NatGas Analysts Embracing New EIA Format; ‘It’s A Big Change, But Not A Big Change’

It has been brewing for a while, but all indications are that the Energy Information Administration (EIA) will take steps this fall to reformat its weekly storage report by adding more regions and thus increasing transparency.

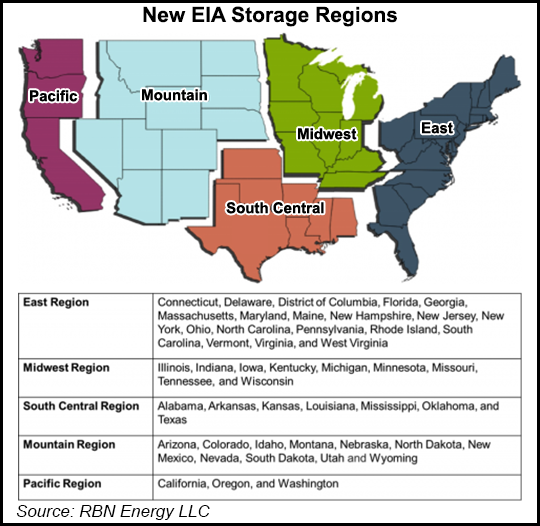

RBN Energy reported recently that “EIA is planning to split the U.S. gas inventory data into five regions, from three macro regions currently. The idea has been floating out there for a while, but now it looks imminent, with a good chance it is rolled out before the gas winter season comes around in November. When it does happen, the increased granularity will vastly improve the transparency of natural gas storage inventory data on a weekly basis.”

Little should change, but instead of an East Region, a West and a Producing Region, there will now be five regions to accommodate withdrawal and injection data. The five new regions are Pacific, Mountain, South Central, Midwest and East.

“We’ve known about this for a while, but it’s just been pushed back so many times because they have 50 other things going on,” said John Sodergreen, publisher of Energy Metro Desk.

RBN posited that the changes are likely to have tectonic dimensions and said “it will break everybody’s storage scrapes and models. Storage modelers and forecasters will have their work cut out for them.”

That view is not widely held.

“Scrapes are scrapes, and it shouldn’t affect the report, but what it should do is shore up at least how accurate we are in the East, and I think it will help that quite a bit, but the Producing Region will be somewhat skewed as it has been,” Sodergreen said. It should tighten up those other regions and make them that more accurate.

“I don’t think it is going to be that disruptive to at least the folks that really watch it closely. It’s a big change, but it’s not a big change.”

Consensus seems to be that the new figures will not need an asterisk by them simply because there are now five regions instead of three. “But there will be an adjustment time because some forecasters are less sophisticated than others. Generally, the folks who do this sort of thing for a living are heads up on this already and it shouldn’t matter that much,” Sodergreen said.

“Everybody gets their data from either EIA, Genscape or Bentek, and all those guys are ready. I think Bentek has been sending out the carved up data already so I don’t see that much of a change. It will be a change for the better and there will be an adjustment period, but the forecasts will be more accurate.”

Accuracy may improve, but as far as price volatility once the storage data is released, that is not likely to be impacted. “I would think more information is better, and I would think it would lower the dispersion of estimates,” said Tom Saal, vice president at FC Stone Latin America LLC. “The weekly ranges of the estimates should be less. The volatility once the number is released will not be less. Even if the ranges are smaller we don’t know if disaggregating the data to two more levels is going to increase the accuracy of predicting the storage number. It’s one thing to reduce the range of estimates, but it’s another to improve the accuracy.”

The EIA said the population of storage operators sampled for the weekly report will stay the same under the new format. “We report weekly inventory numbers for each region and the change from the weekly numbers is derived from that,” said Amy Sweeney of the EIA. “We have also lowered the threshold for reporting revisions from equal to or greater than 7 Bcf to greater than or equal to 4 Bcf.”

Others don’t see the new report format as requiring any massive overhaul of the analysis.

“For me it doesn’t. I don’t tend to spend a lot of time on the inter-regional mechanics of what is going on,” said Stephen Smith, publisher of the StephenSmithEnergy.com Weekly Gas Outlook. “I focus on national production and what is going on at an aggregate level. It’s easier, and I can still get better than average storage results using my approach.”

Kyle Cooper of IAF Advisors sees analysts “having to put everything in new buckets, and it should help in terms of getting more detail of what’s going on where.”

He said he might have to dig a little deeper into the new Rocky Mountain region, as “a couple of months ago CIG pulled some of their postings so that data went away, but the West is one of the most transparent regions of all.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |