Natural Gas Bulls Note Tepid Response to EIA Storage Data

Natural gas futures eased following the release of government inventory figures showing an increase in working gas storage that was greater than what the market was expecting.

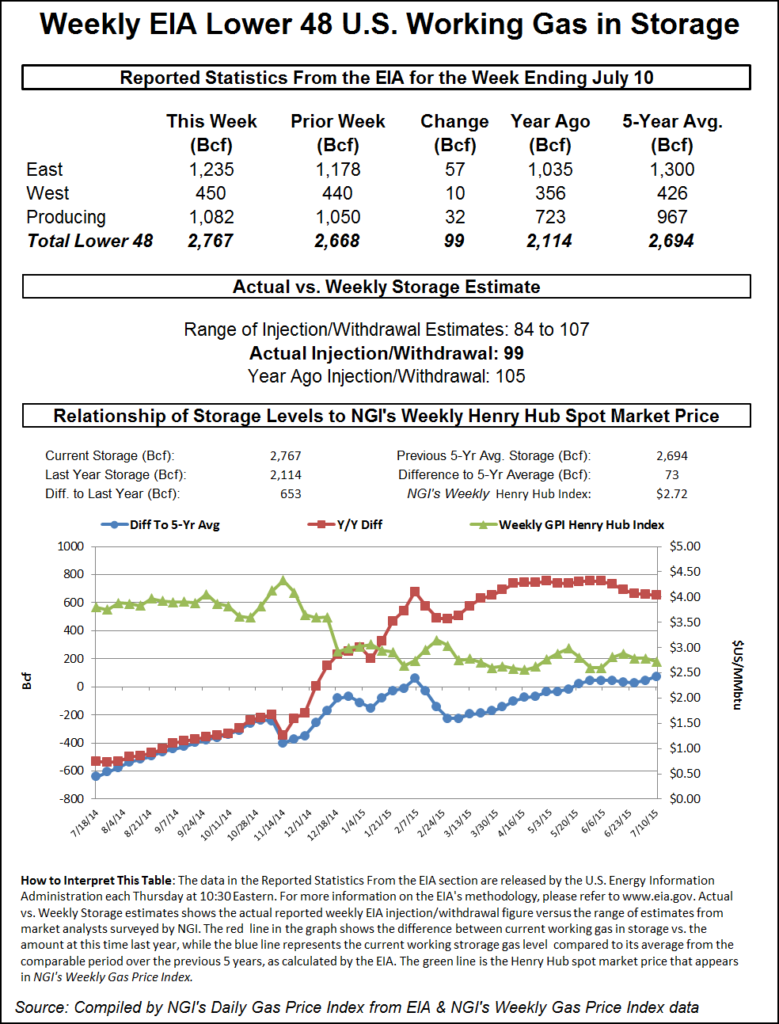

For the week ending July 10 the Energy Information Administration (EIA) reported an injection of 99 Bcf in its 10:30 a.m. EDT release on Thursday. August futures fell to a low of $2.871 after the number was released and by 10:45 a.m. August was trading at $2.889, down 2.9 cents from Wednesday’s settlement.

Prior to the release of the data analysts were looking for an increase in the mid 90 Bcf range. Bentek Energy’s flow model was spot on with a build of 99 Bcf, but IAF Advisors was counting on a 96 Bcf increase. A Reuters poll of 27 traders and analysts showed an average 95 Bcf build with an injection range of 84 Bcf to a 107 Bcf.

The market may be close to a new trading paradigm. Traders have long targeted $3 as what could be the beginning of a move higher, possibly substantially higher, and “if we settle a couple of days above $3, that might be enough to convince people that we might want to be trading above there,” said a New York floor trader.

Analysts suggest this might be just a speed bump to higher prices once warm weather hits. “The 99 Bcf in net injections for last week was somewhat more than expected, short-term bearish for prices,” said Tim Evans of Citi Futures Perspective. “This will test whether the market can withstand a minor disappointment and move higher, based on the warmer than normal temperature forecast.”

Inventories now stand at 2,767 Bcf and are 653 Bcf greater than last year and 73 Bcf more than the five-year average. In the East Region 57 Bcf was injected and the West Region saw inventories increase by 10 Bcf. Stocks in the Producing Region rose by 32 Bcf.

The Producing region salt cavern storage figure was up 8 Bcf at 305 Bcf, while the non-salt cavern figure increased 24 Bcf to 777 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |