E&P | Eagle Ford Shale | NGI All News Access | NGI The Weekly Gas Market Report | Utica Shale

EVEP Focused on Estimated $9B of Assets Up For Grabs

EV Energy Partners LP (EVEP) saw its production decline during the second quarter with bad weather in Texas and Appalachian Basin maintenance shut-ins, but the company is keeping a sharp eye on its estimate of $9 billion in assets on, or soon to be on, the market.

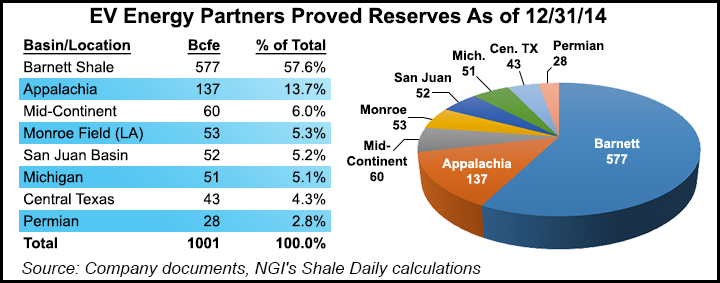

The company produced 162.8 MMcfe/d, down 7% from the 174.9 MMcfe/d it produced in the year-ago period and down 6% from the 174.7 MMcfe/d it produced in 1Q2015. In North Texas’ Barnett Shale, where it’s spent heavily this year, four of the 18 wells that it had waiting on completions at the end of the first quarter were never turned in line due to weather-related issues. Production from non-operated properties also came in under estimates and 3 MMcf/d of Appalachian Basin production in West Virginia was off-line for compressor change-outs and upgrades, said CFO Nicholas Bobrowski.

He added that given 1H2015 average production of 167.6 MMcfe/d, EVEP would likely exit the year at either the midpoint or low end of its 162.6-177.9 MMcfe/d guidance.

But as low commodity prices have hurt revenue and earnings in recent quarters, and the master limited partnership has been active in divesting assets and adding new ones, management said it still has eyes on the broader market and how it can help bolster EVEP’s long-term goals amid the commodity downturn.

Executive Chairman John Walker said there is $9 billion “of assets in the market now, or soon, in deals that we are aware of that will soon be disclosed to the market.” He said a sizable portion of the assets are thought to be coming available in both the Eagle Ford Shale and the Permian Basin, where the company would like to increase its position after having sold some of its assets at a premium in recent years in both of those plays.

He added that the company is working on a joint venture (JV) to provide a large share of its drilling capital.

“In addition to evaluating acquisitions, we are continuing to work on a JV partnership to provide most, if not all, of the drilling capital in exchange for a larger initial working interest that would revert after a specified payout,” Walker said. “We will make the appropriate announcements as binding agreements are signed. While this potential [JV] would not provide a material amount of incremental cash flow to EVEP in the near-term, the acreage we are marketing is up to almost a 50% working interest, and an overriding royalty interest to EVEP of approximately 2%.”

Walker said the company would make available acreage in the Utica Shale, elsewhere in the Appalachian Basin, the Barnett Shale and New Mexico’s San Juan Basin under the possible JV. It plans to spend the remainder of this year’s capital budget in the Barnett, Midcontinent and the Appalachian Basin.

EVEP’s average realized commodity price for the second quarter dropped from $5.54/Mcfe in 2Q2014 to $2.95/Mcfe. It was also down from $2.99/Mcfe in 1Q2015. Revenue also declined from $89.4 million in the year-ago period and $47.2 million in 1Q2015 to $44.5 million.

The company reported second quarter net income of $164.1 million ($3.25/unit), mainly as the result of the $572.2 million sale of its 21% stake in Utica East Ohio Midstream LLC to Williams, which closed in June (see Shale Daily, April 6). UEO has cryogenic processing, fractionation and liquids storage facilities in Eastern Ohio. The deal also helped liquidity, as the company has no bank debt outstanding and nearly $60 million in cash.

The second quarter profit compared to a net loss of $9 million (minus 19 cents/unit) in the year-ago period and a loss of $61.7 million (minus $1.25/unit) in 1Q2015.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |