Weak East Too Much For Broader NatGas Gains Elsewhere; Futures Drop a Nickel

Natural gas for Thursday delivery mostly traded Wednesday within a few pennies of unchanged at points outside the East and Northeast. Eastern points were down a dime or more on average, and that was enough to throw the day’s trading slightly into the loss column.

Gulf prices rose a couple of pennies, the Rockies were close to unchanged, and California points gained.

Overall, the market came in 3 cents lower at $2.47. Futures prices traded lower ahead of Thursday’s storage report with August falling 4.9 cents to $2.783 and September off 4.3 cents to $2.799. August crude oil dropped $2.51 to $56.96/bbl.

Next-day eastern prices took some hits as temperatures struggled to make it to seasonal norms. AccuWeather.com forecast that New York City’s Wednesday high of 83 would ease to 81 Thursday and 80 by Friday. The seasonal high in New York City is 83. Washington, DC, was expected to see its Wednesday high of 89 slide to 84 Thursday and to 79 by Friday. The normal early July high in DC is 88.

Gas for delivery Thursday at the Algonquin Citygates shed 26 cents to $1.23, and packages on Iroquois Waddington skidded 32 cents to $2.49. Gas on Tennessee Zone 6 200 L changed hands at $1.27, down 22 cents.

Deliveries on Tetco M-3 were seen down 6 cents at $1.14, and gas bound for New York City on Transco Zone 6 fell a stout 65 cents to $1.24.

Next-day peak power prices in New England and the Mid-Atlantic did not add to the appeal of buying incremental gas for power generation. Intercontinental Exchange reported next-day peak power at the ISO New England’s Massachusetts Hub fell $2.63 to $22.38/MWh and Thursday peak power at the PJM West terminal fell $3.18 to $32.80/MWh.

Marcellus and Utica shale gas may be given an earlier chance than previously thought to reach higher priced markets. Genscape Inc. in a report noted that two pipeline projects in the region are expected to begin service in August, earlier than expected.

For southwestern Pennsylvania, “Texas Eastern (Tetco) announced their Uniontown-to-Gas-City (U2GC)expansion project will be brought online earlier than expected by August 1. The expansion will provide 425 MMcf/d of new capacity to flow gas westward to the Tetco interconnect with Panhandle near Gas City, IN, to serve Midwest markets.”

On a much larger scale “the Rockies Express Pipeline (REX) stated the Zone 3 East-to-West Project will be in-service on August 1…The project will provide an additional 1,200 Mcf/d of firm westbound service. Once completed, Zone 3 on REX will be able to flow a total of 1,800 MMcf/d bidirectionally between the Clarington Hub in eastern Ohio and the interconnect with NGPL at Moultrie, IL, accessing interconnects along the way with NGPL, ANR, Midwestern, Panhandle, and Trunkline.”

Lower 48 gas production keeps increasing. One of the arguments to the bullish case is for a decline in the rate of growth of production, but for the moment that doesn’t seem to be the case. Tuesday, the Energy Information Administration (EIA) in a new expanded format reported April gross production of 82.05 Bcf/d, up a stout 0.9% from March and 7.1% higher than a year earlier (see Daily GPI, June 30).

“The only somewhat supportive aspect to the data is the possibility that production peaked for the current cycle in December,” said Tim Evans of Citi Futures Perspective in closing comments to clients. “We continue to look for slowing year-on-year production growth and stronger power sector demand to help rebalance the natural gas market of the next few months.”

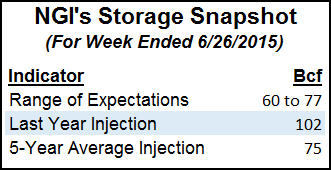

Futures traders Thursday will be assessing what looks to be additions to the Energy Information Administration’s storage report that are below the historical averages. Last year 102 Bcf was injected and the five-year pace stands at 75 Bcf.

Gelber and Associates calculates a build of 60 Bcf, and a Reuters survey of 24 traders and analysts revealed a 70 Bcf average with a range of 60 Bcf to 77 Bcf. Ritterbusch and Associates is looking for an increase of 77 Bcf.

Gas buyers tasked with procuring supplies for power generation across the MISO footprint may have to dig a little deeper going into the holiday weekend as forecasters are calling for tempered wind generation.

WSI Corp. in its Wednesday morning report said, “A trailing frontal boundary will tend to limit showers and storms into the Ohio Valley and lower Mississippi Valley during the end of the week into the weekend. Meanwhile, partly sunny skies and a warming trend are expected across the remainder of the power pool, though an isolated shower or storm cannot be ruled out. Temperatures might rebound in the upper 70s and 80s.

“A cold front may begin to slide into the Northern Plains and Upper Midwest late Sunday with rain and storms, [and] despite the active pattern, wind generation will likely be changeable and relatively light during the remainder of the week into Saturday. Output will vary between 1-3 GW. An increasing southerly flow ahead of a cold front will likely cause wind gen to increase Saturday night through Sunday.”

In a weekly report, Walter Zimmermann of United ICAP suggested that natural gas “does not look like a market poised to fall to new lows. One big question for the coming weeks is whether natgas can congest itself above the down trend resistance line from the $6.493 high.” That would require a weekly settlement of more than $3.00/Mcf, according to figures.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |