Magnum Changes Midstream Course, Plans Sale of Entire Eureka Hunter Interest

Magnum Hunter Resources Corp. said Thursday it would sell midstream subsidiary Eureka Hunter Holdings LLC in a move that finds the company shopping one of its paramount assets to address a liquidity crunch.

The announcement is a deviation from last year’s plans to take Eureka public or other options that management has recently discussed to, at the very least, sell a 5% interest in the nearly 200-mile gathering system operated by Eureka (see Shale Daily, Nov. 7, 2014).

But Magnum has been confronting empty pockets in recent years, running low on cash in its transition to an Appalachian pure-play despite a series of noncore asset sales in Canada, Texas, North Dakota and West Virginia (see Shale Daily, May 26; Jan. 23; April 22, 2014). In May, the company had total liquidity of just $20.7 million, of which $14.4 million was cash (see Shale Daily, May 11).

“We’re an upstream company. We have been tight on liquidity with respect to the downturn that we’ve been experiencing and this is one of our crown jewel assets,” CEO Gary Evans told an industry conference in Pittsburgh on Thursday. He announced the sale shortly after an 8-K was filed with the U.S. Securities and Exchange Commission.

“…We believe the time is right to put [Eureka] in the hands of a much larger player — a much better capitalized player to do everything necessary to protect Magnum Hunter and Triad’s interests in a sale,” he said, referring to Magnum’s Appalachian exploration and production subsidiary, Triad Hunter LLC.

Evans told NGI’s Shale Daily that the company would look to complete a sale as soon as possible. Negotiations are ongoing with a small group of what he said are well-known companies in the region. Magnum has a 46% interest in Eureka and Morgan Stanley Infrastructure Inc. has about the same (see Shale Daily, Sept. 16, 2014). Evans said the company is hoping to get $1.2-1.3 billion for Eureka, of which Magnum would net $600-700 million. Morgan Stanley, Evans said, is in favor of the sale and what it does with its equity interest and other minority interests in Eureka would be determined during any sale negotiations.

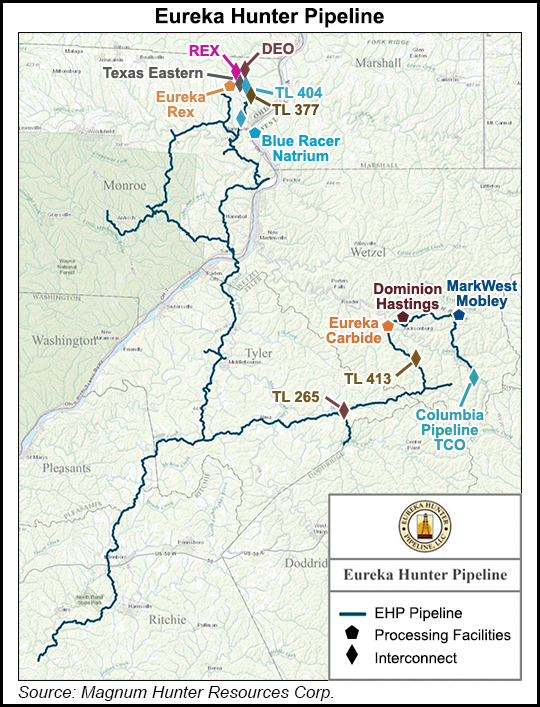

Eureka consists of 175 miles of 20-inch diameter wet and dry natural gas gathering lines that span five counties in West Virginia and three counties in Ohio. About 70% of volumes running through the system come from third parties. Magnum recently reported a peak throughput rate of 640 MMcf/d, but it expects that to increase to nearly 1 Bcf/d by the end of this year.

Last week, Magnum’s lending group gave it a second extension to raise cash and pay down debt. About $65 million is required by July 10 to avoid default, but Evans told NGI’s Shale Daily that the deadline had no influence on the board of directors’ decision last Friday to sell Eureka.

“It has nothing to do with the bank group whatsoever,” he said. “This is in response to an unsolicited offer. We had been talking about it for quite awhile; we were actually looking at possibly selling a minority interest, and what kind of pushed us over the edge is [COO Chris Akers] and his group recently won a really large contract that allows us to model future growth on the system.”

Evans couldn’t say more about that contract or who it was with. He also did not disclose the company that made an offer to buy Eureka, adding only that it’s structured as a master limited partnership and saying that “it’s a well-known company that everybody would know.”

Financial analysts had mixed reactions to the announcement, with some saying Magnum would have to get top dollar for Eureka to make a sale worthwhile. BMO Capital Markets analyst Dan McSpirit said it appears as though the company “has run out of options.”

“The company wants us to believe the contemplated sale of the midstream business is more of a permanent fix,” he said. “OK, but the upstream business that remains doesn’t leave much of a value proposition.”

Magnum’s operations are currently suspended. It has drilled no new wells this year, relying instead on recently completed wells and others in various stages of development to grow production and hit its 180-204 MMcfe/d guidance.

Evans said any proceeds from the sale of Eureka would go toward resuming operations and paying up to $400 million in debt. He said Magnum is also making progress on a $450 million joint venture (JV) for part of its Ohio acreage and is also considering pursuing a $100 million JV for its West Virginia acreage.

“We haven’t really planned it yet,” Evans said, when asked about a drilling plan for the second half of the year if a sale goes through. “We’re trying to get our ship back right at Magnum, which is trying to get some debt paid down. We have a lot of low lying fruit. In other words, we have about 10 wells we’ve either drilled or that are in various stages of completion that would be very additive and cost less than $50 million. We’ll probably do some of that and continue to look at our options.”

Eureka also owns Houston-based TransTex Hunter LLC, a natural gas treatment and processing services company with leased or sold equipment operating in the southern and northeastern U.S., that would likely be included in any sale.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |