Record Demand, Temps Not Enough to Boost Sumas August NatGas Prices

Only a few natural gas forwards markets showed any signs of life during the short Independence Day holiday week, with the majority of price points swinging just a few cents in either direction.

The lack of volatility mirrors that in the futures market, where the Nymex August contract climbed just 1.3 cents from June 26 to July 1 as weather forecasts offered little support outside the West.

The exceptions to the overwhelmingly quiet market were the usual suspects, as both the Northeast and Pacific Northwest remain weak despite some unusually hot weather in the latter region, which has led to record demand amid low hydro output.

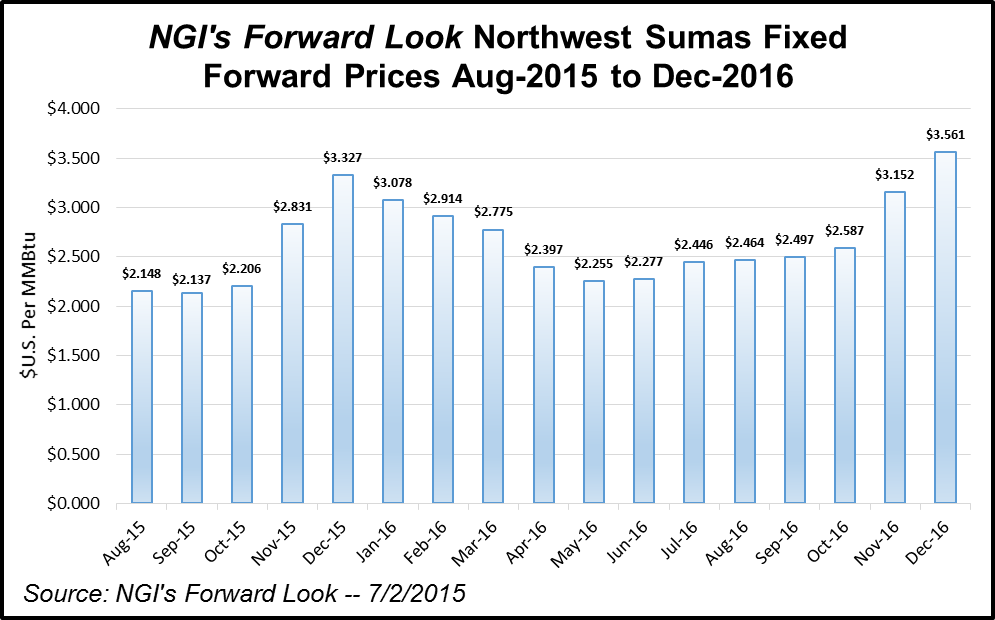

At Northwest Pipeline-Sumas, August basis fell 6.8 cents between June 26 and July 1 to reach minus 63.5 cents, according to NGI’s Forward Look. The fixed price for August dropped 5.5 cents during that time to $2.148.

Sumas’ July fixed price, meanwhile, rolled off the curve June 26 at $2.25.

The weakness at Sumas comes despite unusually high temperatures and record demand in the region, a trend that is likely to continue the rest of the month, according to analysts at industry consultant Genscape.

Gas burn for the month averaged a record-high 636 MMcf/d, shattering the previous record of 207 MMcf/d set in June 2013, Genscape said.

A new single-day high for the month of June was set on gas day June 24, as gas burn hit 791 MMcf/d, which was also the highest day this year to date, according to Genscape.

“Since then, gas burn has averaged 771 MMcf/d, a remarkably large number versus last year’s June burn at 148 MMcf/d, as well as the three-year June average of 138 MMcf/d,” Genscape’s Rick Margolin, senior natural gas analyst, said Wednesday.

Record temperatures have been one driver behind the record demand, as population-weighted temperatures have averaged a record 69.6 degrees, eight degrees higher than the 10-year average and five degrees higher than the previous record high. As a result, hourly load within the Bonneville Power Administration for the month averaged 6,224 MW, a June record, Margolin said.

Meanwhile, hydro’s contribution to the generation stack has been remarkably small, generating a June record low hourly average 7,094 MW, he said. This is 4,600 MWh below last June; 5,200 MWh below the eight-year average and 2,700 MWh below the previous June low set in 2008.

Wind generation also lagged this June, generating a daily hourly average of 1363 MWh, in line with June 2013 but 600 MWh below June 2014.

These trends are likely to continue into July, Margolin said, as Genscape’s meteorologic group shows temperatures in the region continuing to run well above normal, while the region’s snowpack and runoff levels remain at record lows.

But prices further out the Sumas forward curve do not reflect the ongoing strong gas demand.

Sumas fixed prices for the balance of summer (September-October) fell 5.1 cents this week to $2.17, a move against most other markets that picked up a few cents.

One possible reason for the continued weakness at Sumas is the return of supplies to the market as Spectra Energy’s McMahon plant returns to service, making more gas available to flow down to the region from British Columbia.

Sumas wasn’t the only market to fall into the red this week.

Northeast points posted double-digit declines at the front of the curve as cash markets took a nosedive this week on projected low demand over the extended holiday weekend. Long-range weather forecasts also remain unconvincing for the latter half of the month.

Algonquin Gas Transmission city-gates and Transco zone 6-New York cash prices were down 12 cents and 24 cents, respectively, from Friday to Wednesday.

“That’s it, and more supply back on,” a Northeast trader said regarding the increase in production receipts on Transco’s Leidy line following construction.

In forwards trading, AGT August basis tumbled 18.2 cents during that time to minus 93.1 cents. The August fixed price was down about 17 cents to $1.852 and was one of only four pricing locations with a $1 handle for August.

Further out the curve, AGT’s balance-of-summer basis package plunged 14.9 cents to minus 71.9 cents, while the fixed price dropped 13.4 cents to $2.10.

At Transco zone 6-New York, August basis fell 19.1 cents to minus $1.161, while the fixed price dropped about 18 cents to $1.622. The fixed price for the balance of summer was down about 13 cents to $1.57.

Forecasters with NatGasWeather say incoming weather data remains “quite unstable” and could easily bring wildly different patterns compared to what the markets might be led to expect going into the extra-long Fourth of July break.

“We believe what sets up in mid-July will be very important to the nat gas markets as it will determine if weekly builds in supplies will have some breathing room to reach 4.0 Tcf (bearish), or if several weeks of hotter temperatures again find a way to stall gains in surpluses, increasing market risk that fall weather patterns will have to carry the burden if supplies of 4.0 Tcf are going to be met,” NatGasWeather said in a Thursday note to clients.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9915 | ISSN © 2577-9877 |