E&P | NGI All News Access | NGI The Weekly Gas Market Report

Rogersville Shale Tests Shrouded in Secrecy as Oil/Gas Rush Begins

Dozens of oil and natural gas plays in the Appalachian Basin have helped to define the nation’s fossil fuel production since the 19th century, but unconventional drilling technology now finds operators searching somewhat secretly underneath it for more reserves.

Little is known about it. But a deep sub-basin, appropriately described as near-basement rock, known as the Rome Trough could contain the kind of source rock that has sparked an oil and gas renaissance in Appalachia over the last decade. It’s a horizon that some believe could be comparable to the Marcellus and Utica shales.

The Rogersville Shale is one of six formations in the Conasauga Group, which also includes two other shales. There’s been limited production from the group south of Kentucky, but the organic-rich Rogersville is thought to be isolated and confined to Kentucky and West Virginia. At a depth of roughly 9,000-10,000 feet in Kentucky, and 12,000-14,000 feet in West Virginia, the formation is essentially no deeper than some Utica wells that have been drilled. It’s not an inconceivable target.

With a thickness of up to 1,100 feet in Kentucky, geologists don’t exactly know yet where the best zones are located. The question remains how much of that interval is actually good quality reservoir rock.

Operators in both states have set out to answer the question.

Data obtained by NGI’s Shale Daily clearly demonstrates that a land grab is under way in Eastern Kentucky, and interviews support anecdotal evidence that a similar trend is ongoing in Southwest West Virginia (see Shale Daily, June 30). Cabot Oil & Gas Corp., Cimarex Energy Co., EQT Corp. and what could be up to four other unknown operators are clandestinely trying to learn more about the Rogersville with exploratory wells and stratigraphic tests, state records show.

Play Making

Denver-based Cimarex Energy, a company that primarily operates in the Permian Basin and the Midcontinent, has thus far been a pioneer in the play, according to interviews and documents filed in Kentucky.

Through its subsidiary, Bruin Exploration LLC, the company has drilled a vertical test well, the Sylvia Young, to the Rogersville in Lawrence County, KY. That well, according to state records, was first permitted as a stratigraphic test in October 2013, which under state regulations shields the company and permit details for proprietary reasons. Four months later, the well was permitted for oil and gas production. When it was drilled last year, the company was able to request a year of confidentiality before a completions report could be released by the state, said head of the Energy and Minerals Section at the Kentucky Geological Survey (KGS) David Harris.

That report, however, is expected to be released on Aug. 20. It would include initial flow and production rates from the test well. But more importantly, it would mark the first substantial modern data from the Rogersville, and it could serve as an early indication of the formation’s potential as a viable oil and gas play.

“There’s been this little strategy going on in Kentucky where companies are permitting the wells as stratigraphic test permits,” Harris said. “It’s purely research to gather geologic information. That’s what happened with the [Sylvia Young] well; it was permitted as a stratigraphic test and [Cimarex] then applied for an oil and gas permit.”

EQT, which established affiliate Horizontal Technology Energy Co. LLC to prospect in the Rogersville, has also drilled a horizontal well to the formation in nearby Johnson County. State records show that the company was issued a stratigraphic permit last December for that well and was issued an oil and gas permit in April for production. Cimarex has also permitted another well farther south in Lawrence County.

Another oil and gas production permit is expected to be issued in Kentucky by the end of July, at which point details would become available about the operator and location.

In West Virginia, Cabot has drilled a vertical test well to the Rogersville in Putnam County, said West Virginia Oil and Natural Gas Association Executive Director Corky DeMarco. West Virginia Department of Environmental Protection spokeswoman Kelley Gillenwater confirmed that Cabot is the only company in the state with a known Rogersville permit. DeMarco added that the company has been actively leasing land in the southwestern part of the state.

During a second quarter earnings call with financial analysts, Cabot CEO Dan Dinges said the company has nearly one million acres in West Virginia. Although he didn’t provide specifics about any particular formation, he added that the company has ongoing exploration efforts south of Wood County, WV, in the western part of the state looking at a “deeper section” there.

“We’re usually cautious when it comes to discussing exploration efforts…We have a couple areas that we’re continuing to look at that we think have exploratory opportunity anyway,” Dinges said. “…We have enough reason to believe that it merits further capital at some time.”

In Kentucky, there are four anonymous stratigraphic test permits that officials at KGS believe are the beginnings of more Rogersville production wells. All those test permits were issued earlier this year.

“We think they’re Rogersville tests, but we don’t know that for sure,” Harris said. “They’re in Lawrence County. The fact that they’re being permitted as stratigraphic tests suggests [operators] are trying to keep the information confidential.”

Cabot, EQT and Cimarex could not be reached to comment for this story.

The Rush

While sources agreed that Rogersville development has likely been impeded by the commodities downturn in recent months, a bevy of leasing activity since last year suggests that exploration efforts could accelerate if prices rebound and early tests prove successful.

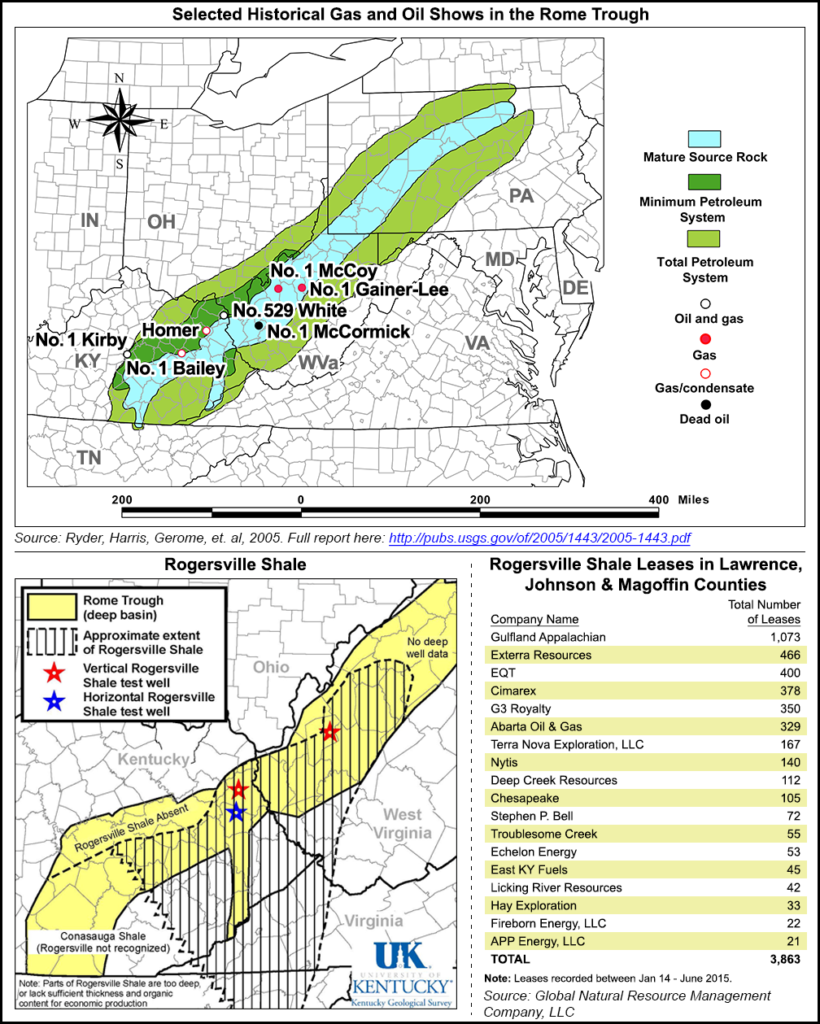

From January 2014 to June, across a three-county stretch in Eastern Kentucky, including Magoffin, Johnson and Lawrence counties, 3,863 leases were signed for the Rogersville, according to data compiled by Wesley Cate, executive vice president of the mineral management firm Global Natural Resource Management Co. Cate went to local government offices in all three counties and obtained lease indexes for the period, plugged them into a database and compiled the statistics.

Generally, the leases are being signed for terms of five years or less, with 12.5% royalties. Historically, land in the three-county region fetched $25-50/acre. Cate found that, on average, Rogersville leases during the period were signed for $150-350/acre. At current rates, assuming each lease is 50 acres, Cate estimated that nearly $65.5 million could have already been paid in bonuses in the counties.

“Absolutely, what’s happened, and I’ve worked in the state since 2002, Cimarex came in in 2012 under the radar with [land brokerage Gulfland Appalachian Energy Inc.] and started the leasing activity in Lawrence County, but didn’t expand into Magoffin until later,” Cate said, characterizing the activity to date as a land grab. “I would not be surprised if you see the same kind of activity spread into Wolfe, Lee and Estill counties [to the southwest of Lawrence County]. Just through the rumor mill, I’ve heard there’s already some leasing activity in Lee County.”

Of the 3,863 leases signed for the Rogersville, 2,127 of them have been executed in Magoffin County, where Cate’s data shows that leasing activity peaked in March. At the end of June, Gulfland had the most leases with 1,073; EQT had 400; Cimarex had 378 and land management company Exterra Resources LLC had 466, among several other companies. Chesapeake Energy Corp., which already has reserves in both Kentucky and West Virginia, had 105 Rogersville leases in the region.

Numerous sources said Chesapeake is either testing or preparing to test the formation. When asked to confirm its activity in the Rogersville, a Chesapeake spokesman declined to comment but did not deny company activity in the play.

The spike in Eastern Kentucky land costs related to the Rogersville is comparable to what happened in the early days of Ohio’s Utica Shale development. In 2011, Cate, who was working in the area during a scramble to obtain land on what is now the play’s western edge, said land was going for $125-175/acre. Shortly after that, as the land grab moved farther east, those prices shot to about $1,500/acre before they continued going up as the Utica was delineated, he said.

“What I’m seeing in the Rogersville is very similar to what I saw in the Utica,” Cate said. “There’s been an uptick in mineral buying in the Rogersville. For perspective, I used to lease land down here for as low as $10/acre per year.”

DeMarco added that in West Virginia joint ventures, farm-outs and land deals have been common in the southwest part of the state where the Rogersville is thought to be viable.

Groundwork

In a 2005 report released by the U.S. Geological Survey (USGS) and authored in part by EQT and Harris — who is considered a leading expert on the formation by many — researchers set out to find the hydrocarbon source rock for producing sandstone reservoirs in the Rome Trough of West Virginia and Kentucky. Their work led them to conclude that the Rogersville was feeding those reservoirs.

“That was at a time when people really weren’t thinking of shales as reservoir rocks,” Harris said of the work that led to the paper, which started in about 2001. “So, that report sat around for awhile. Then a company in Denver called Cimarex sort of discovered it and maybe decided to pursue the Rogersville as a reservoir since we had documented the organic content. They’re the ones that kind of got the whole play started with the [Sylvia Young] well in Lawrence County.”

But the impetus for today’s interest in the Rogersville actually happened decades before. A series of documented wells were drilled to the Rome Trough in the 1960s and 1970s. In the mid-1960s, the Inland No. 529 White well drilled in Boyd County, KY — north of Lawrence County — yielded the first commercial oil production from Cambrian-age rocks in the sub-basin. But it was the former Exxon Corp., which drilled several deep wells in the Rome Trough at the time, that revealed more about the Rogersville.

One of those tests, drilled to the Maryville Limestone in the Conasauga Group in Jackson County, WV, produced natural gas at 6-9 MMcf/d, according to research included in the USGS paper. That well would have been north of Cabot’s current exploration in Putnam County, WV. But Exxon also cored the Rogersville with its No. 1 Smith well in Wayne County, WV.

“A lot of this has been sort of developed off of what was seen in that core, in that old Exxon well,” Harris said. “That was the key evidence that there was organic content and there was also big gas shows when they drilled through that zone. We have those records and mud logs that show potential hydrocarbons in the zone.”

The Rome Trough is also narrow, extending northeastward into Ohio, Pennsylvania and southern New York. It remains unclear what it, or other shales in the Conasauga, could hold for producers north of West Virginia. Other shales in the group have tested poorly for hydrocarbons in the region, Harris added

“We’re not sure what the difference is with the Rogersville. Why is it organic-rich and the other shales in that package are not? So, that’s sort of a mystery right now,” he said. “The [Rome Trough] gets very deep in Pennsylvania and New York. We don’t have real well-defined boundaries in those states, and so it’s a little speculative exactly where it is up there.”

A Guessing Game

With so few drill bits having gone through the Rogersville, there’s no reliable resource estimate for the shale. Every two years, as part of work for the Colorado School of Mines’ Potential Gas Agency, a committee of Appalachian experts gathers in Pittsburgh to update technically recoverable resources for oil and gas plays in the region.

“I’ve worked for the Potential Gas Committee for the past 20 years,” said Director of West Virginia University’s Appalachian Oil and Natural Gas Research Consortium Doug Patchen. “We sit down and evaluate the number for every gas play in the basin, which is more than 30. For the first time, this year, we looked at the Rogersville. Our conclusions — other than a wild guess — were that you really can’t do much with it at this point.”

Right now, Patchen said, the Rogersville resource estimate is “quite small,” adding that there’s not enough information to make a good assessment.

“It’s like the Utica, our numbers were small last year compared to June of this year. We had another year of production to make a better estimate,” he said. “But the Rogersville is of interest, and in two years we’ll likely update those numbers.”

USGS geologist Leslie Ruppert said the agency does not currently have an ongoing assessment of the shale or any personnel with extensive knowledge of its resources. He pointed to a note from a retired colleague, Robert Ryder, who helped author the USGS’ 2005 report, that said the paper was one of the earliest publications indicating the Rogersville’s potential as a source rock.

Kentucky Oil and Gas Association Executive Director Andrew McNeill echoed Patchen and said activity in the Rogersville is merely a matter of speculation at this point. He noted that in his state, where oil has historically been produced from Mississippian limestone and gas from Devonian black shale in the east, the Rogersville sits below an industry stronghold. Although there’s no evidence to suggest the play could be as fruitful as the Utica or Marcellus shales, he said the state is better positioned than most to handle a potential boom with infrastructure already in place for the Huron Shale and Berea Sandstone, among others.

“There would certainly be a need for additional transmission capacity and gathering if this thing comes online, but we wouldn’t be starting from scratch,” he said.

Given the depth of the shale in West Virginia, the industry is betting that the Rogersville is likely a dry natural gas play there, while shallower depths in Kentucky are expected to yield both oil and gas.

“I don’t know if it can be that big. I guess the potential is there,” Harris said when asked if the Rogersville could one day be as prolific as the Marcellus or Utica. “A lot of companies are just trying to prove-up reserves right now and see what’s down there. Whether they’ll start full-blown development under this current pricing situation, I don’t know.

“These are expensive wells, and I’m not sure what the economics are going to be on it. But we’re continuing to see a lot of interest.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |