Iran Impact on Global NatGas A Few Years Away, Fitch Says

With the announcement of a nuclear agreement with Iran, the question of how fast that oil/natural gas-rich nation will get back to full production was examined, and the answer is: Don’t expect an impact on global energy markets anytime soon, according to an analysis by Fitch Ratings.

Over the past 10 years (2005-2014), Iran’s gas production has increased 70%, but its domestic consumption of natural gas also has shot up by 66%.

The nation’s impact on global markets longer term is a different story.

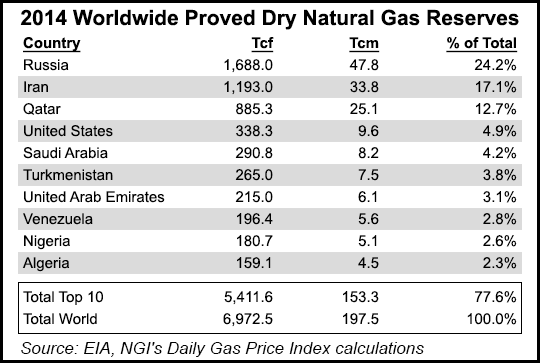

“Iran has the long-term potential to become one of the world’s top gas producers, thanks to its 34 Tcm (trillion cubic meters) of reserves or around 18% of the world’s total,” Fitch analysts in London said. However, even with sanctions lifted, the rating agency thinks it will take “at least five years” to ramp up production and build the infrastructure to become a large gas exporter.

Similarly, Fitch predicted that Iran’s crude oil exports likely will increase next year, but it also will take “a number of years” to get back to the nation’s previous peak levels (about 2.5 million b/d). If the nuclear agreements and sanction-lifting move ahead as scheduled, Iran’s oil exports will definitely be boosted, Fitch said, from its current 1.1 million b/d, or a little less than what North Dakota officials reported for monthly production last Friday (see Shale Daily, July 13).

Last month, the U.S. Energy Information Administration (EIA) issued a report concluding that international sanctions “have profoundly affected Iran’s energy sector,” prompting a number of cancellations or delays of upstream oil/gas projects. “Despite the country’s abundant reserves [second largest natural gas and fourth largest oil reserves], Iran’s crude oil production has substantially declined and gas production growth has been slower than expected over the past few years,” EIA’s analysis said.

Yearly gas production in Iran has hit 173 Bcm (billion cubic meters or 6.1 Tcf), and it currently exports 9 Bcm (318 Bcf) in the region (Turkey, Armenia and Azerbaijan), according to International Energy Agency (IEA) statistics cited by Fitch. “Historically, Iran has never been a major exporter of natural gas, with most of its limited exports going to former Soviet Union nations in the late 1970s,” Fitch said.

According to Fitch, there are a number of developments regarding gas inside Iran. Several significant natural gas projects are in various stages of implementation to tap Iran’s share in the 14 Tcm reserves in the South Pars gas field. Current production capacity there is only 107 Bcm. “IEA expects 67 Bcm of additional capacity to be commissioned at South Pars before the end of this decade.”

Another major project involves the North Pars field, which is estimated to have 1.3 Tcm of reserves. However, Fitch notes that the economic sanctions over recent years have stalled development of projects, such as a $16 billion liquefaction facility that China National Offshore Oil Corp. agreed in 2006 to develop in North Pars.

Meanwhile, Iran’s domestic gas consumption growth has been second only to China, and it has made the nation what Fitch called the “world’s fourth biggest gas consumer” behind the United States, Russia and China. Fitch thinks this means that a big part of added capacity in upcoming years will be dedicated to domestic markets.

Iran has a number of gas export pipelines planned, Fitch said. An example it cited is the IGAT-9 project, a 35 Bcm/year pipeline that Iran wants to use to send gas to Europe via Turkey. Currently there are no gas pipelines through Turkey to serve European markets.

A pipeline now under construction and another one yet to start in Turkey eventually could carry some Iranian supplies, but the timing is still several years away, as is Iran’s expected gas production uptick, Fitch said. Further, developing liquefied natural gas export capabilities will probably take even longer (in the mid-2020s).

Similarly, on the oil side, Iran also will require significant new investment to get back the full 1.4 million b/d production that has been lost over the past 10 years due to the sanctions, Fitch said. In the shorter term, increases in Iran’s oil production will dampen the recovery of global oil prices that Fitch expects to start next year.

“We believe it will take two to three years for prices to recover to their marginal cost of around $80/bbl Brent prices,” the Fitch analysts said, adding that a “wild card” is the estimated 40 million bbl of crude Iran has in storage.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |