E&P | NGI All News Access | Permian Basin

With Four Rigs, Parsley Looks to Spice Things Up in Permian

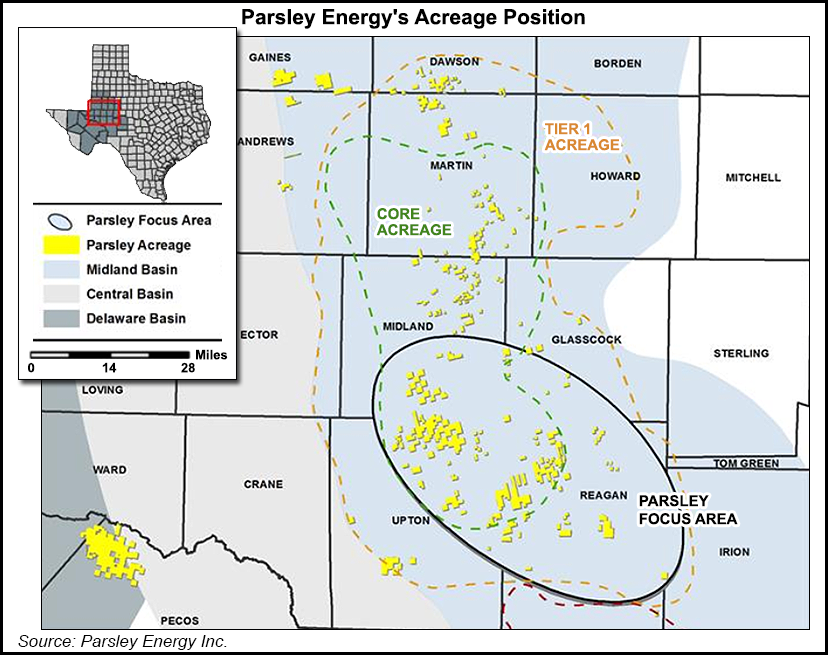

Permian pure-play operator Parsley Energy Inc. said it plans to keep running four rigs through the rest of the year and notched up its production guidance, as it also launches a transition to pad drilling and begins to appraise the development potential of a prospect in the Southern Delaware Basin.

On Tuesday, the Austin, TX-based company said average net production was 22,249 boe/d in 2Q2015, a 17.6% increase over the previous quarter (18,919 boe/d) and 59.0% higher than the preceding second quarter (13,995 boe/d). Crude oil accounted for most of the increase, having climbed 81.0% from 654,000 bbl in 2Q2014 to 1.2 million bbl in 2Q2015.

Parsley, which launched an initial public offering (IPO) last spring (see Shale Daily, May 23), reported that it had reduced horizontal drilling times by 30% over the last two quarters, with lateral lengths increasing by 18% during the same time frame. Consequently, the company said it now believes it can complete more 10 horizontal wells in 2015 than originally planned. It raised its production guidance for the full year from 35-40 to 45-50 gross horizontal wells, and from 20,000-21,500 to 21,500-22,500 boe/d.

Low commodity prices forced the company to drop from 11 horizontal rigs in 3Q2014 to just one rig for part of 2Q2015. But it went back up to four rigs in June.

“Obviously, this was right before the most recent down draft in crude prices,” CEO Bryan Sheffield said during a conference call Wednesday to discuss 2Q2015. “Fortunately, our hedge position helps insulate us from the effect of the most recent drop in oil prices.

“We estimate for the rest of this year, a 20% decline in oil price from $50 to $40 would cause just an 8% decline in rest of the year EBITDA. And for 2016, a $50 to $40 oil price decline would reduce EBITDA by just 11%. So, we’re fortunate to be so well-hedged and we think this sets us apart.”

Parsley said it placed five wells targeting the Wolfcamp B interval — three in Texas’s Upton County and two in Reagan County — into production during 2Q2015. The wells had an average initial production rate of 189 boe/d per thousand completed feet.

The company also said it plans to appraise the horizontal development potential of its Trees Branch prospect, located in northwest Pecos County, TX, and above the Southern Delaware Basin. It is already participating in a non-operated well near the edge of its acreage there, and plans to drill its own horizontal well on its acreage later this year. Both wells will target the upper Wolfcamp interval.

“We’ve seen strong oil production on our vertical exploratory wells, and our proprietary 3D seismic shoot shows abundant potential for long lateral development,” Sheffield said, adding that a three-year extension on most of its Southern Delaware acreage “gives us flexibility on the development timeline. Everything we see is so encouraging that we’re going to go ahead and move forward.”

During the Q&A portion of Wednesday’s call, COO Matthew Gallagher said he doesn’t believe the company is being too aggressive in the Southern Delaware Basin. “We have a long-term project going on out there,” he said. “We’ve taken a very marketed approach to developing it. One test well over a 30,000-acre position [isn’t] getting out over the skis.

“Even on an exploratory basis, it’s an economic prospect at these costs. And once you get in there and drill a few wells, you bring those costs down. It can potentially compete with the Midland Basin.”

Sheffield added “there are a lot of operators getting closer and closer to us and we like what we’re seeing. They’re basically offsetting our acreage…and there’s acreage trading in that area north of $10,000 an acre. So that’s another reason why we’re pushing forward.”

Gallagher said Parsley was in negotiations with “two or three larger companies” over the prospect of trading acreage in the region. But he said the company had focused mostly on drilling during the second quarter, and that was going to continue.

“We’ve seen some data rooms opened from larger acquisitions,” Gallagher said. “We’re interested, but I just don’t see us doing anything with our inventory count right now. I feel like we’ve got a large inventory count to keep moving forward.”

Parsley plans to drill its first Lower Spraberry well in the Midland Basin during 3Q2015, and will commence a three-well pad drilling project — with two wells targeting the Wolfcamp B interval and one drilled into Wolfcamp A.

Parsley reported revenue of $77.9 million from commodity sales during 2Q2015, down 5.4% from 2Q2014 ($82.3 million). Net loss attributable to stockholders totaled $19.1 million (loss of 18 cents/share) in 2Q2015, but an adjusted net loss for the quarter — which excludes non-recurring items on a tax-adjusted basis and adds back non-controlling interest given to Class B stockholders — was $1.8 million (loss of one cent/share).

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |