M&A | NGI All News Access | NGI The Weekly Gas Market Report

U.S. Supermajors Stockpile Firepower For Potential Onshore M&A, Says Goldman

Exploration and production (E&P) companies are on the prowl for mergers and acquisitions (M&A), with U.S. supermajors able make some big deals if they are inclined, Goldman Sachs analysts said Thursday.

With the shift from resource constraints to abundance, finding a route to a lower breakeven portfolio has become the “new oil order,” said Goldman’s Ruth Brooker and her colleagues. They conducted an analysis of the top 420 E&Ps based in the United States and overseas.

“We believe M&A can provide one route to a lower breakeven portfolio and see 10-15 million b/d of production which can be transferred” through mergers.

The oil majors are well positioned, she said, with an estimated “$150 billion of firepower that won’t stretch their balance sheets.” They also have the ability to defer about $325 billion of capital expenditures on marginal projects, “which can be redirected toward acquisitions.”

U.S. supermajors hold around $80 billion of the ammunition, with European-based majors with about $70 million. The majors are at the top of the buyers’ list because they are meaningfully underexposed to U.S. shale oil.

The majors “own only 5% of the total U.S. shale oil resources based on our Top 420 analysis, despite it being the biggest area of supply growth and productivity improvements on a global basis,” Brooker said. And they need to “buy materiality” because their average reserve replacement has been below 100% for the past five years.

ExxonMobil Corp. could make a deal for as much as $40 billion, while Chevron Corp. would have $26 billion to spend. ConocoPhillips, the top independent, has about $14 billion available. Of the European-based supermajors, BP plc has up to $36 billion, despite the Macondo payouts.

The producer “most likely to transact, in our view, is ExxonMobil given its differentiated/strong cash flow profile, limited U.S. shale oil portfolio and strongest equity currency,” Brooker said. ExxonMobil already is the top U.S. natural gas producer.

The capital to buy would come from projects that could be deferred. As many as half of the 61 new pre-sanctioned projects worldwide are uneconomic at current prices, amounting to more than $750 billion of capital expenditures and 10.5 million b/d of cumulative peak production, according to Goldman. The main projects that have been or may be shelved are marginal offshore projects in Africa, heavy oil in Canada, marginal U.S. unconventionals and high-cost liquefied natural gas projects.

“We do not believe M&A within shale will be done by majors alone,” analysts said. “We see an active opportunity for intra-shale consolidation among E&Ps…Multiple shale plays have very fragmented ownership, particularly the Permian Basin, Marcellus Shale, Utica Shale and Denver-Julesburg Basin (Wattenberg/Niobrara play).

“Year to date we have seen two meaningful acquisition announcements,” separate deals by Noble Energy Inc. and WPX Energy Inc. (see Shale Daily, July 14; May 11).

“We believe more companies are reaching agreement on our multi-year ‘shale scale’ thesis — that larger contiguous acreage positions are needed to drive superior execution and cost reduction. As such, we believe we will continue to see moves by existing shale players let alone those with lower quality shale assets to expand/enter shale.”

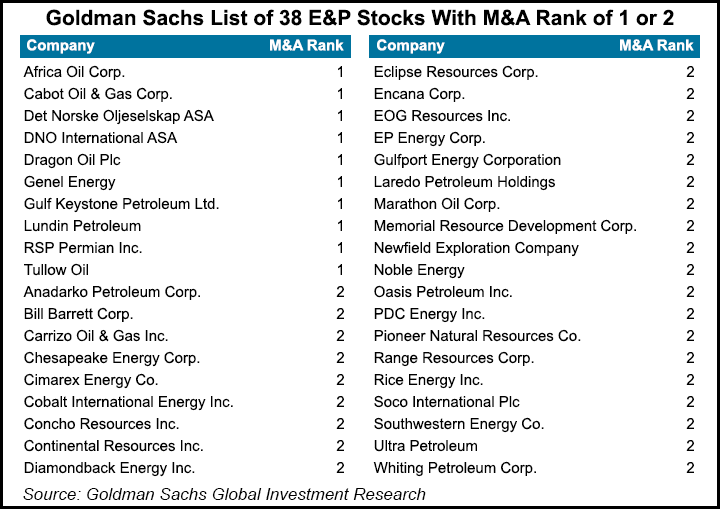

The “most likely M&A targets” were selected based on several factors: U.S. shale exposure, asset quality, cost curve positioning, materiality and upside potential. The top targets overall that were identified by Goldman were Anadarko Petroleum Corp., Cabot Oil & Gas Corp., Concho Resources Inc., Continental Resources Inc., EOG Resources Inc., Pioneer Natural Resources Inc., Noble Energy Corp. and Range Resources Corp.

Also listed as among the most capital-constrained E&Ps with strong M&A appeal were, again, Continental and Range, as well as U.S.-based Memorial Resource Development Corp.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |