Vertical Rigs Stand Up For Count, Horizontals Lie Down

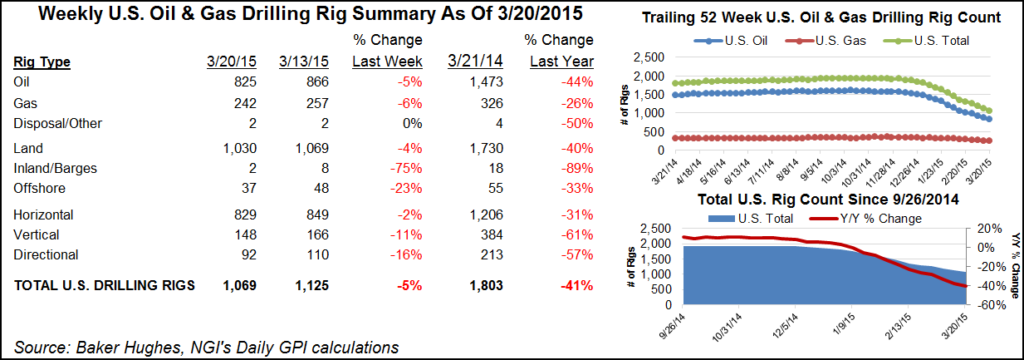

Vertical drilling rigs made a strong return to the oil/gas patch, climbing by 13, according to the latest data from Baker Hughes Inc. released Friday (July 10). It was enough to give the U.S. count of active rigs a tiny nudge up by one and continue a recent climb back from the count’s June 19 level, which had set a multi-year low.

There were 863 rigs active in the United States, according to the latest count. The June 19 count was 857, which was the lowest since the count hit 845 for the week ending Jan. 17, 2003. The June 26 count had the number of active U.S. rigs at 859 (see Daily GPI, June 26).

While U.S. vertical rigs climbed to a total of 121 for the week, directional and horizontal rigs gave up nine and three, to end at 88 and 654, respectively. U.S. producers continued to favor oil, adding five oil rigs, over gas as two gas-directed rigs were benched. The North American count stood at 1,032 in the latest count after only recently breaching the 1,000 level (see Daily GPI, July 2). Canada added 30 rigs, according to the latest count.

The big gainer among U.S. plays was the Permian Basin, adding seven rigs to land at 239 for the week. Meanwhile, four rigs left the Eagle Ford, leaving it with 102 active, and six rigs left the Williston Basin, leaving it with 71 active. Among states, Texas gained the most rigs, five, while North Dakota was the biggest loser, giving up six.

The fact that the oil-directed rig count is still way off from where it was not that long ago should put a dent in associated natural gas production, “…but that is not likely to be enough to materially firm up North American prices, in our view,” BMO Capital Markets analysts said in a note Tuesday. They’re calling for natural gas prices to be rangebound at $2.25-3.00/Mcf. The outlook for crude is also rangebound at $55-65/bbl for Brent and $50-60 for WTI, BMO said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |