NGI Archives | NGI All News Access | NGI The Weekly Gas Market Report

Hercules, Now in Chapter 11, Expects ‘Tough’ GOM Market Through 2015

More bankruptcies could be ahead for “challenged” offshore drillers following the restructuring plan filed by Hercules Offshore Inc. last week, Fitch Ratings analysts said.

The Houston-based oilfield services contractor, whose fleet is concentrated in the shallow waters of the Gulf of Mexico (GOM), filed a prepackaged bankruptcy plan after indicating in June it was preparing a Chapter 11 filing (see Daily GPI, June 19).

The filing “may be a leading indicator of more bankruptcies among other challenged high yield (HY) offshore drillers,” Fitch said.

Hercules and 14 of its affiliates filed the case in U.S. Bankruptcy Court for the District of Delaware (No. 15-11685). According to the filing, the pre-package will convert $1.2 billion of debt to equity, raise about $450 million of new capital and provide an opportunity for existing equity holders to receive a distribution. The debtors have “sufficient” unencumbered assets to complete the restructuring without a debtor-in-possession loan, the filing noted.

The restructuring, subject to court approval, also would allow the operator to fund delivery of its contracted newbuild drilling rig, the Hercules Highlander, which is going to cost around $200 million.

During a conference call in late July to discuss second quarter results, CEO John Rynd talked with analysts about the planned restructuring. The funds not used for the Hercules Highlander would provide the company with “needed additional liquidity to help navigate the current down cycle, which we believe could last for some time,” he said. “This financial restructuring is intended to impact our balance sheet only, so I want to emphasize that we work to effectuate the recapitalization, our operations are to continue with business as usual.”

Before the filing, Hercules had around $140 million of cash on hand, which might appear to be enough liquidity.

“However, given the business outlook and the need to raise additional financing to deliver the Highlander, we concluded there was a growing risk that our cash might not be adequate to maintain our operations through the downcycles as well as to fully refund the Highlander,” Rynd said.

“The offshore drilling market is going through what is becoming one of the most challenging downcycles our industry has ever seen…In a nutshell, there will be too many rigs facing too little work for the foreseeable future. It’s been a difficult time for our company and a difficult decision to choose this path, but it is the right one.”

Hercules reported a net loss of $88.3 million (minus 55 cents/share) in 2Q2015, versus profits of $6.6 million (4 cents) in the year-ago quarter.

“In the domestic drilling segment, the low commodity price environment has certainly impacted the demand,” Rynd said. “While oil prices seem to have found a range of $50 to $60/bbl, we don’t think these pricing levels are sufficient to spur much demand and could actually result in further weakness. Compounding the oil price environment for some of the large acreage holders, our balance sheet issues restrict their ability to redeploy capital in the drilling. Marketing utilization in the region is approximately 50%, although some of these marketed rigs may not be fully crewed.”

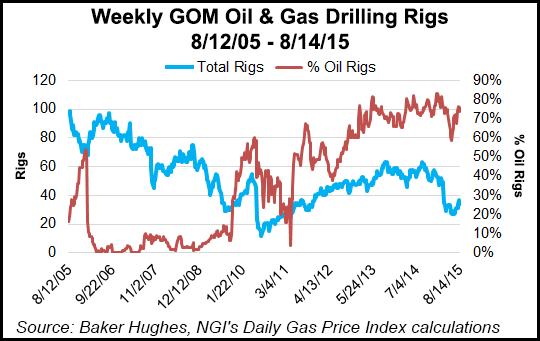

Seven exploration and production (E&P) companies had active jack-up rigs on the Outer Continental Shelf of the GOM in July. That compares with July 2013, when Hercules was working for 17 different E&Ps, the CEO noted.

“We expect the Gulf of Mexico to be a tough market throughout 2015,” Rynd said.

The filing by Hercules moved the energy trailing 12-month, or TTM, default rate to 3%, up from 2.5% at the end of July, Fitch noted.

“The recent oil price drop has compounded the effects of the offshore rig oversupply cycle, resulting in limited tenders, weak dayrates and legacy fleet rationalization,” said Fitch analysts. “Existing backlogs have generally insulated offshore drillers from lower market activity and dayrates so far.

“However, backlog protections for offshore drillers are falling away at a fast clip — a significant portion roll-off within the next year — which will likely begin to pressure cash flows.”

Liquidity profiles are mixed, analysts noted, “though larger, investment-grade offshore drillers tend to be better positioned to bridge the downcycle.”

Fitch said the ultra-deepwater rigs have legacy contract dayrates that are mostly in the high range of $400,000 to $600,000, “but a scarcity of tenders over the past several quarters has introduced uncertainty regarding market dayrates.”

The best guess for short-run market dayrates is around $325,000 for ultra-deepwater rigs, according to Fitch.

“This would probably represent a ‘purge day rate’ that disincentivizes uncontracted newbuild deliveries and facilitates legacy fleet rationalization, leading to an eventual inflection point currently anticipated to be late 2016/early 2017. Other rig types are anticipated to see similar day rate reductions with uncompetitive rigs being stacked or scrapped.”

Analysts expect HY offshore drillers to be at a contracting disadvantage relative to larger, more established offshore drillers, because of their smaller size, limited customer history and higher counterparty risk.

“Our view is that customers may, in most cases, prefer the highest quality assets, but are also giving careful consideration to an operator’s size, staying power, geological familiarity and historical operating performance. This assumed contracting disadvantage would greatly reduce HY offshore drillers’ ability to build a future backlog in the current downturn, raising their probability of default.”

Fitch recently reviewed three HY offshore drillers: Vantage Drilling Co., Pacific Drilling SA and Ocean Rig UDW Inc. Analysts determined that secured noteholders had above average (more than 50%) recovery prospects, while unsecured noteholders had poor (0-10%) prospects.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |