WPX CEO Says RKI’s Permian Portfolio ‘The Whole Enchilada’

Natural gas producer WPX Energy Inc. on Tuesday agreed to buy RKI Exploration & Production LLC’s Permian Basin operations in a transaction worth $2.75 billion, which would increase liquids reserves by one-third and substantially add to the drilling inventory.

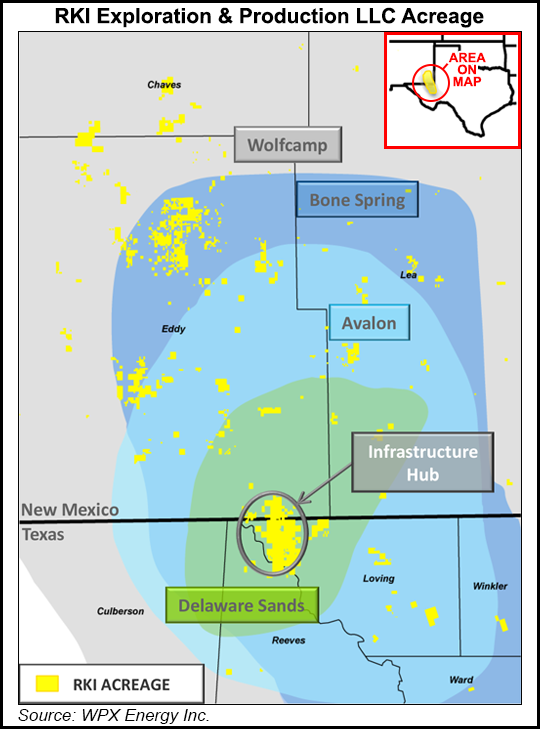

The agreement, for $2.35 billion and assuming $400 million of debt, would give the Tulsa-based independent a leasehold that extends from Loving County, TX into Eddy County, NM, where four rigs now are deployed. Two more rigs are set to be lifted by the end of the year, and by 2017, management envisions an 11-rig program.

RKI is “the whole enchilada,” WPX CEO Rick Muncrief said during a conference call Tuesday morning. WPX actually has been working on some kind of a deal for months, “working on a perfect fit…We kicked some tires…We charged the technical team to find a new basin.

“Everything pointed to the Permian…”

When it’s exactly what was in the plan, “you have to act decisively,” said Muncrief. No, he said, it’s not the greatest time to produce, but “the time to buy is when prices are down. When oil prices are stronger, we won’t be buying, we’ll be drilling. Ultimately, we believe this transaction helps us to go bigger and faster.”

RKI is a “transformative opportunity that fits perfectly with our strategy to increase our oil production and high-quality oil inventory,” said Muncrief. Since taking over in late 2013, he has overseen a big shift for WPX, selling off assets to concentrate on the West, and adding more oil and liquids to the portfolio (see Shale Daily, June 25; Dec. 3, 2014; Oct. 9, 2014; Dec. 19, 2013).

The leasehold has 22,000 boe/d of output, more than half weighted to oil, more than 92,000 net acres in the Permian’s Delaware subbasin. Almost all (98%) is held by production, with 3,600 gross risked drilling locations and 375-plus miles of gas gathering and water infrastructure.

With the transaction, WPX is projecting oil production growth of 125% from current 2015 guidance to 2017 pro forma projections. RKI’s assets would increase total proved liquids reserves by 33% to 268 million bbl as of year-end 2014.

WPX still would be a gas-heavy, but it expects oil to account for 22% of equivalent production this year, 30% in 2016 and 36% in 2017 on a pro forma basis.

“For our shareholders, this further drives high-margin oil growth, accelerates our portfolio transition to more liquids, and solidifies our premier position in the western United States, which enjoys the advantages of established infrastructure and higher realized commodity prices,” Muncrief said.

The acquisition metrics, he said, include $1.1 billion for RKI’s existing production at $50,000/flowing bbl and $500 million for the established midstream infrastructure, which equates to an average of $12,500/acre, or $1.15 billion, for the undeveloped locations.

Although oil reserves now hold the most promise, the RKI leasehold also has “massive natural gas optionality and long-term growth visibility,” Muncrief added.

RKI also has operations in Wyoming’s Powder River Basin but those assets are not included in the purchase. RKI still plans to divest or transfer out its Powder River assets before completing the merger.

WPX produced 169,000 boe/d in 1Q2015 and surpassed 50,000 b/d of total liquids production for the first time in the company’s history.

With the deal, WPX would increase its onshore oil drilling inventory to an estimated 4,600 locations from the Permian, Williston and San Juan basins. The Permian property has existing production from 10 of 12 prospective benches in the Delaware play that includes the Wolfcamp, Bone Spring, Avalon and Delaware Sands intervals.

The purchase also includes 192 miles of gas gathering pipeline, 90 MMcf/d of gas compression capacity, a 174-mile produced water system, and 16 miles of freshwater transfer pipe.

The transition to a more balanced portfolio is the long-term strategy, Muncrief said.

“We have a plan in place, we’re executing very well and it shows in our results,” he said. “We believe this transaction will help us take our plan further and execute it faster.”

In addition to capturing reserves and new output, cash margins also are expected to benefit, increasing by around 45% to more than $19.00/boe on a pro forma basis in 2017 from more than $13.25/boe on a standalone basis in 2015. WPX also expects to grow cash flow by about 25% to more than $4.60/share in two years.

Once completed, the transaction is projected to increase output from 160,000-165,000 boe/d in 2015 to 180,000-190,000 boe/d in 2016, and to 190,000-200,000 boe/d in 2017.

Muncrief noted that RKI’s wells now generate 30% returns at $60 West Texas Intermediate. Employing additional completion technology should capture more upside, he said.

In 2014 and 2015, WPX had executed more than $1.5 billion in transactions prior to the RKI deal.

“Our ability to execute is one of our strengths,” Muncrief, a former Continental Resources Inc. executive, said. “All of the progress we’ve made focusing our business and strengthening our balance sheet has positioned us to be opportunistic.”

RKI staff, which number around 130 that are affected by the transaction, are to be retained, as well as its offices in Oklahoma City and Carlsbad, NM. RKI has been understaffed, while WPX has been top heavy, Muncrief noted. WPX actually had laid off people earlier this year, closed some offices and moved most staff back to Tulsa (see Shale Daily,March 4). The new deal changes any downsizing, the CEO said.

“There’s substantial knowledge and expertise behind RKI’s assets,” he said. “Having operations and technical teams already in place and on the ground will help grow production, drive efficiencies and optimize resource potential.”

RKI founder and CEO Ronnie K. Irani, called WPX a “technically minded company that can take the potential of our acreage and infrastructure to significantly higher levels.

“Turning over the reins of RKI to a proven operator is very important to me and our team because of the great pride we have in this exceptional asset base we have amassed and developed over the past 10 years…We have a lot to be proud of in this company — our people, our success and the extensive long-term potential we have created.”

Privately held Oklahoma City-based RKI was founded by Irani five years ago with a primary focus on the Powder River Basin and the Permian.

The board of each company has unanimously approved the merger, as well as 85% of the bondholders. Closing is expected by the end of September.

RKI unitholders are to receive 40 million shares of WPX stock, valued at $470 million based on the terms of the agreement. The balance of the acquisition would be funded through a combination of long-term debt, additional equity and cash on hand.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |