BC LNG Project Startup Pace Quickens, Says Province Finance Minister

All necessary permits will “shortly” be received to construct jumbo pipelines to launch liquefied natural gas (LNG) from British Columbia (BC) onto global markets, TransCanada Corp. CFO Don Marchand predicted Tuesday.

Marchand described TransCanada’s readiness at an investment conference held in Calgary amid the latest burst of political fanfare about gas-driven, global-scale economic growth prospects for Canada’s west coast province in its capital of Victoria.

BC Finance Minister Mike de Jong described a glowing outlook as he released the 120-page text of an agreement announced May 20 with an Asian contender to start tanker exports: the Pacific Northwest LNG terminal project led by Malaysian state energy conglomerate Petronas and its Progress Energy subsidiary in Calgary (see Daily GPI, May 22).

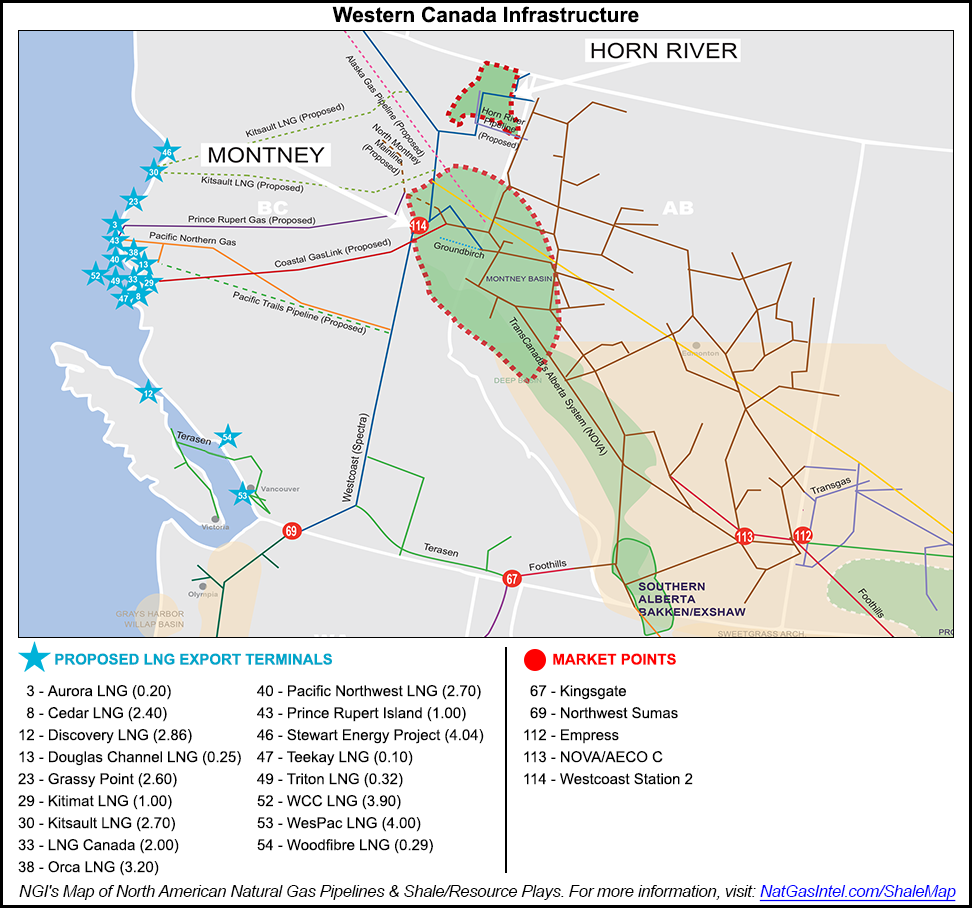

Pacific Northwest is the anchor customer for one of two big new pipelines, described as “transformational” by Marchand, which TransCanada is sponsoring to cross BC from northeastern shale gas deposits to the northern Pacific coast ports of Prince Rupert and Kitimat.

Petronas-Progress is the prime customer for the C$5 billion ($4 billion) Prince Rupert Gas Transmission proposal. The Canada LNG consortium led by Royal Dutch Shell plc is the anchor supporter for TransCanada’s proposed C$4.8 billion Coastal GasLink pipeline to Kitimat (see Daily GPI, July 6). The two projects have combined, planned initial capacity exceeding 4 Bcf/d, a total on the scale of the dormant Alaska gas pipeline project. The BC government’s official long-range target for LNG exports is 82 million metric tons/year, an Asia-bound torrent of gas approaching 11 Bcf/d.

The Petronas-Progress terminal is forecast to start a C$36 billion ($29 billion) chain reaction of development including pipelines, processing plants and horizontal drilling and hydraulic fracturing in the province’s shale deposits. The Shell terminal is projected to start a C$40 billion economic development stream.

Total overseas shipments proposed by 25 Canadian LNG projects that have matured to the stage of lining up for export licenses from the National Energy Board, on both the Pacific and Atlantic coasts, exceed 45 Bcf/d. None of the contenders have disclosed sales contracts or made decisions to start terminal construction. Petronas-Progress and Shell have said loose ends remain to be tidied up, although breakthroughs could start by early 2016.

In Victoria, the release of the Petronas-Progress agreement text was the first step toward promised speedy ratification by the provincial legislature. A special summer sitting is being held to enact the deal, starting Monday (July 13).

Passage without amendments is virtually guaranteed by the Liberal majority government, which won re-election in mid-2013 on a platform that focused on grand LNG plans including a provincial “prosperity fund” for new gas revenues. The package includes favorable low production royalties and export terminal taxes for 25 years, backed by rights for Petronas-Progress to sue for compensation if a different regime is elected in future and attempts to go back on the deal.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |