Marcellus | E&P | NGI All News Access | Utica Shale

Magnum Hunter Details Possible Lifeline With Tentative $430M Ohio JV

Magnum Hunter Resources Corp. has entered a non-binding agreement with an undisclosed private equity fund to farm-out 28,500 net acres in Ohio to jointly develop unproven Marcellus and Utica Shale acreage that could net the company up to $430 million in sorely needed cash.

Last Friday, Magnum CEO Gary Evans said an announcement regarding the joint venture (JV) would likely come this week (see Shale Daily, Aug. 10). Since the company closed on the sale of more than 5,000 net acres in Tyler County, WV, to Antero Resources Corp. in June, the tentative JV agreement is the latest in a series of liquidity events Magnum is working on to generate more cash and rejuvenate its suspended drilling program in the Appalachian Basin (see Shale Daily, May 26).

In a filing with the U.S. Securities and Exchange Commission (SEC) Tuesday, Magnum said it would farm-out the land in Monroe and Washington Counties, OH, where “no reserves underlying the acreage are currently classified as proved reserves.” The private equity fund would commit up to $430 million in cash, including $25 million for Magnum’s producer subsidiary, Triad Hunter LLC, to prepare the acreage for drilling, according to the terms detailed in the filing.

The JV would initially target 9,500 net acres, with all of Magnum’s working interest dedicated to the private equity fund. But the company would have a right to participate with up to a 25% working interest, which financial analysts said they expect Magnum to do. Ninety-five percent of the partnership’s interest reverts back to Magnum once the fund has achieved a 12% internal rate of return or a 1.20 multiple on its investment. All the interest reverts back to Magnum once a 16% internal rate of return is achieved, according to the early terms of deal, which are still subject to change.

Magnum added that its letter of intent with the private equity fund also provides for an area of mutual interest adjacent to the JV acreage for possible development in the future that would require the fund to commit more capital.

In the SEC filing, Magnum said it expects to reach a definitive agreement in 30-45 days, with a closing 15-30 days after that.

Earlier this year, citing low commodity prices and ceding to a cash crunch, Magnum suspended its drilling program (see Shale Daily, March 2). The company’s borrowing base was recently redetermined at just $50 million. Its shares, traded on the New York Stock Exchange, recently hit a 52-week low of 70 cents.

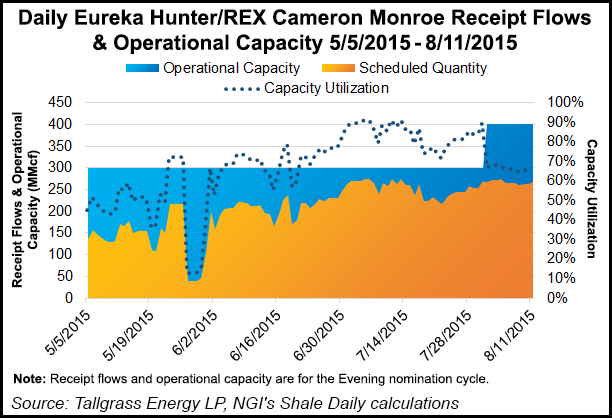

The company earned $37.6 million when it sold the noncore West Virginia acreage to Antero, but it wants more for its drilling program and to pay down debt. Magnum is also working on a deal to sell its 46% stake in midstream subsidiary Eureka Hunter Holdings LLC for up to $600 million and looking for a third party to assume some of its firm transportation liabilities to help free up more credit (see Shale Daily, June 25).

Management has not ruled out additional joint ventures and acreage sales. While the company has 44 horizontal Marcellus wells producing, it has just 4 horizontal Utica wells producing.

Topeka Capital Markets analyst Gabriele Sorbara said the Ohio JV could benefit Magnum, as it would at the very least allow the company to move forward with the development of unproven acreage with minimal capital spending.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |