Gas-Directed, Vertical Rigs Make Gains in Latest Count

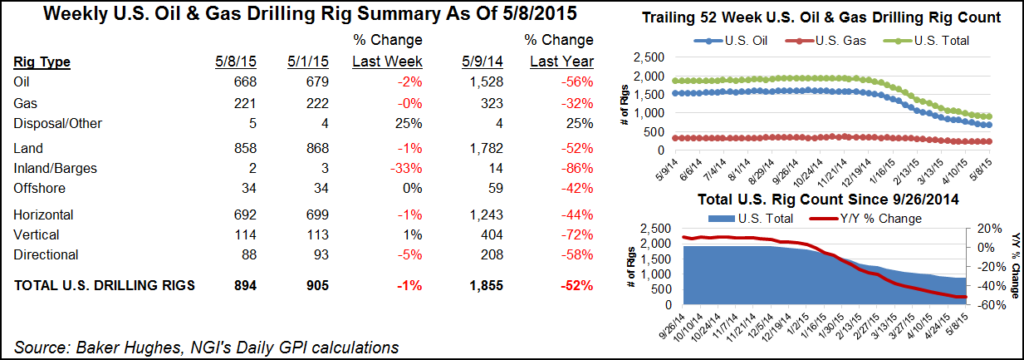

The count of active U.S. drilling rigs in the latest Baker Hughes Inc. count issued Friday (June 26) gained by two overall to rest at 859 as the count saw modest changes across plays and some comparatively big gains for natural gas-focused rigs, vertical rigs and for the state of Louisiana.

Five natural gas-directed rigs came back to the game while three oil-directed rigs left. Vertical rigs gained seven, rising from 100 to 107, and the horizontal category lost eight soldiers, falling to 654 from 662. Directional rigs gained three to end at 98.

Among the states, Louisiana was by far the biggest gainer, adding six rigs to the active column to end the week at 75, still far from its year-ago tally of 107. North Dakota and Ohio each lost three rigs to end at 74 and 17, respectively, also far off from their respective year-ago tallies of 171 and 41. Texas lost two rigs — a modest decline for the Lone Star State in recent months — ending at 361, which is miles from its year-ago tally of 889 active rigs.

All those fallen rigs in Texas have started to make their absence felt in production data from the Railroad Commission of Texas (RRC). Texas oil and gas production has been trending downward, according to RRC data.

Preliminary April crude oil production averaged 2.32 million b/d (69.60 million bbl for the month), up from the 2.04 million b/d (61.30 million bbl for the month) of April 2014; however, it was down from 77.21 million bbl in January, 70.02 million bbl in February and the preliminary 71.59 million bbl in March, according to RRC data.

Texas oil and gas wells produced 587.18 Bcf of gas based upon preliminary figures for April, up from the year-ago preliminary total of 562.82 Bcf. Preliminary April total gas production averaged 19.57 Bcf/d. Total gas production was 672.96 Bcf in January, declining to 605.29 Bcf in February but climbing to 614.35 Bcf in March.

As has been the case of late, declines across basins were rather evenly distributed compared with past months when plays such as the tall-in-stature Eagle Ford Shale and Permian Basin were taking the biggest haircuts.

Losing three rigs each were the Utica Shale and Williston Basin. The Permian, Mississippian and Granite Wash each lost two rigs, as did the Eaglebine of East Texas. The Barnett and Eagle Ford were each down by one, while the Cana Woodford, Haynesville, Marcellus and Tuscaloosa Marine Shale were each up by one.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |