E&P | NGI All News Access | NGI The Weekly Gas Market Report

U.S. Rigs in Retreat Again, But Canada Gains

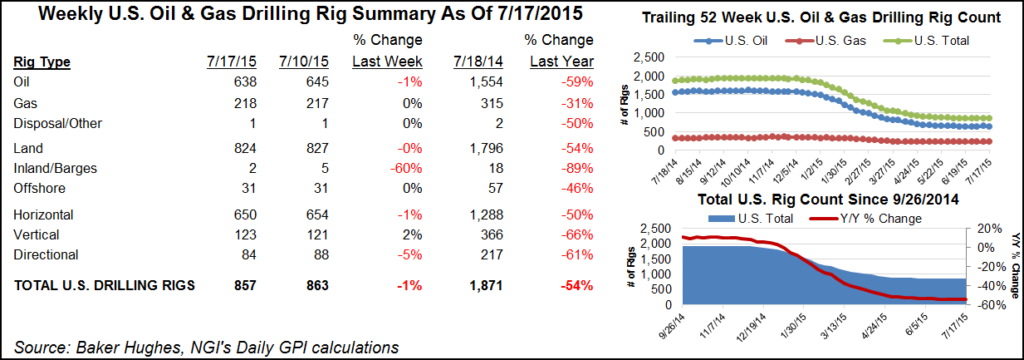

U.S. drilling rigs were back on the retreat — declining by six — in the Baker Hughes Inc. rig count for the week ending July 17; however, Canada added 23 rigs to land the North American count at a net gain of 17.

The U.S. lost seven active oil-directed rigs but gained one active gas-directed rig. Of the net decline of six, three rigs were lost from land and three left the inland waters arena. The offshore category was static. The majority of the rigs added in Canada, 16, were gas-directed; seven oil-directed rigs were added.

In the U.S. four each of directional and horizontal rigs were lost, but two vertical rigs were added. In the previous week’s count, it was a strong return by vertical rigs that made for a net gain of one by U.S. rigs (see Daily GPI, July 10).

In the current count, among states Louisiana lost the most rigs, down three, followed by North Dakota, Pennsylvania and Texas, which each lost two. California lost one rig, but Alaska, Colorado, Kansas and New Mexico each gained one.

Among major basins tracked by Baker Hughes, the Eagle Ford gave up four rigs, followed by the Marcellus, which lost three. The Ardmore Woodford, Cana Woodford, and Williston each lost two rigs while the Arkoma Woodford and Haynesville each lost one.

The Permian Basin added three rigs, and the Denver-Julesburg/Niobrara, Mississippian and Utica each added one rig.

The North American count, at 1,049 rigs, is down more than 53% from the year-ago tally of 2,252 active rigs. The U.S. count at 857 is down more than 54% from a year ago when it stood at 1,871. Canada is off nearly 50% from a year ago at 192 active rigs versus 381 a year ago.

“Domestic [natural gas] production averaged a very slightly stronger 72.4 Bcf/d for the week ended 10 July, highlighting its underlying strength in spite of some of the headwinds it faces through summer, largely weak Marcellus basis pressure,” said Societe Generale’s Breanne Dougherty in a Thursday note. “We continue to expect production to trend around these levels through most of the injection season and see risk of material sustained downside as low.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |