Utica Shale | E&P | NGI All News Access

Antero Resources Set to Drill Its First West Virginia Utica Well

Antero Resources Corp. plans to spud its first Utica Shale well in West Virginia in the third quarter with results expected by the end of the year, the company said.

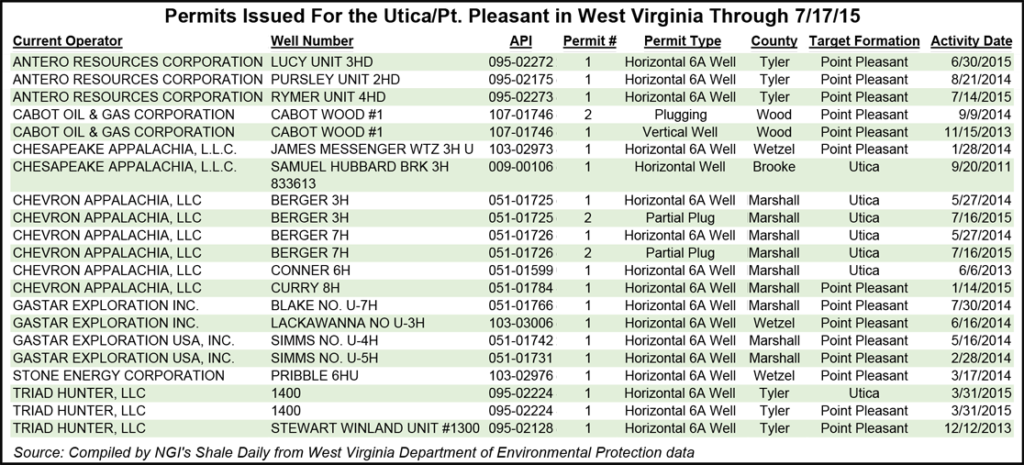

Antero acquired an additional 4,400 acres in the state during the second quarter. With that bolt-on, the company now holds 181,000 net acres of Utica rights outside of Ohio when combined with its assets in Pennsylvania. Antero, which has been discussing the possibility of a test of its Utica acreage in the state since last year, plans to drill the well in Tyler County (see Shale Daily, March 26, 2014).

In an operations update, the company said its sequential production decreased slightly in the second quarter, going from 1.485 Bcfe/d in the first quarter to 1.484 Bcfe/d. Volumes increased 67% from the 891 MMcfe/d it produced in 2Q2014 (see Shale Daily, April 16; July 18, 2014).

The company’s liquids production, however, increased 127% year-over-year and 15% sequentially to 45,900 b/d. The slight drop in overall production was expected. Earlier this year, Antero said it would defer the completion of 50 horizontal Marcellus Shale wells as a result of the drop in commodity prices (see Shale Daily, Jan 21). Slight production declines are expected to persist through the end of the year.

Although it hasn’t been board-approved, CEO Paul Rady said the company is targeting 25-30% production growth next year. At the time it announced the Marcellus deferrals, Antero said those wells would represent a loss of 400 MMcfe/d in production. The company plans to complete the wells in the first half of 2016.

It added that service costs continued to decline during the second quarter. Most of those gains, though, would not be realized until next year. But the company is estimating that they would generate $150 million in drilling and completion savings, which would help increase production next year with just a slight increase in the capital budget.

In the Marcellus, the company completed 13 horizontal wells last quarter at an average lateral length of 8,300 feet. One of those wells, the Hawkeye Unit 1H, was drilled with the longest lateral in company history at 12,353 feet. Antero plans to complete 26 Marcellus wells by the end of the year.

In the Utica, the company completed 10 horizontal wells at an average lateral length of 10,600 feet. It plans to complete 35 Utica wells by the end of the year.

A bump in natural gas prices helped to offset a decline in realized natural gas liquids prices. After hedging, the company earned $3.86/Mcf and realized a hedge gain of $182 million during the quarter. Next year, the company said it has more than 1.6 Bcfe/d of natural gas hedged at $4.02/Mcfe.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |