Marcellus | NGI All News Access

Seneca Shut-Ins, Oil/Gas Impairments Hurt NFG Profits

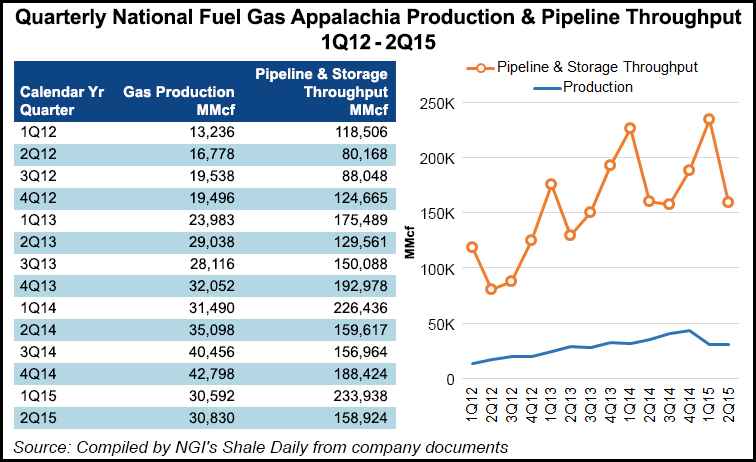

National Fuel Gas Co. (NFG) once again saw its earnings plummet in the third quarter 2015 fiscal year, mainly on low commodity prices and significant production curtailments in its upstream segment, Seneca Resources Corp.

For the second straight quarter the producer — which primarily operates in California and Pennsylvania, where it has 790,000 net acres in the Marcellus Shale — curtailed 12.5 Bcf of natural gas, down slightly from 13.5 Bcf of curtailments in the second quarter 2015 fiscal year (see Shale Daily, May 1).

“We continue to look for opportunities to sell our spot production at acceptable prices, but there is simply too much gas and not enough pipeline infrastructure to move those supplies to attractive price points,” CEO Ron Tanski said of the company’s Appalachian operations.

Seneca produced 36.2 Bcfe in 3Q2015, which ended on June 30, down from 40.6 Bcfe in the year-ago period and up slightly from 35.7 Bcfe in 2Q2015. Seneca President Matt Cabell said the company sold only its firm Marcellus volumes during the quarter. Without the 12.5 Bcf, or 140 MMcf/d of curtailments, production for the period would have grown 20%, he said.

After hedges, the company’s average natural gas price during the third quarter was $3.32/Mcf, a decrease from $3.55/Mcf in the year-ago period and $3.65 in 2Q2015. The lower commodity prices forced Seneca to take a $339.8 million non-cash write down on the value of its oil and natural gas reserves.

The company hopes that three interstate pipeline projects that it currently has under construction to move more gas to Canada and on Spectra Energy Corp.’s Texas Eastern Transmission pipeline can help it earn more favorable prices for its Pennsylvania production. Cabell added that the company has two Utica Shale tests planned before the end of the fiscal year in North-Central Pennsylvania, where it tested a well in March in an unproven area of Tioga County at a peak 24-hour rate of 22.7 MMcf/d (seeShale Daily, March 9).

NFG’s utility and pipeline and storage segments reported flat earnings, with marginal gains from a lower effective income tax rate at its utility segment offset by higher depreciation and property tax expenses at its midstream segment. The company said that it would also consider a master limited partnership structure for its pipeline and storage business next fiscal year.

NFG’s consolidated revenue declined from $440.1 million in 3Q2014 to $339.8 million in 3Q2015. As a result of lower commodity prices and the impairment at Seneca, NFG reported a net loss of $293.1 million (minus $3.44/share) in the third quarter, down from net income of $64.5 million (76 cents/share) in the year-ago period.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |