consolidated were quoted 2 cents lower at $2.95.

All indications are that traders are going to have to deal with another round of heat.

“The latest mid-morning data has trended slightly cooler with this system so far, which would be a slightly bearish trend for next week,” wrote Natgasweather.com in its Wednesday report. “We are still dealing with an unseasonably strong weather system sweeping through the central U.S. with cooler than normal temperatures for a couple more days.

“Out ahead of this system it remains quite warm with highs in the mid-80s to 90s. After the central U.S. system exits Thursday, high pressure will gain ground east of the Rockies, with temperatures warming back into the 80s over the northern U.S. and 90s over the southern Plains and Texas.”

Analysts see Thursday’s inventory report coalescing around 60 Bcf, above the 48 Bcf five-year average.

“Although the weather map will still include some warmer than normal temperatures, there won’t be enough power sector demand to offset the year-on-year growth in natural gas supply, at least according to our model,” said Tim Evans of Citi Futures Perspective in closing comments to clients.

Evans is estimating a 65 Bcf build in Thursday’s report and sees the current 81 Bcf year-on-five-year surplus growing to 121 Bcf by Sept. 4.

“A rising surplus confirms the market is becoming better supplied on a seasonally adjusted basis, with a corresponding downward fundamental pressure on prices,” he wrote. “With prices conservatively valued already at the bottom of their five-year range for this time of year, we think the downside for natural gas may remain limited, but the growing storage surplus may also push back the calendar on the recovery back above the $3.00 mark we have been looking for.”

Last year a stout 86 Bcf was injected and the five-year pace stands at 48 Bcf. ICAP Energy is looking for a fill of 60 Bcf, and IAF Advisors figures 58 Bcf was injected. A Reuters survey of 20 industry cognoscenti revealed an average 58 Bcf with a range of 44 Bcf to 68 Bcf.

The National Hurricane Center (NHC) in its 5 p.m. EDT report Wednesday said Tropical Storm Danny was continuing to show winds of 50 mph as it headed west at 17 mph. The storm was about 1,325 miles east of the Lesser Antilles and NHC projections showed it headed to Puerto Rico.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |