NGI Data | NGI All News Access

Weekly Natural Gas Prices Post Modest But Broad Gains

Physical natural gas prices for the week ending Aug. 14 were remarkably consistent with nearly all points gaining between a nickel and a dime. The NGI Weekly Spot Gas Average rose 10 cents to $2.68 and only a handful of points nationally traded in the red.

By Friday temperatures in the Pacific Northwest had receded from their above-normal readings and Northwest Sumas recorded the week’s greatest loss by dropping 9 cents to $2.53. The locations scoring the week’s greatest gains were Transco Zone 6 New York with a gain of 90 cents to $2.73 followed closely by Transco Zone 6 non New York North with a rise of 89 cents to $2.72. Regionally the Northeast added the most posting a double-digit advance of 30 cents to $2.06, and numerous regions vied for the smallest gain of 6 cents.

South Texas, East Texas, South Louisiana, the Rocky Mountains, and California all rose by 6 cents. South Texas, East Texas and South Louisiana finished the week at $2.81, $2.83, and $2.84, respectively. The Rocky Mountains and California ended at $2.73 and $3.03.

The Midcontinent rose 7 cents to $2.80 and the Midwest gained 8 cents to $2.95.

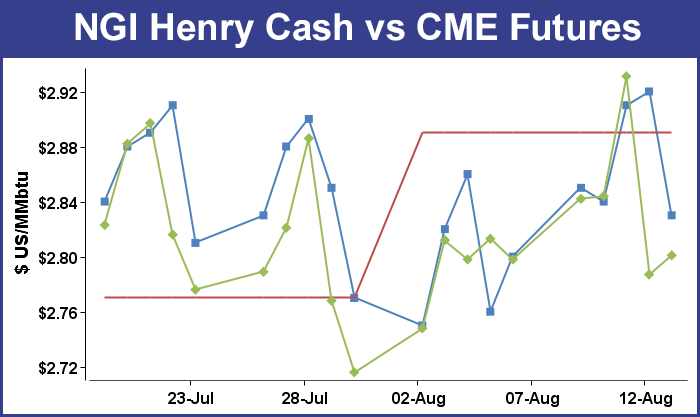

In spite of a 14-cent dive on Thursday, September natural gas was able to close 0.3 cent higher on the week at $2.801.

The Energy Information Administration (EIA) inventory report Thursday for the week ending Aug. 7 caught a number of traders by surprise and the reported 65 Bcf build was about 10 Bcf greater than industry estimates. Prices tanked and at the close September had given up 14.4 cents to $2.787, and October was down 13.6 cents to $2.820.

When the EIA report rattled across trading desks at 10:30 a.m. EDT September futures fell hard and fell often. September reached a low of $2.838 after the number was released, and by 10:45 EDT September was trading at $2.848, down 8.3 cents from Wednesday’s settlement.

Prior to the release of the data analysts were looking for an increase in the 55 Bcf range. ICAP Energy estimated 56 Bcf, and Citi Futures Perspective had calculated a 48 Bcf increase. A Reuters poll of 27 traders and analysts showed an average 55 Bcf with a range of 38 Bcf to a 60 Bcf injection.

“There’s nothing fundamental to move the market higher,” said a New York floor trader. “If the market can build a base in the $2.85 to $2.86 area then it can confront $3. A close over $2.86 could give traders an incentive.”

Tim Evans of Citi Futures Perspective said the number was a “bearish surprise just a week following a significant bullish surprise, suggesting there may have also been some timing issues between the two reporting periods. The data will be a test for the market after the recent rally.”

Inventories now stand at 2,977 Bcf and are 521 Bcf greater than last year and 81 Bcf more than the 5-year average. In the East Region 53 Bcf were injected and the West Region saw inventories increase by 5 Bcf. Stocks in the Producing Region rose by 7 Bcf.

“The market’s relatively strong reaction hints at the possibility that traders might be rethinking the upcoming shoulder season weakness,” said Teri Viswanath, director of commodity strategy for natural gas at BNP Paribas. “Clearly the moderation in temperatures on the East Coast last week, that only marginally lowered the national cooling-degree days, had an amplified effect on restocking. This suggests that, as long as the southern states record normal or above-normal temperatures, the ‘swing’ factor for electric power demand growth will be centered in the Northeast. According to the updated weather guidance, the Middle-Atlantic states will likely record the hottest temperatures of the summer next week. Consequently, the return of very warm weather in this region implies a restrained build in storage for the balance of the month.”

In Friday’s trading physical natural gas for weekend and Monday delivery traded lower with the exception of a few “hot spots.” Overall, the NGI National Spot Gas Average fell 7 cents to $2.65, but weekend weather forecasts along the Eastern Seaboard called for temperatures to run 10 or more degrees above normal, and eastern points averaged gains of a nickel or more, with some spots posting double-digit advances.

Futures were able to fend off further selling resulting from Thursday’s outsized addition to inventories, and September rose 1.4 cents to $2.801 and October gained 1.7 cents to $2.837.

Weekend and Monday gas at metropolitan areas along the East Coast jumped as temperatures were forecast to be well above seasonal norms. Forecaster Wunderground.com said Boston’s 85 high Friday was seen rising to 89 Saturday and 92 by Monday. The normal high in Boston in mid-August is 80. New York City’s Friday high of 86 was predicted to reach 91 Saturday and 93 by Monday, 10 degrees above normal. Philadelphia’s forecast high Friday of 86 was anticipated to reach 93 Saturday, and 95 by Monday. The normal high in Philadelphia is 83.

Gas at the Algonquin Citygate was up 76 cents to $3.08 and deliveries to Iroquois Waddington gained 3 cents to $3.11. Gas on Tennessee Zone 6 200 L jumped 79 cents to $3.02. Gas for weekend and Monday bound for New York City on Transco Zone 6 added 16 cents to $2.93.

Stout Monday on-peak power prices made incremental purchases of natural gas for power generation an easy decision. Intercontinental Exchange reported that on-peak Monday power at the New York ISO Zone A delivery point (western New York) rose $28.92 to $67.17/MWh. Power at the ISO New England’s Massachusetts Hub added $28.45 to $60.50/MWh and on-peak power at the PJM West Hub rose a hefty $20.12 to $62.11/MWh.

Other market centers saw declines of a dime or more. Gas at the Chicago Citygate shed 11 cents to $2.90, and deliveries to the Henry Hub were off 9 cents to $2.83. Gas at Opal dropped a dime to $2.72, and gas at the SoCal Citygates was also a dime lower at $3.11.

Industry consultant Genscape reported that the beleaguered Alliance Pipeline has restored cross-border flows after being shut down earlier this week. “While upstream prices reacted predictably to the event, the lack of downstream price response provides insight to the ample supply situation the Midwest finds itself in amid the reshuffling of North American gas flows. Nominated flows at the Alliance U.S. Mainline point at the Canadian-U.S. border for today are at 1,667 MMcf/d after having been at zero since Aug. 8.

“The pipe was shut down due to excess levels of hydrogen sulfide, which required the pipe to be purged by flaring, then repacked. Flows just prior to the shutdown were running around 1,800-1,900 MMcf/d on the roughly 2,000 MMcf/d capacity system,” Genscape said (see Daily GPI, Aug. 13, Aug. 7).

Futures got some supportive help from overnight near term weather forecasts which turned modestly warmer. “While no major changes are noted this morning, the general themes for [Friday] include slightly warmer to hotter East Coast conditions in the six-15 day range, some slightly cooler Midwest weather early in the 11-15 day, slightly cooler West Coast and about the same for the Deep South,” said Matt Rogers, president of Commodity Weather Group.

“We have enough warmer changes earlier in the period to still eke out a slight demand gain to mark the fifth day in a row of increases. The biggest overnight shift was a more significant pullback in temperatures on the European ensemble, but it was not a major pattern change and basically just drifted closer to the model consensus mean…”

Tim Evans of Citi Futures Perspective said Thursday’s outsized storage build of 65 Bcf may be “casting some doubt over the prevailing trend in the underlying supply-demand balance. It’s possible that there were some timing issues between the two periods that contributed to the volatility, as well as some related issues involving nuclear plant outages.”

Evans said that although the data was a “bearish surprise, we note the year-on-year surplus that was as high as 753 Bcf back on June 5 declined to a new low of 521 Bcf as of Aug. 7. This suggests that while the data for last week was bearish relative to expectations and relative to the five-year result, it was at least less bearish than a year ago.

“We’ve been making a case for natural gas futures to move back above the $3.00 mark, and that’s still a possibility in our view, although Thursday’s storage report was a clear setback and the revised neutral storage forecast is more consistent with further volatile sideways chop.”

Texas power buyers over the weekend will be able to offset purchases with some wind generation. Forecaster WSI Corp. in its Friday morning report said that ERCOT “will be seasonably hot and moderately humid with high temperatures in the mid 90s to low 100s. A southerly flow will cause humidity levels to creep up during Sunday into early next week. This will lead to partly cloudy skies along with the chance of isolated pop-up storms, mainly along the Gulf Coast. Temperatures will generally range in the 90s to near 100.

“An east-southeast breeze will support models and changeable wind generation during the next couple of days. Output is forecast to peak during the overnight hours upward of 4-5 GW, but drop off and become weak during the midday hours. The wind will gradually turn more southerly during the weekend into early next week, which should cause output to increase a bit. Peak output levels might range 6-8 GW.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |