Utica Shale | E&P | NGI All News Access | NGI The Weekly Gas Market Report

MarkWest Plans $1B-Plus, 250-Mile Utica NatGas Gathering System

MarkWest Energy Partners LP said Thursday that it would develop a more than 2 Bcf/d natural gas gathering system in Southeast Ohio’s Utica Shale that would be supported by a long-term, fee-based contract with Ascent Resources LLC.

The system, which is expected to begin initial operation by the end of the year, could cost more than $1 billion to construct over the next three years, said MarkWest CEO Frank Semple. It would be developed by MarkWest and one of its primary investors, The Energy & Minerals Group (EMG), under a new joint venture. Ascent, which was formed by American Energy Partners LP as one of several businesses to oversee onshore exploration and production across the country, separated as an independent producer in June (see Shale Daily, June 10).

Ascent has 280,000 net acres in the Marcellus and Utica shales, and it would dedicate 100,000 gross acres in Belmont and Jefferson counties, OH, to support initial growth on MarkWest’s new system, which would also gather volumes from other producers.

The gathering system could ultimately consist of more than 250 miles of pipeline and have more than 200,000 hp of compression, MarkWest said. It would be designed to offer multiple takeaway options with connections capable of delivering gas to the Rockies Express Pipeline, the Texas Eastern Transmission pipeline and the proposed ET Rover Pipeline, among others.

In July, Marathon Petroleum Corp.’s (MPC) midstream master limited partnership, MPLX LP, agreed to acquire MarkWest for more than $15 billion in a deal that’s expected to double MarkWest’s growth profile over the next five years (see Shale Daily, July 13).

“This significant dry gas gathering system in the Utica Shale is an example of the $6-9 billion of additional growth opportunities that we will have an even greater ability to deliver after consummation of the announced strategic combination with MPLX,” Semple said.

The merger with Marathon is expected to close in the fourth quarter. MarkWest’s Class B Units are held by an affiliate of EMG. If the merger is completed, the private equity firm would become the second-largest equity holder in MPC.

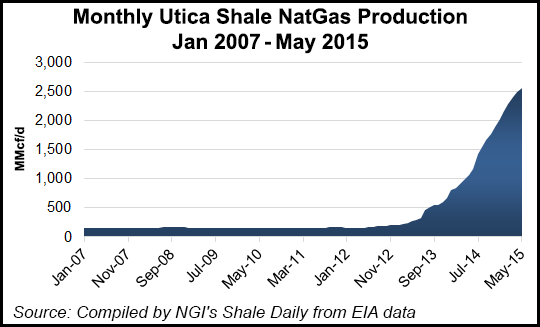

While the Energy Information Administration has forecast a slight dip in the Utica Shale’s production between August and September, oil and natural gas volumes have risen significantly over the last year (see Shale Daily, Aug. 11). Operators produced 4.4 million bbl of oil and 183.6 Bcf of natural gas in the first quarter, the latest period for which data is available from the Ohio Department of Natural Resources (see Shale Daily, June 1). That’s compared to 1Q2014 production of 1.2 million bbl of oil and 67 Bcf of natural gas.

MarkWest is the nation’s second-largest gas processor and fourth-largest fractionator. Its largest position is in the Marcellus and Utica shales, where it operates 34 processing facilities and has another 18 under construction. Under a partnership with EMG and Summit Midstream Partners LLC, MarkWest’s Ohio Gathering Co. LLC already operates one of the larger gathering systems in the state. In May, Ohio gathering began initial operations of a dry gas gathering system in Monroe and Belmont counties, OH, that has already grown to transport more than 150 MMcf/d.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |