Markets | NGI All News Access | NGI Data

Natural Gas Cash, Futures Ramble Higher; $3 in Sight

Both physical natural gas and futures posted hefty gains in Wednesday’s trading, as deliveries for Thursday received support from a rising screen and a strong power environment. Outside of a few points in the Marcellus, all points traded about a nickel to a dime higher.

The NGI National Spot Gas Average gained 7 cents to $2.73, and eastern points rose about a dime. Futures romped higher encouraged by weather reports showing warmer near-term temperatures across northern and eastern population centers.

At the close, September had risen 8.7 cents to $2.931, and October had gained 8.5 cents to $2.956. September crude oil added 22 cents to $43.30/bbl.

A change in the near-term weather outlook was all it took to get futures bulls excited. WSI Corp. reported that overnight weather models turned warmer.

“The latest six-10 day period forecast is warmer than [Tuesday’s] forecast across the Northeast and Ohio Valley, as well as the West Coast. The Rockies and Plains are a bit cooler.” Period population-weighted cooling degree days (PWCDD) were up 1.6 to 58.6 for the continental United States. “Forecast confidence has improved,” and it was about average on Wednesday.

“Medium-range models have come into much better agreement with the large scale pattern, but there are still technical and timing differences,” WSI said. “There is a cooler risk across the Rockies and central U.S. The West Coast, Southwest and even the East have a small upside risk.”

Going into Wednesday’s trading, weather trader Bespoke Weather Services was still holding a long September natural gas futures contract from Sunday evening. “We maintain our one long position” into Tuesday night. “Our natural gas sentiment remains slightly bullish as we expect positive price action to carry over” into Wednesday. “We saw yet another mid-day reversal in natural gas prices [Tuesday],” primarily because of “bullish runs” of the global forecast system guidance mid-day.

“This was the main catalyst behind the decision to re-establish our long position. This past week, we have noticed trading opportunities have been slightly shorter-term than usual, partially due to increased weather model variability,” Bespoke forecasters stated. “In the past few days we have seen a sharp decline in forecasting accuracy, with only a small bounce back so far,” the firm said. “This is part of why weather model variability is so high.”

Sometimes its better to be lucky than correct, and despite less forecasting accuracy, that positive price action indeed did carry over, and left the traders at Bespoke a little puzzled. “Overnight weather guidance did not indicate that this much strength should be expected, and as we ran into resistance around $2.90 we closed our previous long position. This proved to be premature, as prices ran up another 4 cents through the day with volume exceeding 170,000 on the September contract,” the firm said in closing comments.

Analysts see continued high power demand and resulting thinner storage builds carrying into next week.

“The updated weather forecasts suggest that the intense heat currently centered in Texas will likely shift to the Midwest and Northeast next week, preserving the current above-normal cooling demand from the electric power sector,” said BNP Paribas analyst Teri Viswanath, director of natural gas commodity strategy.

“Most of the commercial forecast services now agree that there is better model agreement for a surge of above-normal temperatures on the East Coast at the start and end of next week, with the abbreviated period of cooler temperatures unlikely to disrupt the overall warming trend. “Moreover, extended guidance now suggests that this late-breaking summer heat might linger into September, possibly limiting the opportunities for the normal shoulder-season deterioration in price,” she said. “This daily affirmation of heightened weather demand appears to be giving the market second thoughts about the seasonal supply/demand balances.”

Earlier estimates of ending storage north of 4 Tcf are now off the table.

“Earlier this month the market consensus held that the industry would likely breach 4 Tcf of working gas in storage by end October 0– an expectation that was supported by injections running 20% higher than the five-year average,” Viswanath said.

“The updated weather forecasts now hint at the possibility that end-of-season storage might not breach 3.9 Tcf. To be sure, with increased cooling demand offsetting surplus domestic production, injections will likely align closer to the five-year average. The reduced likelihood of hitting physical constraints for storing excess supply this season has set into motion what appears to be a long convalescence for gas prices.”

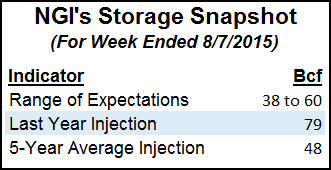

Thursday’s Energy Information Administration (EIA) storage report should give traders a better idea if indeed 4 Tcf is within reach. Last year a stout 78 Bcf was injected and the five-year pace stands at 48 Bcf.

ICAP Energy calculates a 56 Bcf increase, and Citi Futures Perspective analysts are banking on a build of 48 Bcf. A Reuters poll of 27 traders and analysts revealed a sample mean of 55 Bcf with a range of 38 Bcf to 60 Bcf.

Physical natural gas prices showed strength of their own as stout loads and firming next-day peak power prices kept a bid under the market. Intercontinental Exchange reported that peak next-day power at the ISO New England Massachusetts Hub rose 12 cents to $31.19/MWh, and peak power Thursday at the PJM West Hub added $2.23 to $35.59/MWh.

Gas at the Algonquin Citygate rose 38 cents to $2.38, and deliveries to Iroquois, Waddington added 6 cents to $3.06. Deliveries on Tenn Zone 6 200L gained 29 cents to $2.30.

West Coast next-day gas benefited from strong power loads and firm prices as well. CAISO forecast that peak load Wednesday of 37,172 MW would rise to 39,251 MW Thursday. Intercontinental Exchange reported that on-peak power at NP-15 rose $2.31 to $42.31/MWh, and peak power at SP-15 gained $1.91 to $43.21/MWh.

Gas at Malin was seen 6 cents higher at $2.86, and deliveries to the PG&E Citygate came in 6 cents higher as well to $3.28. Packages at the SoCal Citygate changed hands 4 cents higher at $3.18, and gas at the SoCal Border Avg. was seen up 4 cents to $3.00. Deliveries to El Paso S. Mainline/N. Baja were quoted a nickel higher at $3.02.

Parcels headed west on the newly reformatted REX Zone 3 gained as well. According to NGI’s Rockies Express Zone 3 Tracker, deliveries to NGPL at Moultrie, IL, added 5 cents to $2.90, and gas at Shelby, IN, into ANR rose a nickel to $2.91. Parcels at Edgar, IL, bound for Midwest Pipeline came in 7 cents higher at $2.91.

Deliveries to the Chicago Citygate rose 7 cents to $2.98.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |