NGI Data | NGI All News Access

NatGas Held To Narrow Moves In Weekly Trading; Futures Slide A Dime

Talk about a balanced market! In weekly trading all but a handful of points moved less than a nickel either side of unchanged. TheNGI Weekly Spot Gas Average eased a miserly 2 cents to $2.60, and even those actively traded points showing the greatest gains and losses had a hard time making meaningful double-digit moves.

The strongest point proved to be Algonquin Citygate, with an advance of 13 cents to $2.17, and the week’s biggest loser was Northwest Sumas with a loss of 20 cents to $2.08.

Regionally it was a tight field, with the Midcontinent and Rocky Mountains making microscopic moves lower of just 3 cents to $2.79 and $2.72, respectively. On the “high” side of the week’s results were East Texas, the Northeast and California, each losing a penny to $2.84, $1.84, and $3.04, respectively.

The Midwest, South Louisiana, and South Texas all fell 2 cents to $2.91, $2.85, and $2.81, respectively.

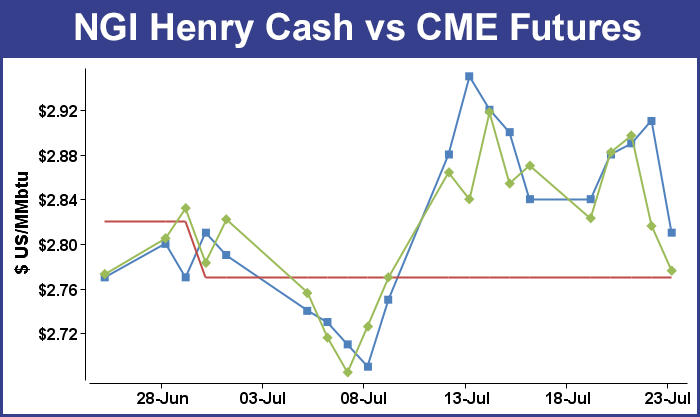

August futures for the week shed 9.4 cents to $2.776, and much of that had to do with the 8 cent drop recorded Thursday as traders factored in new storage data. Traders were initially caught off guard by a revision in the weekly storage figures which showed 7 Bcf reclassified from working gas to base gas. Futures shot higher, and the seemingly bullish 61 Bcf storage build was quickly re-factored and at the close August was down 8.1 cents to $2.816 and September had fallen 9.1 cents to $2.817.

Futures bulls noted that the two previous storage reports had a decidedly bearish luster to them, but August futures were sitting higher by close to a dime after Thursday’s report. A run of three straight may have been a bit too much to ask. August futures rose to a high of $2.951 after the number was released but quickly adjusted. By 10:45 EDT August was trading at $2.861, down 3.6 cents from Wednesday’s settlement.

Prior to the release of the data analysts were looking for an increase in the upper 60 Bcf range. Industry consultant Bentek Energy utilizing its flow model estimated 67 Bcf, and IAF Advisors was counting on a 67 Bcf increase as well. A Reuters poll of 25 traders and analysts showed an average 70 Bcf with a range of 64 Bcf to a 79 Bcf injection.

The 7 Bcf reclassification caught some traders by surprise. “It didn’t make any sense. We were looking for a build in the high 60s, 67 to 70, but the 61 Bcf was a bit of a surprise,” said a New York floor trader. “We are looking at a $2.85 to $2.95 trading range, and support below at $2.75 and resistance at $3.”

Tim Evans of Citi Futures Perspective saw a positive tone to the figure. “The DOE reported 61 Bcf in net injections for last week, but noted that it had moved 7 Bcf in gas in the Eastern Region total from working gas into the base gas category. So the flow for the week was more like 68 Bcf, even though the total increased by just 61 Bcf. Either way, we consider this a constructive report, with even the 68-Bcf figure still a robust drop from the 99 Bcf level of the prior week and closer to the 54-Bcf five-year average result than it might have been.”

Inventories now stand at 2,828 Bcf and are 622 Bcf greater than last year and 89 Bcf more than the 5-year average. In the East Region 41 Bcf were injected and the West Region saw inventories increase by 8 Bcf. Stocks in the Producing Region rose by 12 Bcf.

In Friday’s exchanges both physical gas for the weekend and Monday as well as futures marched lower. Prices in the East and Northeast showed some stout advances but were unable to offset wider declines of a dime or more at points west of the Hudson River. The overall market fell 6 cents to $2.54, but Northeast points on average were higher by almost a dime.

Futures prices wobbled lower as traders had a new round of more mild weather forecasts in pivotal northern markets to deal with. At the close, August was down 4.0 cents to $2.776 and September had given up 4.2 cents to $2.775. September crude oil continued lower, falling 31 cents to $48.14/bbl.

Northeast points advanced, aided by a firm power environment. Intercontinental Exchange reported Monday on-peak power at the PJM West Hub rose $5.11 to $44.58/MWh, and peak power at the ISO New England’s Massachusetts Hub gained $11.78 to $36.00/MWh.

Gas on Transco Zone 6 into New York City rose 17 cents to $1.67, but farther to the south gas on Transco Zone 6 non-NY North bound for southeastern-most Pennsylvania and southern New Jersey added 25 cents to $1.73.

At the Algonquin Citygate weekend and Monday packages changed hands at $1.39, up 5 cents, and gas on Tennessee Zone 6 200 L was quoted 18 cents higher at $1.61.

Gas in the Midwest fell a more representative 7 to 8 cents, and some marketers took advantage of the lower quotes. “We bought some gas for the weekend because we wanted to get ahead of the big heat next week,” said a Michigan marketer. “We bought on Consumers at $2.92 and $2.915. It’s better to be safe than sorry, and any gas we don’t use we can put in storage.”

In the words of one marketer, “it’s better to be long and wrong than short and fired!”

Declines of close to a dime were dominant throughout the Great Lakes. Gas on Alliance and deliveries to the Chicago Citygate fell 7 cents to $2.85 and $2.86 respectively, while gas on Consumers shed 8 cents to $2.90. Packages on Michcon changed hands at $2.90, down 8 cents as well.

Losses of a dime were common throughout the Gulf. Gas at the Henry Hub shed 10 cents to $2.81, and deliveries to Katy were off 9 cents to $2.80. Three-day packages on Tennessee 500 L shed a dime as well to $2.79, and gas on Columbia Gulf Mainline was seen a dime lower as well at $2.77.

Although a much more warm and humid pattern appears to be in store for the southern Plains and Southeast next week, in its Friday morning six- to 10-day forecast WSI Corp. said, “[Friday’s] forecast has trended several [degrees] cooler across the Great Lakes, whereas slightly cooler across the central and Northeastern U.S. when compared to yesterday. Forecast confidence falls to near-average standards as there’s excellent agreement between the models regarding the heat-up over the West, but there are timing differences with the cool over the East.

“Raw model guidance are showing strong warmer risks across CAISO when compared to the AM forecast and ensemble MOS products. Cooler risks are in store for the northern Plains, Midwest and Great Lakes and Northeast under a series of cool air masses to impact the East.”

Analysts see Thursday’s decline as not offering any trading opportunities, at least not yet. “This market briefly saw a price advance yesterday into our suggested $2.95-3.00 sell zone immediately following release of the EIA storage report,” said Jim Ritterbusch of Ritterbusch and Associates in a Friday morning note to clients. “From here, some additional price weakness would be expected, given the adjustments in the temperature forecasts that are now calling for cooler than normal patterns across the upper Midcontinent that extend across the first week of August. These mild trends, if realized, should accommodate some larger storage injections than we had been plugging in for the next two to three weeks.

“While we had been assuming supply builds similar to those seen yesterday, it now appears that an upswing into the 70-80 Bcf zone could be seen for a few weeks unless production slips more than expected. Nonetheless, we don’t see either the commercial or speculative entities approaching the short side of the market aggressively at current levels. Despite yesterday’s selloff that has extended through the overnight trade, the market is only about 4 cents away from the midpoint of our expected $2.65-3.00 trading range. As a consequence, we will caution against fresh short entry at current levels given risk-reward ratios that approximate one to one at best.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |